In practice, you may encounter a situation where you urgently need to find out the TIN number, but the certificate itself is not at hand. In this case, people usually start looking for various services on the Internet that allow them to discover the data of interest. However, the systems request a number of additional information. So, today you can find out your Taxpayer Identification Number (TIN) from SNILS.

Why is the Federal Tax Service INN needed?

Important! Please keep in mind that:

- Each case is unique and individual.

- A thorough study of the issue does not always guarantee a positive outcome. It depends on many factors.

To get the most detailed advice on your issue, you just need to choose any of the options offered:

- Use the online chat in the lower corner of the screen.

- Call: Federal number: +7 (800) 511-86-74

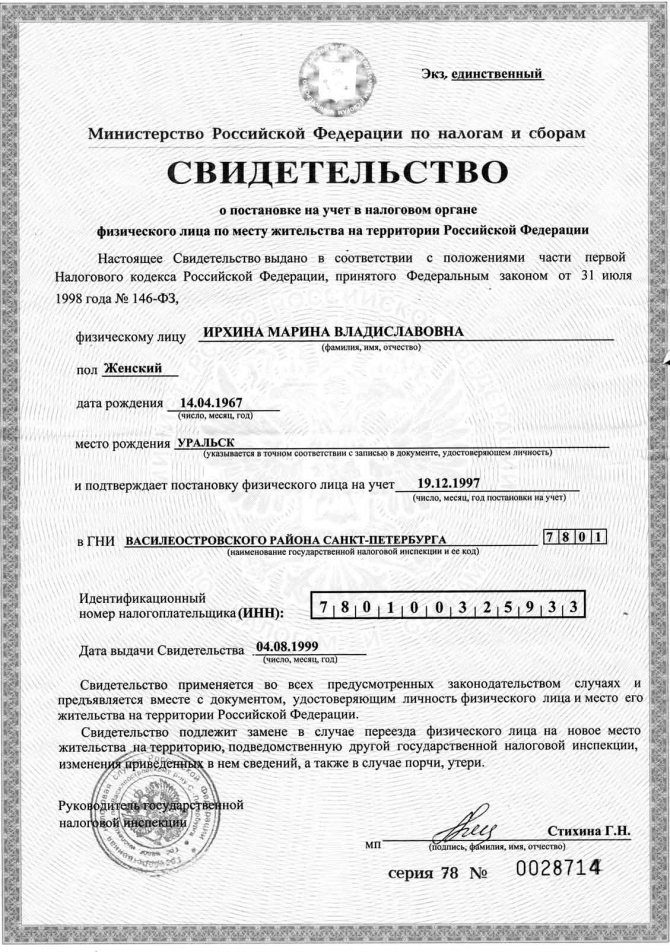

Information may be required in a whole list of situations. The data is used to personalize individuals. The number is available to citizens and organizations. The code is necessary to determine the amount of income received and the amount of deductions made to the state. The code size is strictly defined. It consists of 12 digits. Their location is unique. The number is assigned after the application is written. A person wishing to obtain a TIN will have to contact the territorial tax service. You need to have your passport with you.

Why do you need an individual taxpayer number?

The inspectorate employee assigns a code to the person who applied and provided personal information. The digital identifier is subsequently used as a personal account when transferring fees to the treasury. The number is assigned once. If the taxpayer's personal information changes, amendments are made to the register, and the certificate is updated with the appropriate changes.

The code consists of 12 digits, which indicate:

- The region in which the subject is registered. The first 2 digits carry this information.

- The next two are the tax division number.

- The last 8 digits are the personal number assigned to the person.

Related article: Difference between TIN and SNILS

This information is used in the following cases:

- when applying for a job;

- for calculating benefits and government assistance;

- when participating in events and programs at the state level;

- for registration on global network portals;

- when concluding financial transactions.

A tax number is not required to obtain. It may be useful for processing benefits, contracts related to cash transfers and salaries.

