TIN - meaning and application

The identification number is assigned to taxpayers once. This code is unique and consists of 12 digits. It is used for the following purposes:

- individual accounting of tax deductions and pension savings;

- receiving a deduction when filing a tax return 3-NDFL;

- opening your own business with individual entrepreneur status.

Even if the certificate is lost and restored, the individual number is retained. It can be assigned at any age if you have the necessary documents. Persons over the age of 14 who have received a passport receive a certificate on their own; before this age, a parent or legal guardian is required for registration.

All identification numbers are entered into the Unified State Register of Real Estate. This register is the database of the Federal Tax Service. Thanks to it, you can find out your personal taxpayer code. Proceed according to the following algorithm:

- Go to the official website of the Federal Tax Service https://www.nalog.ru/rn43/.

- In the list of services section, find “Information about the TIN of an individual.”

- Confirm your consent to the processing of personal data.

- Fill in the required fields - last name (indicate the one for which the TIN certificate was issued), first name and patronymic, date of birth. Select the type of identification document, enter its series and number. Additionally, you can enter your place of birth with the date of issue of your identity document, but these fields are optional.

- If the data is filled out correctly, a field with the Taxpayer Identification Number (TIN) will appear on the screen.

It is important to note that the request on the official website is free. Third-party resources may provide information for a fee, and entering passport data on them is unsafe.

TIN - how to find out and where to get it in Moscow

For legal entities, the digital sequence is slightly shorter and consists of ten characters. For individuals and individual entrepreneurs, the sequence is 12 Arabic numerals. The first two digits are the code of the subject of the Russian Federation, the next two digits are the tax office department number, the next six characters are the taxpayer’s record number, and the last two are control ones to check the correctness of the entire combination.

We recommend reading: At whose expense do we replace risers and pipes in an apartment? Law 2021

If you do not have an electronic signature issued by an organization accredited by the Ministry of Telecom and Mass Communications of Russia, then in any case you will have to visit the tax authority, at least to obtain a certificate. The application can be submitted online using the service on the Federal Tax Service website: service.nalog.ru/zpufl/ To submit an application via the Internet, you will have to fill out the registration form and attach copies of documents in electronic form.

Restoration of TIN in the tax service

To obtain a duplicate certificate, it is better to contact the nearest branch of the Federal Tax Service . Its official website will help you save time. On it you can apply, study the recommendations for filling it out and pay the state fee online.

It is impossible to organize the entire procedure remotely, therefore you must come to the tax office in person, providing a certain package of documents.

The first time the certificate is issued free of charge; upon renewal, a state fee of 300 rubles is paid . It takes up to 5 working days to produce a duplicate TIN .

You can speed up the process by paying an additional 300 rubles.

If you live in another city, you can send documents to restore your TIN by mail, contact the tax office at the temporary registration address, or another convenient location. Even the lack of registration is not an obstacle to restoring the certificate.

Where and how to obtain a TIN in Moscow for an individual (algorithm for obtaining)

To register a TIN through the official website of the Federal Tax Service, select , then open the form “Application of an individual for registration with a tax authority on the territory of the Russian Federation.”

Where to get a TIN in Moscow? The answer to this question will be of interest to permanent and temporary residents of the capital who, for certain reasons, do not have this document. The TIN is necessary for tax registration of all citizens, therefore it is assigned to every citizen of the Russian Federation. You will learn how and where to get a TIN in Moscow from our article.

Package of documents

If you contact the Federal Tax Service office to restore your TIN in person, you will need:

- completed application, prescribed form;

- identification;

- document confirming registration at the place of residence;

- a receipt confirming the paid state duty.

An application for TIN restoration can be submitted by a representative. In this case, the list of documents is the same, but a photocopy of the document is additionally required to confirm authority.

When sending papers by mail, you must include an application and a receipt for payment of the state duty. The remaining documents from the list must be photocopied and certified.

