04.11.2020

To confirm the temporary residence permit, a foreign citizen who has received a temporary residence permit is required to submit a notification to the Ministry of Internal Affairs within a certain period of time about his actual stay on the territory of the Russian Federation.

This is a system of state control over people arriving from other countries, their working conditions and living conditions. Failure to comply with this rule is considered a serious administrative violation and may subsequently prevent the migrant from obtaining a residence permit. From January 7, 2021, confirmation of temporary residence permit is carried out according to new rules:

- Documents for confirmation of temporary residence permit can be submitted online on the State Services website in the form of scans with an electronic digital signature.

- The list of documentation for submission to the Main Directorate for Migration Affairs of the Ministry of Internal Affairs has been shortened.

- The law requires migrant departments to request the applicant's income statement from the tax office.

- Changes have been made to the notification form.

Who is required to submit a notification under a temporary residence permit?

New Decree of the Government of the Russian Federation No. 1855 dated December 26, 2019, requires, from January 7, 2020, all foreign citizens with a temporary residence permit over 18 years of age to notify the territorial bodies of the Ministry of Internal Affairs about their actual residence at the place of registration. Confirmation of the temporary residence permit through State Services or on paper on behalf of minors must be submitted by one of the parents. A separate notification must be filled out for each child, along with a photocopy of the birth certificate.

Read further in the article about what this procedure is, what documents are needed to confirm the temporary residence permit and other important issues.

When should notification be given?

A temporary residence permit gives the right to reside in the Russian Federation for 3 years. During this period, the annual notification for temporary residence permit is submitted twice. A foreign citizen must confirm his stay in the country at least two months after the end of the one-year period. The reference date is the day the stamp was affixed at the Department of the Ministry of Internal Affairs for Migrant Affairs. This rule is regulated by Federal Law-115, Part 9, Article 6.

If there are good reasons for preventing, they must be documented (illness, force majeure). In this case, all rules for submitting documents to the Ministry of Internal Affairs must be observed.

Where to contact

The annual notification for temporary residence permit 2021 is submitted in the region and division of the Ministry of Internal Affairs for migration issues where the residence permit was issued.

The form of submitting documents in person to the Ministry of Internal Affairs remains the same. The migrant must submit an application and documents to confirm the temporary residence permit (read what exactly).

According to the new rules that came into force in January 2021, it became possible to confirm the temporary residence permit through State Services electronically. The portal contains a completed application and copies of documents with the applicant’s electronic signature or scans of signed papers.

To confirm the RVP 2021, a sample form is freely available online for review and correct completion.

Submitting documents online is a convenient new rule. However, to be on the safe side, the preferred option is to submit papers in person to ensure their acceptance and to insure against delays.

What documents are needed to notify a temporary residence permit?

To quickly resolve the issue, the migrant should inquire in advance what documents are needed to notify the temporary residence permit.

First of all, you need to fill out an application. The current TRP 2021 confirmation form can be downloaded from the Ministry of Internal Affairs website and entered information on a computer or manually. In addition, you need to submit:

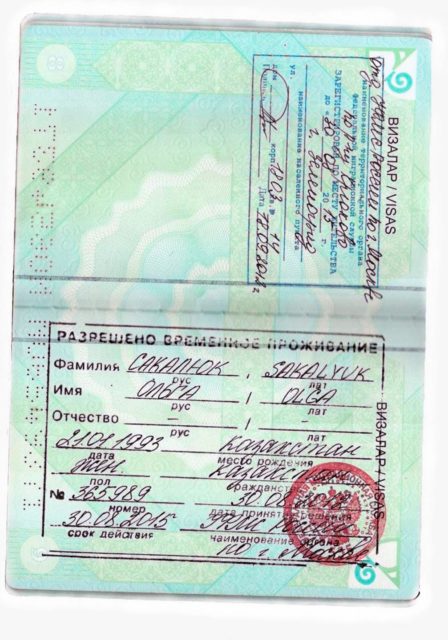

- Passport with registration mark.

