Personal visit

Although obtaining a paper certificate is not mandatory for citizens, it may still be required in various life situations, for example, during employment. The TIN is issued by the territorial inspectorate at the person’s place of residence. To receive one, you need to fill out an application and present your passport. A child under 14 years of age is issued a document based on an application from one of the parents, to which copies are attached:

- parent's passport;

- baby's birth certificate;

- certificate of registration at the place of residence.

Five days after registration of the application, the document is issued in person. But it is much faster and easier to order a TIN from the tax office online.

What will you need?

What will you need? Prepare only a passport of a citizen of the Russian Federation. Please note that every person over 14 years of age must independently obtain a code.

Read also: How to privatize the land under a house?

Please note that registration must be included in your passport. If this is not the case, you will have to provide an additional document. You will also have to take with you a document that would explain the change of name, if there was such a procedure.

Advice! If you want to issue a code to a child who is under 14 years old, then to do this, arm yourself with a document confirming the legality of the representative, and you will also need a birth certificate.

Since 2012, every citizen has the right to receive a TIN according to a simplified version at the location:

- registration;

- residence in the absence of permanent registration (for example, a foreign citizen);

- real estate registration;

- registration of a vehicle in the absence of a place of registration.

"Government Services"

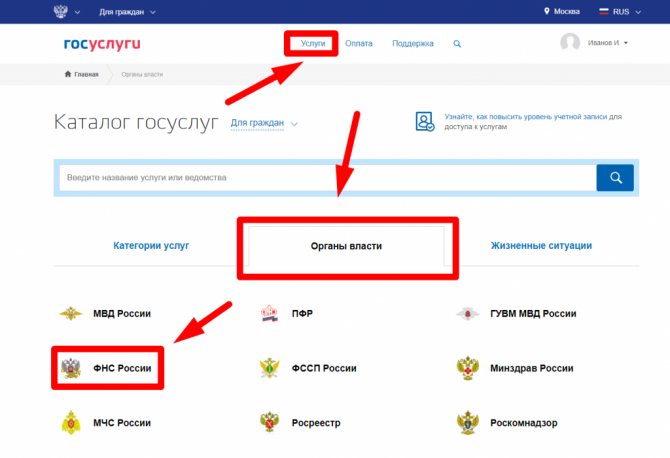

The “Find out your TIN” service is available on the government services portal. To do this, you need to log in, go to the catalog and select the agency “Federal Tax Service of Russia”.

On the page that opens, select the appropriate service.

Help: The service is provided free of charge in real time.

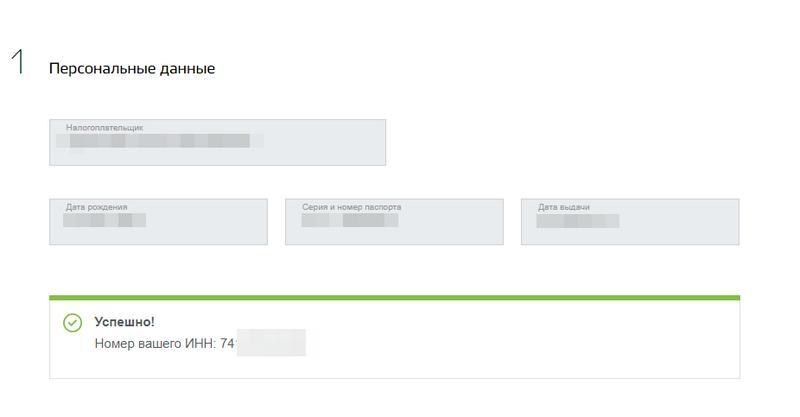

To receive information you need to fill out:

- surname, first name, patronymic;

- date of birth;

- passport details.

The portal will automatically show the taxpayer code.

However, you cannot obtain a TIN online via the Internet on the government services website. It is only possible to view the previously assigned number.

