What does this code mean

The tax identification number is a unique 12-digit code. It has been assigned to every citizen of the Russian Federation since 1999. This personal account is opened once and remains unchanged throughout life. His data is not adjusted when changing his last name, marital status or passport document.

The identification code is opened by tax office employees. The corresponding certificate is issued to the person. For individuals, it is a “tag” before the tax authorities. Using this code, inspectors instantly determine what taxes he needs to pay and what payments the person has made previously.

Where is the inn in the passport?

2019 N SA-7-14/ “On the organization of the work of tax authorities to enter a note about the taxpayer identification number (TIN) into the passport of a citizen of the Russian Federation at the request of the citizen” (together with the “Procedure for making a note about the taxpayer identification number into the passport of a citizen of the Russian Federation ( TIN) at the request of the citizen"). Already from the name it is clear that the document defines the procedure for entering a TIN mark in the passport of a citizen of the Russian Federation. 2002 N BG-3-09/215 “On organizing the work of tax authorities to enter a note on the taxpayer identification number (TIN) into the passport of a citizen of the Russian Federation at the request of the citizen” provided for the possibility of obtaining such a service only at the tax authority at the place of residence of an individual.

Why does an individual need a TIN?

This information will be needed in the following situations:

- When applying for a job.

- For registration of social benefits, budget payments and subsidies.

- To participate in preferential government programs.

- When concluding financial transactions.

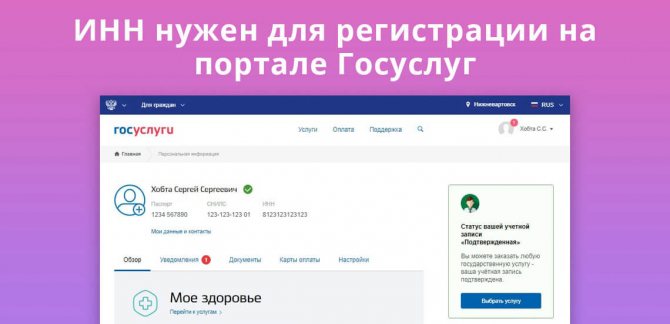

- For authorization on various Internet portals, for example, the State Services website.

When transferring various taxes and fees, it is advisable to indicate the TIN. Having a unique payer number will help avoid confusion in documents. In some cases, banks also request a certificate when applying for a loan. Using the code, they check whether the borrower has debts on taxes, alimony, and other budget payments.

Fraud with passport data

Any documents that confirm a person’s identity should be given special attention. Especially when it comes to a passport. Personal information contained in this document must be kept confidential from unauthorized persons. This is due to the fact that today there are many ways in which fraudsters can use passport data. Very often, information can fall into the wrong hands when an employee is fired. It is in this case that an offended employee, having all the possibilities for this, can take various illegal actions, including an attempt to use someone else’s passport data. To do this, he just needs to rewrite or photograph the information.

24 Dec 2021 marketur 231

Share this post

- Related Posts

- Utility benefits for teachers in the Volgograd region

- Is it possible to take out a partial mortgage?

- Additional leave for disabled people and for irregular working hours

- In which slacks must the store return the difference to the buyer?

How to get a TIN

To obtain an identification number, you must contact the tax office at your place of residence. Provide your civil passport and fill out an application in the prescribed form. Within five days, the certificate is issued in person.

If this document is lost, it can be restored. You need to submit a corresponding application to the tax office at your place of residence. A duplicate is issued within 2-3.

If necessary, a TIN can be assigned to a child, even before he receives a civil passport. The application is accepted from the child’s legal representative - parents, guardians or adoptive parents.

How legal entities and individuals can obtain a TIN

The current version of the Tax Code describes in detail the procedure for obtaining a TIN. Now, at least for individuals, there are several ways to do this. The most traditional of them is visiting the tax office in person. Upon arriving at the inspection, a citizen must provide the following set of documentation:

- application on form No. 2-2 (what it is and what this form looks like can be found on the Federal Tax Service portal, applications on this form can also be found there);

- passport of a Russian citizen and two photocopies of it.

If the place of permanent registration is not marked in the passport, you will need to show an additional document containing correct information about registration.

No later than five days (usually this period is sufficient) after receiving the documents, tax officials will register the citizen and issue him a certificate.

If you are unable to visit the tax office in person, you have the right to send an application with the specified list of documents by registered mail. In response, the Federal Tax Service is obliged to issue a TIN within the same period (five days).

In addition, you can now fill out an application in a section specially created for this on the Federal Tax Service website. The list of documents and application form are similar. The only difference is that the certificate will be sent to the citizen’s email in electronic format. However, this is only possible if the citizen has used an electronic signature and verified the application with it. In turn, the certificate file is also certified by the electronic signature of the responsible employee of the Federal Tax Service. If a citizen does not have an electronic signature, then he will still have to go to the tax office to get his TIN certificate.

What does a TIN look like?

Children over 14 years of age have the right to receive a TIN in the same manner as citizens who have reached the age of majority . But for a child under 14 years of age, the application for registration with the Federal Tax Service is filled out by the mother, father or other legal representative. In this case, you will need to provide your passport, the child’s birth certificate, and a document indicating the child’s registration address.

