basic information

Changing the surname of an individual entrepreneur is practically no different from changing the surname of a sole proprietor. The only difference is the need to change not only “physical” but also “legal” documents. Changes must also be entered into the Unified State Register of Individual Entrepreneurs. The entrepreneur will need to change the OGRNIP certificate. The procedure for changing an individual entrepreneur's surname is regulated by Federal Law No. 143 “On Acts of Civil Status” dated November 15, 1997.

Is it necessary to submit a SZV-TD in relation to hired workers if the individual entrepreneur has changed his last name?

The surname changes in several stages. The entrepreneur will have to send relevant applications to various authorities. And this must be done within a certain time frame. It is not enough for an entrepreneur to simply change his passport. If the information in business documents does not correspond to reality, the individual entrepreneur will not be able to carry out activities.

FOR YOUR INFORMATION! If an individual changes his last name, he only needs to change his passport and civil papers. If an individual entrepreneur changes his last name, he needs to change all papers related to entrepreneurial work.

A few more words to note

Changing your last name is a lengthy process that begins with obtaining a new passport. As soon as the new document is in hand, you will need to make a list of all institutions where you need to provide new information about yourself (including the tax office).

Changing your TIN when changing your last name is not such a complicated procedure, so you can start with this when you receive your passport. Don’t forget that you also need to change your SNILS, but this is done by the Pension Fund at your place of residence. The previous TIN certificate is no longer valid, so you only need to present a new one.

The article discussed a pressing issue for those whose last name has changed. An employee can answer any questions that arise when a citizen comes to change documents.

First step

First, an entrepreneur needs to contact the registry office and request a certificate to change his last name. To do this, you need to go to the authority at the place of residence/registration of the individual entrepreneur. An application to change the surname is sent to the registry office. Before submitting an application, a fee is paid, and all the necessary documents are collected.

Question: An individual entrepreneur changed his last name. Is it necessary to make changes to the employment contracts concluded with its employees? View answer

Change of surname is carried out on the basis of an application. The corresponding instruction is in Government Decree No. 1274 of October 30, 1998. The application records this information:

- Basic data (full name, date of birth).

- Children under 14 years old, if any (you must indicate their full name).

- Details of documents (number, date, name of the registry office) about marriage.

- Selected last name.

- Reasons why the surname changes (personal desire, marriage).

- List of attached papers.

Question: The individual entrepreneur changed his last name. In this regard, is it necessary to conclude additional agreements to employment contracts with employees? View answer

The following documents are attached to the application:

- Birth certificate.

- Old passport.

- Marriage or divorce certificate if the surname changes due to these circumstances.

- Authorization of official representation if the surname of minors changes.

The package of documents in question, the application and the receipt for payment of the state fee must be sent to the registry office.

The application is reviewed by the registry office within 30 days. Under exceptional circumstances, it is possible to extend the period to 60 days. As a result, the person receives a certificate. Based on this, you can change your passport. It must be changed within 30 days from the date of receipt of the certificate. A passport with current data will be ready 10 days after it is ordered.

Is it possible to get a TIN through State Services?

Only the Federal Tax Service is responsible for assigning individual numbers to citizens and maintaining tax records. It is impossible to obtain a Taxpayer Identification Number (TIN) from State Services; a citizen must contact the Federal Tax Service.

Options for obtaining a TIN for the first time:

- Contact the Federal Tax Service office at your place of residence in person and submit an application.

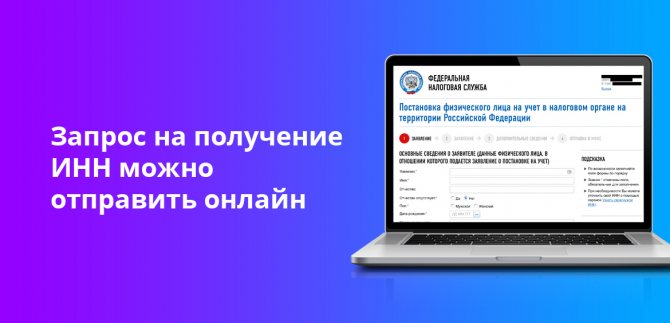

- Register on the tax service website, obtain credentials and submit a request online.

- Contact the MFC at your place of residence.

It is impossible to obtain a paper TIN certificate completely remotely. Even if you send a request through the online service of the Federal Tax Service, you will still need to go to the department to receive a paper version of the document.

Through the goportal you can only find out your TIN, that is, the number itself. It is impossible to get a new one; you will have to contact the MFC or the Federal Tax Service. But the procedure is simple and will not take much time and effort.