Website of the Federal Tax Service

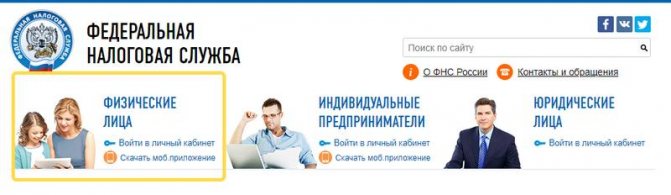

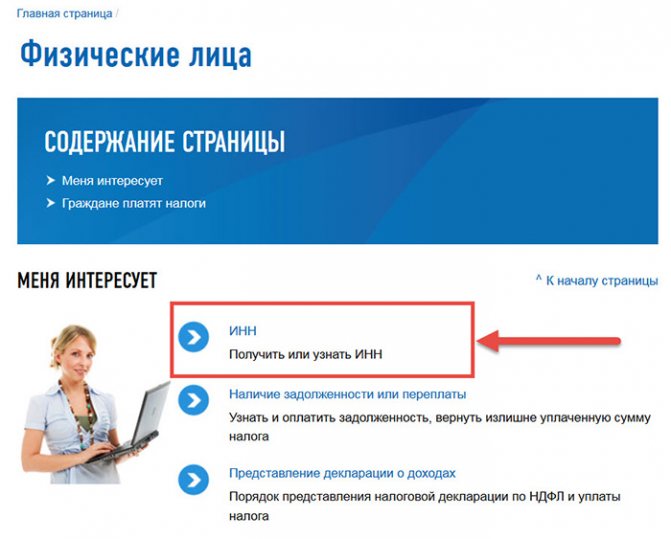

On the website www.nalog.ru you need to go to the “individuals” section.

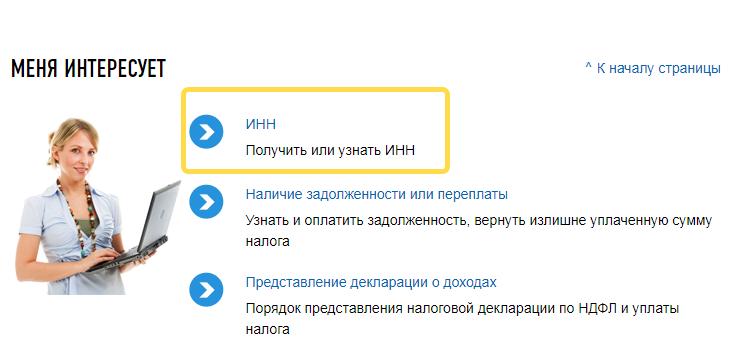

Next, find the subsection “Get or find out the TIN.”

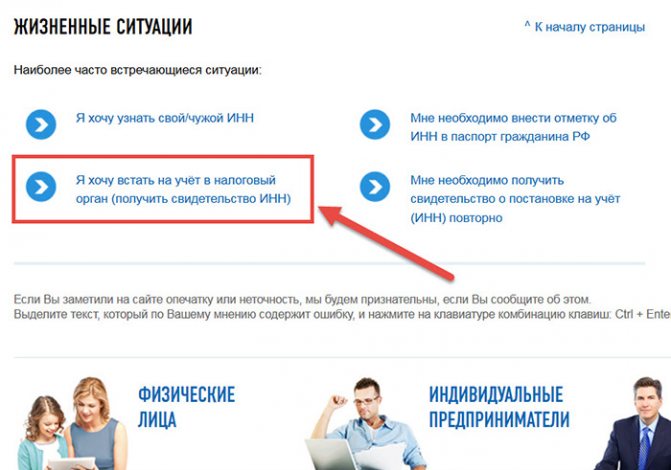

On the page that opens, at the bottom there is a section “Life Situations”, in which the most common requests from citizens are grouped:

- find out the tax payer code;

- register with the Federal Tax Service;

- enter the payer's number in your passport;

- get the certificate again.

Depending on whether a person wants to obtain a TIN online through the tax website for the first time or for the second time, you should select the appropriate section.

Step-by-step instructions for obtaining a TIN on the website of the Federal Tax Service of the Russian Federation