As for a legal entity, it is required by law to register with the tax authorities within ten days after completion of registration. The application to the tax office is signed by the head of the organization or a person authorized to sign such documents. In addition, in order to register, you will have to provide all available constituent documentation.

How to find out TIN

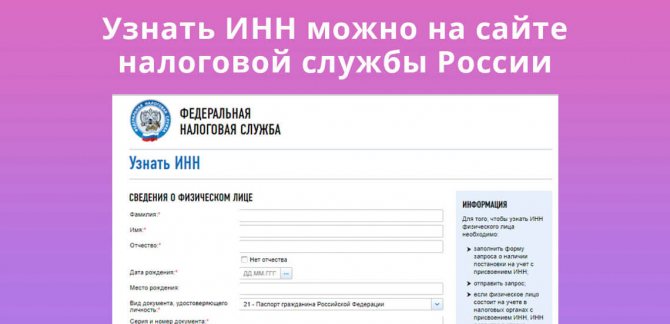

If you only need to know the code and do not need a document confirming its issuance, then there is no need to contact the tax office. This information can also be found on the Internet:

- Go to the website of the Russian Tax Service.

- Go to the “Find out TIN” section.

- In the form that opens, indicate: full name, passport details and date of birth.

- If a citizen is registered for tax purposes, his identification code will be displayed in the result period.

Through the website of the Federal Tax Service, you can find out the TIN of any person, possessing his personal data.

On the State Services portal, information about the TIN is provided only to its owner. In your personal account, you need to set the search query “Find out your TIN” and instantly receive an answer.

Passport and tax identification number of one person

You can find a person by cell phone number using search engines. To do this, open several tabs in your browser with search engines known to you: Yandex, Google, Mail, Rambler and sequentially enter into each search engine a known phone number in various interpretations: +7 921 ХХХ ХХ ХХ, 8921ХХХХХХ, 8-921-ХХХ-ХХ- XX, etc. If you receive the answer “According to the information you provided, the TIN assigned when registering you with the tax authority was not found in the FDB of the Unified State Register of Real Estate,” then this means that the person does not have a TIN, which happens extremely rarely, so I recommend that you check correctness of input of initial data when requesting.

Please note => Letter to the housing department about mold in the room

TIN and religion

Many believers, due to their religious beliefs, would like to refuse a tax number. But current legislation does not provide for a procedure for canceling or destroying a TIN.

The leadership of the Federal Tax Service comments on this issue as follows. If a believer has received a tax receipt that contains his identification code, he may not pay this document. He needs to go to the bank branch and fill out the payment document himself. It is not necessary to indicate the TIN. But payments must be made to the budget within the established time frame.

But the payer must understand that without a TIN, the payment risks being lost. Full name is not unique information. There is a risk that money will be credited to the wrong taxpayer.

A tax identification number is mandatory for all citizens of the Russian Federation, regardless of their religious beliefs. Whether you want it or not, it will be assigned to you automatically when taxes are calculated. Persons who are officially employed pay income tax, so they must have a code.

It is advisable to contact your local tax office and receive a certificate. It may be useful in the future when applying for loans, concluding financial transactions, or contacting budgetary structures.

about the author

Evgeniy Nikitin Higher education majoring in Journalism at Lobachevsky University. For more than 4 years he worked with individuals at NBD Bank and Volga-Credit. Has experience working in newspapers and television in Nizhny Novgorod. She is an analyst of banking products and services. Professional journalist and copywriter in the financial environment [email protected]

Is this article useful? Not really

Help us find out how much this article helped you. If something is missing or the information is not accurate, please report it below in the comments or write to us by email

Why does a fraudster need a tax identification number and a passport?

You should not trust your data to other people. A similar rule applies not only to passports, but also applies to other papers, such as SNILS. You need to monitor not only the original document, but also its copies. Photographs of papers must not be allowed. The information they contain is sufficient to commit an unlawful act. Important! The main question that worries citizens who have allowed their data to leak to third parties is whether fraudsters can take out a loan using their passport data without the passport itself? Experts say that such fraud is possible. Today there are many companies operating online and providing loans based on the information contained in the main document of a citizen of the Russian Federation. To apply for a loan from such a company, a copy of the document or information contained in it is sufficient.

- get a loan from a banking organization;

- issue debt obligations;

- re-register real estate;

- register a company;

- obtain a legitimate duplicate for subsequent fraudulent activities;

- manage bank cards;

- perform actions on behalf of the owner on the Internet.

Please note => What do you need to get a job as a nanny in a kindergarten?

Comments: 0

Your comment (question) If you have questions about this article, you can tell us. Our team consists of only experienced experts and specialists with specialized education. We will try to help you in this topic:

Author of the article Evgeny Nikitin

Consultant, author Popovich Anna

Financial author Olga Pikhotskaya

What does the document look like?

The document, which is usually called a tax code or TIN, is a certificate of registration of an individual. It indicates the citizen’s personal data - full name, date and place of birth, as well as the actual 12-digit code. The document is issued on a standardized A4 format with a hologram, security elements and the seal of the tax service that issued it.

The original document is issued once based on the citizen’s application. In case of loss, a citizen has the right to request a copy of the document.

You can learn how to restore your TIN on the Federal Tax Service website or on our information portal.