Where to get an inn at your place of residence in Moscow addresses

Where to get a TIN for foreign citizens 2021: registration with the tax office. Moreover, from 2021, migrants are required to personally submit documents for registration of a patent - no intermediaries are allowed. To obtain a patent, a migrant worker must first acquire a TIN - an identification code that foreigners receive in the same tax structures as Russians.

Indicate your email address in the Application and you will receive messages about the status of your application to your mailbox. After filling out the Application for a TIN and sending it through the online service, the Federal Tax Service of Russia is responsible for the safety of the information after it is received. how to obtain a tax identification number for a child The legal representative (parent) of a child under the age of 14, in order to obtain a document confirming the assignment of a taxpayer identification number, must contact the tax office at the place of residence and provide:

Application for TIN restoration

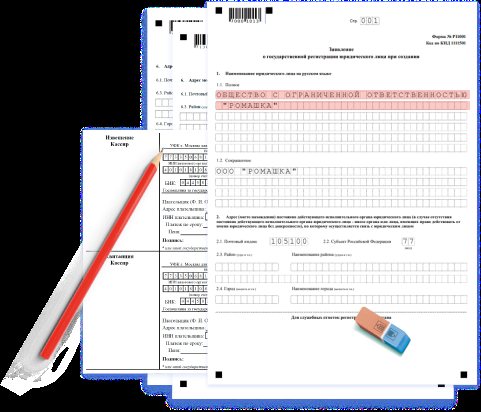

You can visit the official website of the Federal Tax Service after registration. The form can also be found on third-party resources. You can submit an application only on form 2-2-Accounting; other options will not be considered. When filling out the form, you must consider the following rules:

- use a ballpoint pen, the paste can be blue or black;

- Only block letters are allowed, each in its own square;

- all data must be reliable and legible;

- corrections are not allowed;

- the application consists of three pages, each printed on a separate sheet;

- All dates should be indicated in numbers.

It is possible to fill out the application in electronic format. This option is only available to persons with an electronic signature. For filling, use Courier New font, size 16.

The recommendations on the Federal Tax Service website will help you fill out the form correctly. They can be viewed online. When filling out the form at the tax office, samples can be found on stands. The form will be issued on site, so there is no need to print it in advance.

If a mistake is made when filling out the application, you need to ask (print) a new form . You should not deliberately leave erroneous data, as the request will be rejected during verification.

Sample and form

Application form for TIN restoration.doc Sample of filling out an application for TIN restoration.doc

Where and how to obtain a TIN in Moscow for an individual (algorithm for obtaining)

Thus, Moscow residents who do not have registration in the capital have nothing to worry about, since they can contact the Federal Tax Service department at the place of temporary registration, for example. And the tax office will not have the right to refuse to assign them a TIN number and issue the corresponding certificate.

To register a TIN through the official website of the Federal Tax Service, select , then open the form “Application of an individual for registration with a tax authority on the territory of the Russian Federation.”

Recovery conditions

restore your TIN in the following ways:

- personally submit the application and package of documents to the tax office, and pick up the completed duplicate there;

- contact the MFC;

- entrust the entire matter to an authorized representative;

- send a package of documents by mail.

Submitting the necessary documents by a representative or sending them by mail is an excellent alternative to visiting a tax office in person, since this is not always possible. In any case, no more than 5 working days will pass from acceptance of the application to the availability of the duplicate.

Papers should be sent by mail with acknowledgment of receipt. The person receives the finished duplicate at the tax office in person or through an authorized representative. If the applicant (representative) fails to appear for the certificate in person, it will be sent by registered mail.

Each accepted application for TIN restoration receives a unique code. It allows you to control the process. It is enough to go to the official website of the Federal Tax Service and enter this code to find out the stage of processing of the application or its readiness.

Who to notify about a change in the name of the company

3.1. Submit documents to the tax office

There are different ways to submit documents to the Federal Tax Service:

- Personal submission

by the applicant indicated on sheet H, or his representative to the MFC or tax office. - Sending by mail

with a valuable letter with a list of attachments. In Moscow you can use the services of courier services. - Electronic transmission of information

through the tax office’s online service; this requires the applicant’s digital signature. - Through a notary

- he will send documents to the Federal Tax Service online using his digital signature.