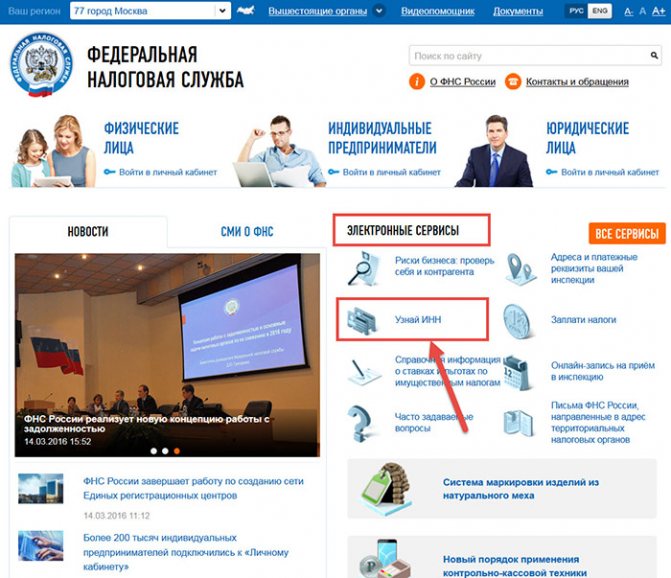

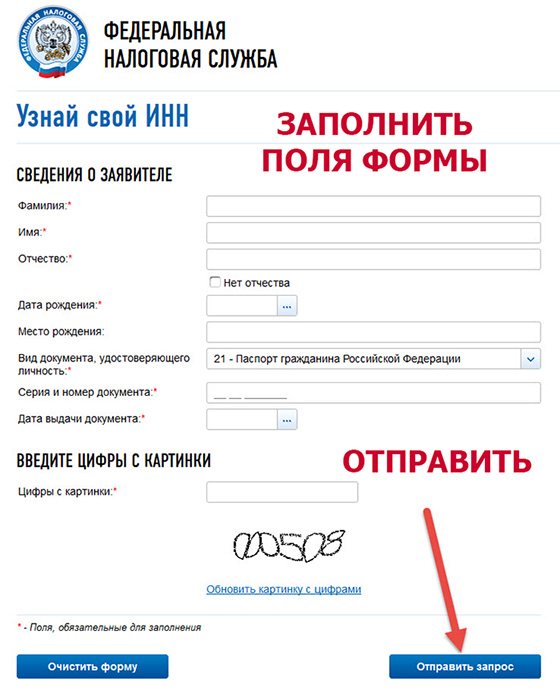

Step-by-step instructions for obtaining a TIN using a passport online on the website of the Federal Tax Service of the Russian Federation are extremely easy to follow. If for some reason the user is not sure whether he is already in the Federal Tax Service, then an online check is offered on the tax.ru website. To do this, click on the “Find out TIN” tab, which is located in “Electronic Services”.

After opening, you need to enter data into the form that opens.

If you are convinced that there is no TIN certificate, then you should go to “Individuals”, and then click on the “Get or find out TIN” item.

A page will appear where you need to select the appropriate item, expressing your desire to register.

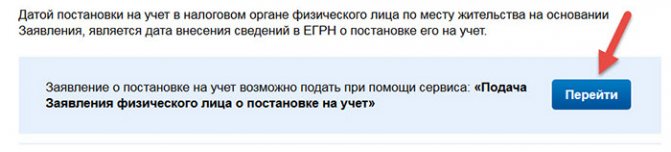

Next, click the “Go” button.

After this, the following information will open.

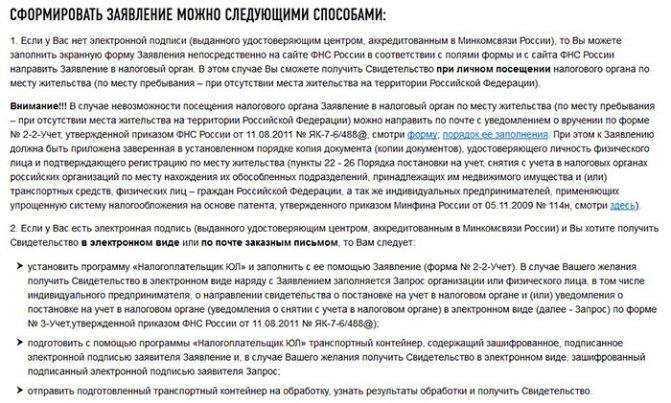

You are invited to submit an application, fill it out and submit it to the NSF in a convenient way.

Finally, the portal offers registration by entering a login and the desired password (at least eight characters). Next, the activation code will be sent to the mailbox that you registered during registration. Keep in mind that the navigation on the site is not the best, so you may not find everything you need right away. Read also: Russian Presidential Elections 2018

Change of personal data

Replacing the certificate when the personal information (last name, first name or patronymic) of the tax payer changes is not his responsibility. The civil registry office registering the change must independently send information to the Federal Tax Service.

But it is still better to contact the Federal Tax Service department to obtain a new document. Moreover, such a replacement is absolutely free. To do this, you need to fill out an application in the prescribed form and present a passport with updated data.

The application can also be filled out online on the tax office website. To do this, you need to select the form of initial application, since a state fee is charged for re-issuance.