It is not difficult to obtain a TIN. The inspector will issue a completed form within 5 working days from the date of submission of the application. If the form is lost or damaged, it can be easily replaced at the nearest tax office.

What is SNILS and how does it differ from TIN?

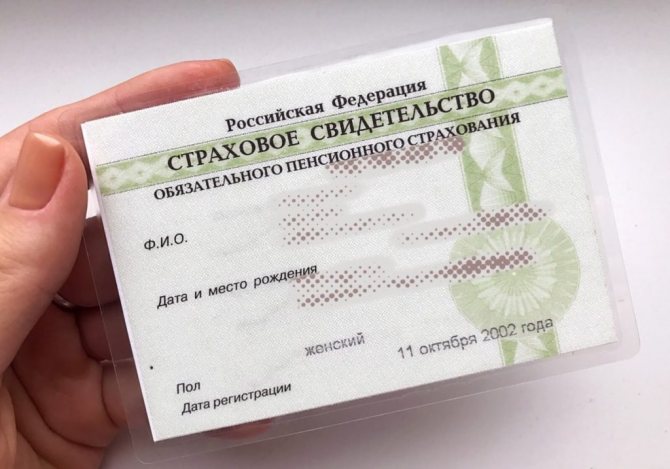

Before you find out the SNILS number by TIN, you need to understand what the first document is. The abbreviation hides the insurance certificate. It also has a unique personal code. With its help, a citizen’s individual personal account is designated. However, the number is used in the pension system of the Russian Federation. It consists of 11 digits. It is only available to individuals.

To obtain SNILS, you will need to contact the Pension Fund. You must first fill out an application for a TIN. Additionally, you will need a passport. The main difference between the documents is the accounting system. The fact is that both numbers are used in completely different state control authorities. A certificate of insurance is required in the pension system. Another number is used so that the Federal Tax Service can freely perform its functions. The above documents are in no way related to each other. They use completely different algorithms for personalization.

However, the rooms also have common features. With their help, it is possible to identify the owner on the government service website. As a result, the person will be able to obtain the information of interest. To enter the database, you can use an INN or SNILS.

Important! The documents differ significantly in appearance. The pension certificate is a green laminated card. The TIN is provided on an A4 sheet. It has security symbols that prevent counterfeiting.

Is it possible to find out your tax number using SNILS?

Today, most people are accustomed to requesting data via the Internet. Therefore, many people are trying to figure out how to find out SNILS by TIN of an individual or perform the reverse procedure. If a person is interested in a tax number, a search is sometimes performed by last name. In such a situation, difficulties usually do not arise.

To send a request, you need to be able to access the Internet and take your passport. Information can be requested through the official website of the Federal Tax Service on the Internet. The applicant is required to make a request by providing data in the appropriate field. The following information will be required:

- Full name of the taxpayer and his date of birth;

- information about the document used for identification;

- security key.

The Federal Tax Service system does not require the use of SNILS. Therefore, it will not be possible to search using the state pension account number. The fact is that the tax service does not apply the above account. SNILS can be useful if a person needs to use various government services, wants to apply for benefits and payments, and also plans to receive an electronic card.

If a person wants to find out information about the TIN, it is recommended to use alternative methods. It is permissible to carry out verification through government services. To carry out the manipulation, you need to go to the Taxes and Finance column, and then select a form to request the information of interest. It will require you to provide personal information. Information from the identity card is also recorded. You can use it as a passport, birth certificate, foreigner, temporary residence permit or residence permit.

An alternative to a remote request is a personal visit to the tax authority. It is necessary to contact institutions located at the applicant’s place of residence. The data is provided free of charge. Based on the request, the person may be provided with a digital combination. It is acceptable to obtain a duplicate certificate. An application will be required. In this case, a state fee is required. You must have your passport with you.

Find out SNILS by TIN

By searching IRS databases, you can find out if there is a debt. However, you will not be able to search for your insurance certificate number. The code is associated with the citizen’s pension contributions, which are made from his salary. At the same time, a small amount of personal data is encrypted in the number. Organizations use different algorithms. As a result, the search cannot be performed.