To register changes, the Federal Tax Service requires the following documents:

- Completed application form No. P13014,

- The charter in the new edition or a list of amendments to the charter,

- Document confirming payment of state duty in the amount of 800 rubles. You can fill out a receipt on the Federal Tax Service website. If you submit documents electronically with the applicant’s digital signature, through a notary or through the MFC, you do not need to pay a state fee.

Registration of changes will occur within 5 working days. After this, data on changes in the charter will automatically be reflected in the Unified State Register of Legal Entities.

According to the law, the Federal Tax Service sends documents after state registration of changes in electronic form. To do this, in application P13014 on sheet H you need to indicate the email to which the response will be sent. If you want to receive documents in paper form, please mark this on page 2 of sheet N. You can download an extract from the Unified State Register of Legal Entities for free and at any time in the online service of the Federal Tax Service; it will be signed with an enhanced qualified electronic signature and is equivalent to a paper document.

3.2. Reissue internal documents

After the company has officially changed its name, it is necessary to change the seal, if used, and indicate the new name of the company in internal documents. To do this, you will have to re-issue employment contracts, work books, the company’s staffing table, and the list of LLC participants. In addition, it is necessary to replace the organization’s letterhead, as well as forms with details. After this, the company’s licenses, permits, certificates of ownership of real estate, digital signatures are reissued, powers of attorney are replaced, etc.

3.3. Notify the bank about the name change

When you receive a record sheet from the Unified State Register of Legal Entities about the change of name, this information must be reported to the bank where the LLC has an account. It is necessary to issue a card with a new seal and sample signature. To do this, the head of the LLC personally comes to the bank with the following documents:

- Passport,

- Record sheet from the Unified State Register of Legal Entities,

- Minutes of the general meeting or the decision of the sole participant to change the name,

- An order or other document on the appointment of a director.

In addition, the bank may also request a charter, record sheets or TIN, OGRN certificates. It is best to clarify information about the required documents in advance before your visit.

There is no need to notify extra-budgetary funds - FSS, PFR, MHIF - about the name change. The tax office will do this.

You can inform your counterparties about the change of the company's name; this is not necessary, but it will not be superfluous. Notifications can be sent in simple written form, with the director’s signature and the organization’s seal on them, or sent electronically.

Are you changing the name of your LLC? Download all documents for free!

Our online service will generate a complete package of documents for your LLC to change the name, in accordance with the new requirements of the law, including changes to the Federal Tax Service dated November 25, 2020. Just enter the data in the fields, the service will do the rest - competently, quickly and free of charge. You can download the documents, print and submit according to the attached instructions.

Prepare documents

Prepare documents

Restoring TIN through MFC

The MFC is only an intermediary between the citizen and the Federal Tax Service, so the process may take longer. It may take up to 7 business days from submitting an application to receiving a duplicate.

You should know that not every MFC branch provides such a service. You can find out more information about a specific department by phone. Contacts are listed on the official website of the MFC (https://mfc.rf). Just select “sign up in queue”, find your locality and the desired branch.

You must contact the MFC in person . Provide standard documents. You can make an appointment in advance or pick up a ticket on the spot and wait for your turn. The employee who accepts the documents will issue a notification receipt. In it you can see the approximate date of readiness of the duplicate. They issue it in the same department.

An authorized person can submit documents and pick up a completed duplicate at the MFC. This requires a notarized power of attorney. The package of documents should not contain the passport of the person who lost the TIN, but a certified photocopy of it.

Restoring a TIN involves obtaining a duplicate of a previously issued certificate. The unique code is retained. The recovery process takes only a few days and can be carried out in different ways. The package of documents is minimal, and the state duty is small. You can find out the TIN online before issuing a printed duplicate.