Change of passport

The passport must be changed within 30 days after receiving a certificate of change of surname or after marriage. To obtain an updated document, you can send an application to the Ministry of Internal Affairs, MFC. You can also initiate the process of changing your passport through the government services website.

If the application is submitted at the place of residence of the individual entrepreneur, a new document can be received within 10 days. If the package of documents is submitted to another authority, the passport will be prepared within 30 days. To change you need to prepare these papers:

- Previous passport.

- Statement.

- Marriage/divorce certificate.

- A receipt confirming payment of the duty.

- Photo 35 by 45 mm.

- Papers needed to put marks in the passport: military ID, marriage certificate.

The fee is 300 rubles. When paying through government services, you can get a 30% discount.

What documents are needed?

We list what documents are needed to change the TIN when changing your last name. It is worth reassuring citizens: the procedure for collecting documents is not at all complicated.

First of all, you need to have a new passport in hand. Some tax offices may ask you to bring copies of all documents.

Next, you should find the old certificate of issuance of the TIN (A4 sheet). It is recommended to immediately put all found and prepared documents and their copies into a separate folder (just in case).

In addition to the passport and the old TIN certificate, there must be a document from the registry office about the reason for the change of name. It can be:

- Marriage certificate;

- divorce certificate;

- certificate of change of surname.

Now here is a list of all the required documents once again:

- new passport;

- certificate (of marriage, change of surname or divorce);

- certificate with TIN number;

- copies of passport and certificate of marriage, divorce or change of surname (if required).

When all the documents in the folder are collected, you need to decide where the tax service is.

Obtaining an extract from the Unified State Register of Individual Entrepreneurs (USRIP)

An entrepreneur does not need to contact an individual entrepreneur to change information. The passport office itself will send all the necessary information on the basis of which changes are made. An entrepreneur can receive an extract from the Unified State Register of Entrepreneurs about the change of data. Providing an extract is a free service. The document will be ready within 5 days.

Sometimes information in the Unified State Register of Individual Entrepreneurs does not change in a timely manner. The entrepreneur can speed up the procedure. To do this, you need to send a corresponding application formed according to form P24001. The application is sent to the tax office. This can be done either in person or by mail. There is no need to pay a fee.

Standard scheme for obtaining a TIN

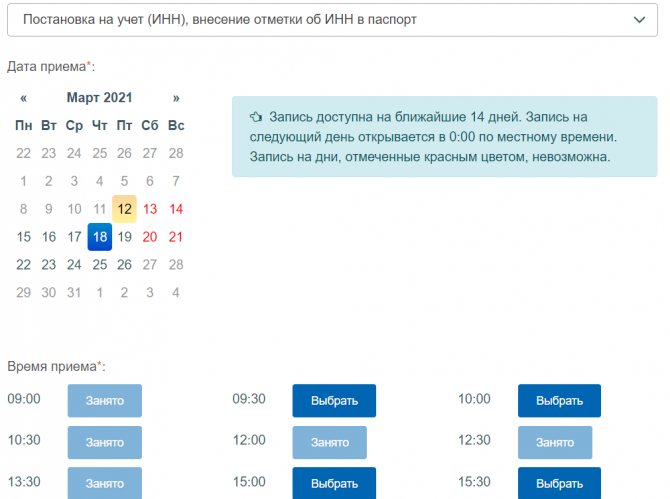

If online application is inconvenient for you, you can use the standard scheme - personally visit the Federal Tax Service department. You must first make an appointment; this can be done online on the Federal Tax Service website:

- Go to the online registration page for an appointment with the inspectorate and agree to data processing.

- Indicate the type of taxpayer (in our case, an individual), indicate your full name, phone number and email address.

- Select your region and tax office at your place of residence. Specify the type of service - registration.

- The system will open free “tags”. Choose a convenient date and time and confirm your appointment.

At the designated time, you must visit the selected department of the Federal Tax Service with your passport and submit an application for tax registration. Within 5 days the application will be processed and a certificate will be generated. After this period, you need to come to the same Federal Tax Service again and pick up the document.

Sending notifications to partners

The first step is to send the changed information to the servicing bank. The client's current account will remain the same, but the name of the individual entrepreneur will be updated. A notification must be sent to the bank before the next payment from the counterparty so that the money goes through the correct details.

It is also recommended to contact counterparties. Free-form letters are sent to partners. They must indicate that the details of the individual entrepreneur, and in particular the last name, have changed.

If the entrepreneur has a seal, it also changes. This is due to the fact that the surname of the individual entrepreneur usually appears in it. If you do not update anything, the seal will no longer be relevant.