SNILS is part of the citizen’s personal data, which is not subject to disclosure. This becomes another reason why it is impossible to search for a number on the Internet based on the TIN. The easiest way to find out the code is to find the insurance certificate and read it. However, in practice, the card may not be available for some reason. In this situation, it is recommended to visit the Pension Fund. A visit to an institution located at the place of residence or registration is acceptable. If the certificate is lost, you can get a copy of it. To do this, you need to write an application. It is important to fill out the paper correctly. It will contain your passport information.

Obtaining information is also possible through the public service system. However, the method is available only to registered users. If a person wants to discover information, the following actions must be taken:

- Go through the authorization procedure. To perform the manipulation, you will need a TIN.

- Go to the pension savings section.

- Request notification of account status.

The public service system is the only service with which it will be possible to obtain SNILS data online. The method is suitable for physical a person who has previously registered and provided the necessary information in the system’s personal account. There are no other methods for requesting data via the Internet. It will not be possible to find SNILS using your passport.

Note! If a person works, information about the insurance certificate can be found by contacting the employer. You will have to visit the HR department. Companies are asked to provide citizens with copies of SNILS and TIN.

How to find out TIN via the Internet

This information is for you because you are interested in how to find out your TIN via the Internet. Please note that it is now easy to search for a tax ID in the online system on the official portals of the Federal Tax Service and State Services. A similar service is provided by other resources.

You can find out your TIN on the tax service portal. To do this, just follow 7 steps:

- Log in.

- Select the line “Individuals”.

- Click the “TIN” button. Receive or find out."

- Select the item “I want to find out the TIN”.

- Fill in the information in the electronic form and submit your request. Prepare your passport. You will need information from it.

- Enter the captcha (computer test) to check for spam.

- Wait for an answer.

The Gosuslugi website is designed specifically to make it easier for individuals to access information of interest and provide the opportunity to remotely receive a number of services via the Internet. This measure helped reduce the flow of citizens in government institutions and made it easier for citizens to access the necessary information.

Article on the topic: Features of the appearance of the SNILS card in Russia

To obtain a TIN you need to follow simple steps:

- Log in to the portal and log in.

- Select the “Service Catalog” tab.

- Click on the “Taxes and Finance” button.

- Go to .

- Fill out the electronic form using personal information.

Attention! If you do not have registration on the portal, you will need to register first. The event is very complex and takes several days.

State portals will require consent to the processing of personal information. This is necessary to confirm the reliability of the source.

According to SNILS

The child’s parents may be interested in how to find the TIN of an individual using a passport or SNILS. Employers often turn to Internet resources to find out the employee’s TIN using SNILS. In fact, such an opportunity is not available today. It is impossible to find out the TIN from SNILS!

SNILS may be needed for authorization on the State Services website or in the personal account of the Pension Fund. But this will not solve the issue of obtaining a tax certificate code.

To find out the TIN number of your children, you can search on the State Services website or contact a tax officer.

We remind you! The TIN is an optional document, so it will be assigned to the child only at the request or need of his legal representative.

By passport

If you have the employee’s passport details, this will allow you to find out his TIN on the Federal Tax Service website and other web resources. An employer may need a code to transfer funds from an employee's income to the budget. The procedure for obtaining information is the same as for yourself. To receive or check information on your passport, you need to enter information into a form on the electronic service and wait for a response.

By last name

Having information only about the last name, it will not be possible to obtain a TIN number.

To fill out the electronic form you need to know:

- passport number and series;

- date of birth information;

- passport issue date;

- code of the department that issued the document;

- First and middle name.

Related article: What scammers can do if they know the SNILS number

Having all the information, you can search for the TIN number.

Remember! To prevent acts of fraud, passport information cannot be passed on to third parties.

Using the tips on how to find out the TIN of an individual, you can get the necessary information from reliable sources. It is better to contact government sources to prevent the transfer of personal information to unidentified persons.