Attention: It is currently not possible to change the payer code when changing personal data through the State Services portal. Although in the future the developers promise to add such a function.

How to get a TIN through State Services

If a person does not have a TIN at all, then it can be ordered using the Federal Tax Service website. A registered user of State Services will be able to do this without much effort by entering all the requested information in the appropriate lines.

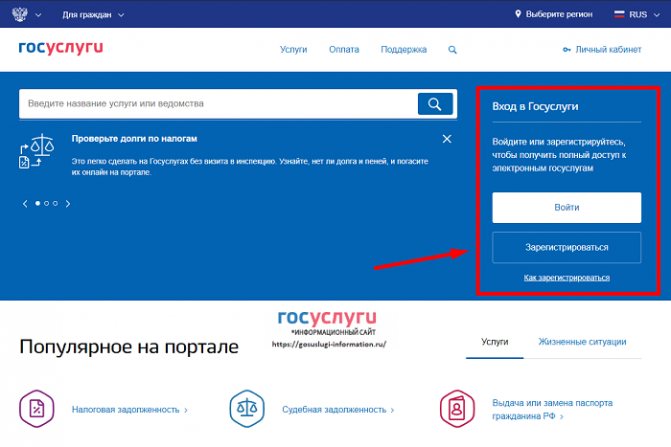

To obtain a TIN through the State Services portal, you should:

- Go to the portal: https://www.gosuslugi.ru/

- Log in to your “Personal Account”.

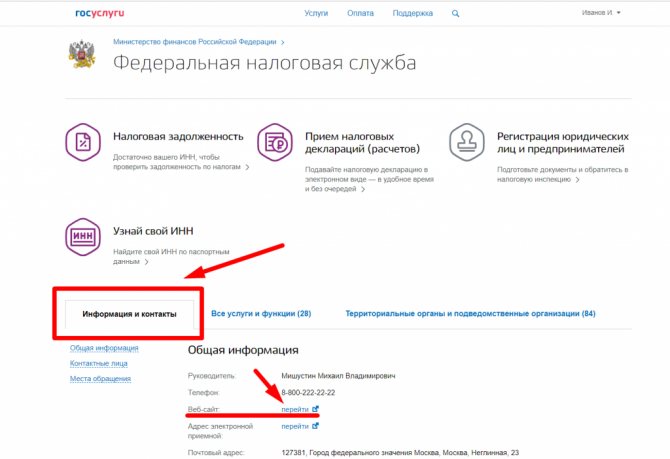

- Next, click “ and click on “Federal Tax Service of Russia”.

- Then select the “Information and Contacts” tab and click “go” where it says website.

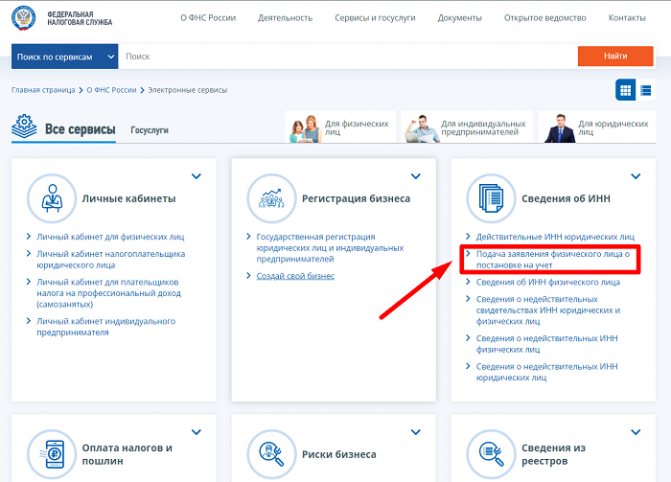

- After you have been redirected to the Federal Tax Service website, click on “Services and government class=”aligncenter” width=”700″ height=”496″[/img]

- In the “Information about TIN” menu, click on “Submission of an individual’s application for registration.”