An entrepreneur may have loans. In this case, you need to contact the credit institution.

1Replacement of TIN – package of necessary papers

When replacing the TIN, only personal data (for example, last name or first name) is corrected. The number itself (a unique sequence of numbers) remains the same, because assigned to a person once and for life. The main purpose of updating the TIN, most often, is the correspondence between the information in the tax service database and the person’s passport data. To replace the document, prepare the following papers:

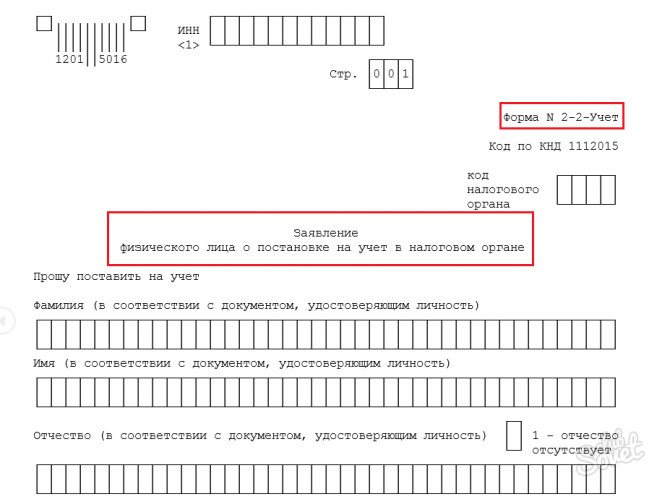

- Receive and fill out an application form in form 2-2-Accounting.

- Passport or any other document identifying a citizen and containing information about his registration. If a TIN replacement is required for a foreign citizen, the latter submits not only his passport, but also its translation, certified by a notary. In addition, it is necessary to submit a paper containing information about the registration of this person.

- Previous personal registration number with the tax service (if available) in the original.

- The document providing the basis for changing the data in the TIN. Most often, such paper is a certificate of marriage or divorce. A copy of this document is submitted.

The prepared papers can be submitted to the tax service or MFC at your place of residence or stay.

Scheme for contacting government agencies

Changing the last name of an entrepreneur is a lengthy process that involves contacting various authorities. Moreover, the process is complicated by the fact that the individual entrepreneur needs to meet the deadlines. Let's consider all the authorities where you need to go, with current deadlines:

| Government agency | Action | Deadlines |

| Passport Office | Change of passport | Submitting an application within 30 days from the date of wedding/divorce or issuance of a certificate for changing a passport |

| Federal Tax Service | Change of TIN | The application must be submitted immediately after the new passport is issued |

| Pension Fund | Change SNILS | Within 2 weeks from the date of issue of the new passport |

| Bank | Change of details | After receiving an extract from the Unified State Register of Individual Entrepreneurs |

| Federal Tax Service | Extract from the Unified State Register of Individual Entrepreneurs. Requested as needed | Issued within 5 days |

| Insurance | Change of compulsory medical insurance | Within 30 days from the date of receipt of a new passport |

The process of amending documents due to a change of surname can take up to 2 months.

Where to go now?

There is a tax service in every region of the country. If you live in a big city, for example Moscow, then you need to go to your place of residence, finding out the address, for example, to the MFC.

You can ask neighbors, colleagues or government organizations (EIRC, for example). You can change the TIN when changing your last name only strictly at the place of residence or at the place of stay, if the citizen is registered.

As a rule, tax offices work on weekdays. Therefore, if you work on a daily basis, you will have to ask management for time off. It is advisable to arrive at the venue no later than half an hour before closing. When you approach the employee, you need to inform that the purpose of the visit is to change the TIN when changing your last name.

2Replacing TIN - procedure

The prepared package of papers must be submitted to the tax authority. You can do this:

- By personal contact to the tax office.

- Through a correspondence delivery service (mail). In this case, the letter is sent with a notification, as well as a list of attachments.

- Through electronic portals - State Services and the Federal Tax Service. The advantage of this method is its mobility and convenience. Find the section for submitting an application to register an individual for tax purposes and fill out the necessary forms.

- If you have an electronic signature, you can use the “Legal Taxpayer” program (the application is downloaded from the Federal Tax Service portal). In this case, the applicant receives an electronic version of the TIN (without visiting the tax office, MFC).

The new document will be ready 5 days after sending the documents. Replacement of a document in case of changes in its data is carried out free of charge, because positioned as the issuance of a new document. If the TIN is replaced due to the loss of the previous certificate, you will have to pay a state fee.