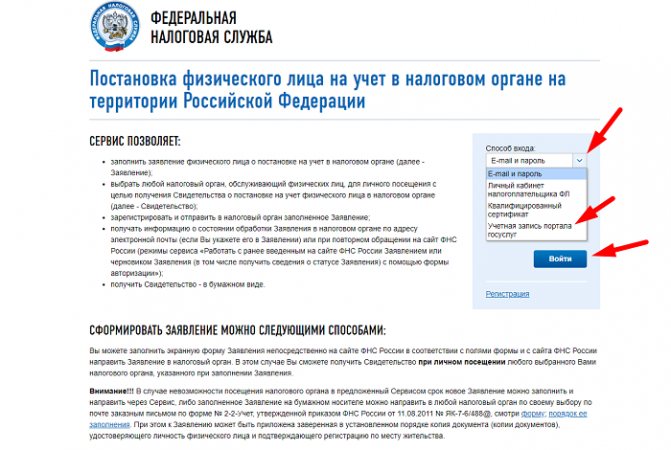

- Log in to your State Services portal account and fill out an application for a TIN.

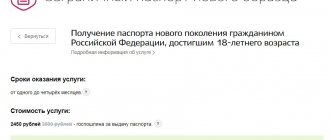

If the application is successfully accepted, then within 5 days a notification will be sent to your email (which is required when drawing up the form). It notifies you when and with what documents you should come and pick up your TIN yourself. The document is issued exclusively in person upon presentation of a passport . The tax office will be the one indicated in the application.

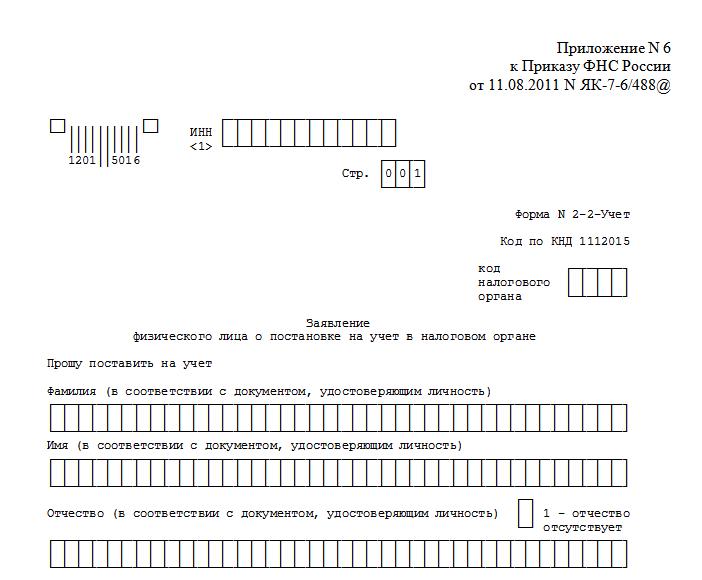

An application for a TIN can be submitted via mail. A completed application (the form can be downloaded from the Federal Tax Service or State Services website) and all documents (copies) are placed in the envelope. A photocopy of the passport is accepted, only notarized.

If you have any difficulties, watch the video instructions.

Video instructions

Make an appointment

Since obtaining the document is possible at the Federal Tax Service office, it is advisable to make an appointment in advance at a convenient time. This will avoid long waits in line.

You can make an appointment on the tax office website, in the “Electronic Services” section.

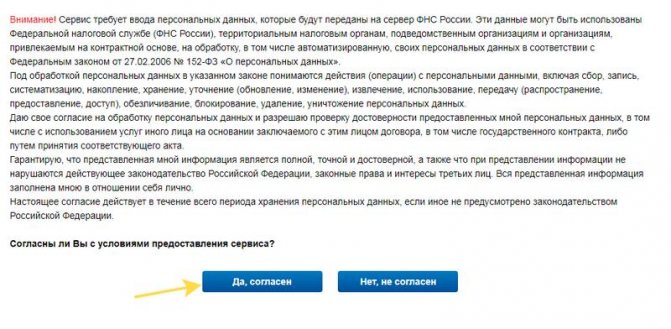

When filling out the form, the citizen automatically gives his consent to the processing of personal data by clicking on the “Yes, I agree” button.

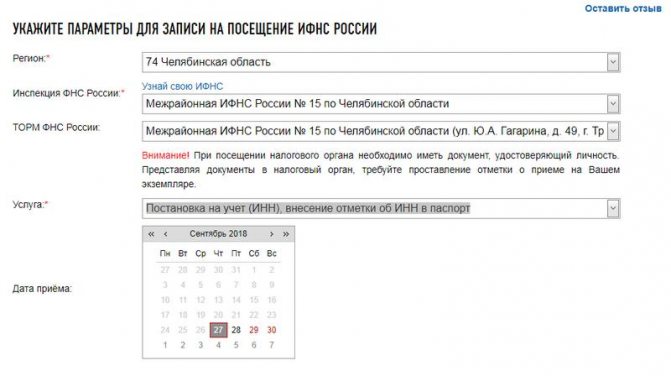

To register you must indicate:

- last name;

- Name;

- surname;

- TIN (if available);

- telephone;

- e-mail;

- region.

Next, from the list that opens, you should select the address of the inspection and the service that the citizen wishes to receive. And after filling out all the fields, indicate the date and time of your visit to the Federal Tax Service.

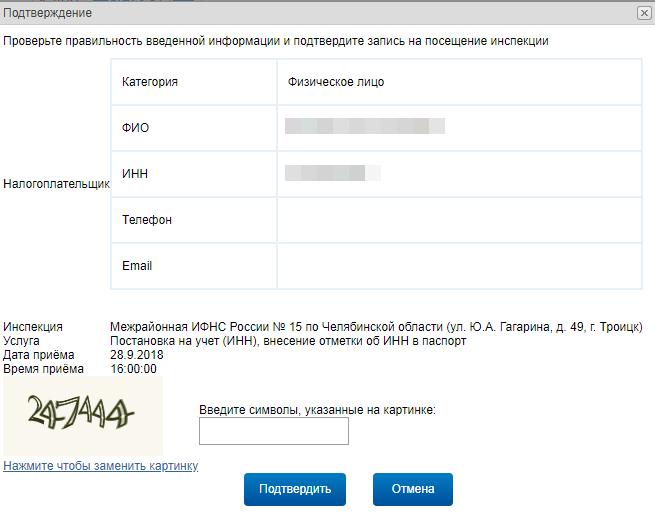

Then you need to check the specified data and enter the code from the picture in a special window.

After clicking the “confirm” button, the reservation for the specified time is sent to the Federal Tax Service. On the appointed day, you must visit the selected department. Have your passport with you.

Is it possible to restore a TIN certificate through the State Services website?

In case of loss, theft or damage to a certificate, ordering a duplicate is more difficult than for the first time. This is primarily due to the fact that such an opportunity is not available on the website of the tax service or State Services. This can be done in person, through a representative or by sending documents by mail. In addition, when restoring, you will have to fork out: there is no fine, but there is a state duty for re-issuance. Size 300 rubles (if you change your last name, the replacement is free). To pay the fee, follow the link. Production time remains the same - 5 days.

Read also: How to change the TIN when changing your last name through the State Services portal

You can also get a registration and replacement service after losing a certificate at the “My Documents” branches. Make an appointment in advance and visit at the appointed time. You will need two documents:

- application form No. 2-2-Accounting (filled out in advance or in the presence of a specialist);

- passport.

Readiness status is tracked by the certificate number, which will be issued after receiving the documents.

Digital signature key

If a citizen has an electronic digital signature, then he can receive a TIN online, in the format of a digital document with the digital signature of the responsible person.

To obtain an electronic signature, a person should contact a certification center and present:

- passport;

- SNILS.

The company concludes an agreement with him for the production of a key and signs a consent to the processing of personal data.

Interesting: In various certification centers, the cost of the service varies from 1.5 to 2.5 thousand rubles.

Advantages of using digital signature to obtain a tax payer code:

- no need to attend inspection;

- saving time on contacting government agencies;

- wide range of possibilities.

Using an electronic digital signature, you can not only obtain a taxpayer code, but also pay taxes, fill out declarations, submit applications to the Federal Tax Service and perform other actions.

Mark in the passport

To prevent the code on paper from being lost or spoiled, you can simply put the payer’s number in the passport of a citizen of the Russian Federation. To do this, you need to contact any branch of the Federal Tax Service and present documents. This opportunity has become available in 2021.

The mark is made in the form of a black stamp on page 18-19 of the passport, at the top. If there is not enough space there, then below. It states:

- taxpayer number;

- Date of entry;

- signature of the official.

A citizen has the right to independently decide whether to mark it or use the certificate as a separate document. No one can force him to do this.

Inspectors note that this innovation makes it easier and easier to confirm that a code belongs to a specific person when preparing documents or contacting government agencies.

The stamp in your passport is free of charge. The whole procedure takes no more than 15 minutes.

Ordering a Taxpayer Identification Number online is very easy. Filling out the application takes minimal time. Thanks to the electronic service, there is no need to visit the inspection twice. It is enough to come once to receive a certificate, which is provided free of charge upon initial application or change of personal data.