- Temporary residence permit stamp.

- Certificate of earnings, confirmation of source of income.

- If a migrant has changed his place of registration over the past annual period, the confirmation of residence under the temporary residence permit must contain information about the new address.

Instead of a certificate, at the choice of the applicant, the migration authority of the Ministry of Internal Affairs may request a tax return or bank account statement from the Federal Tax Service.

Some departments of the Main Directorate for Migration Affairs of the Ministry of Internal Affairs may request additional information: notarized translations of passports, an employment contract (copy), TIN and others. Therefore, before submitting a notification on a temporary residence permit to the authorities, the list of documents should be clarified with employees of the regional division of the Ministry of Internal Affairs.

Being a dependent to confirm income for temporary residence permit

Hello, please help me, I have the following problem: I’ve lived in Russia for 15 years, I’ve been going to school since the 1st grade. when I got married, I started doing paperwork, I myself am a citizen of Ukraine, I have 2 children, one is 2 years old, the second is only 4 months old. I received a temporary residence permit a year ago and I need to provide income, I don’t work, and my husband only works informally, they ask me for a 2nd income tax certificate. But I cannot provide, if I am dependent on a friend of mine and she provides a 2NDFL certificate, is this possible, if possible, what certificates need to be provided. Thank you in advance.

By virtue of Art. 7 Federal Law of July 25, 2002 N 115-FZ “On the legal status of foreign citizens in the Russian Federation” a temporary residence permit is not issued to a foreign citizen, and a previously issued permit is canceled if this foreign citizen: within the next year from on the day of issuance of the temporary residence permit, did not carry out labor activities in the manner established by the legislation of the Russian Federation for one hundred and eighty days or did not receive income or does not have sufficient funds in the amount to support himself and his dependent family members without resorting to help state, at a level not lower than the subsistence level established by the law of the constituent entity of the Russian Federation in whose territory he is allowed temporary residence. This provision does not apply to a foreign citizen whose average monthly income or the average monthly per capita income of a family member is not lower than the subsistence level established by the law of the subject of the Russian Federation on the territory of which the specified foreign citizen is permitted temporary residence. The average monthly income of a foreign citizen and the average monthly per capita income of a family member of a foreign citizen are determined in the manner established by the federal executive body authorized by the Government of the Russian Federation; a full-time student in a professional educational organization of the Russian Federation; a full-time student in an educational organization of higher education in the Russian Federation, including in postgraduate (adjunct) training programs for scientific and pedagogical personnel; pensioner or disabled person.

Considering the above, you may be dependent on a family member. The law does not provide for dependents on acquaintances.

We advise you to watch

Failure to pay a fine upon expulsion from the Russian Federation

Registration at place of residence when applying for temporary asylum

Extension of stay in Russia

Having a USSR passport

Published in Citizenship, registration

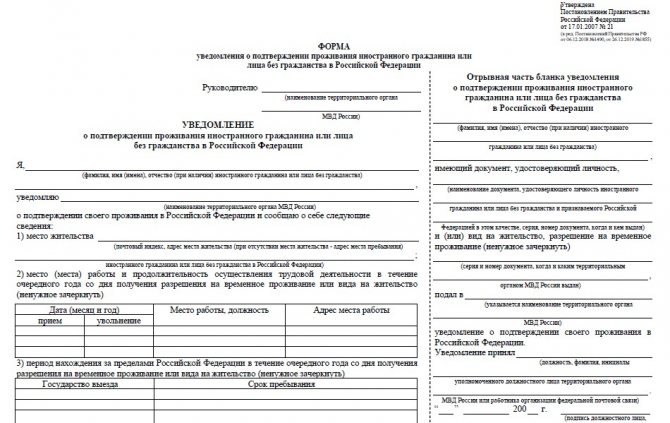

RVP Notification Form 2021

With the introduction of new rules on January 7, 2021, the form of paper and electronic confirmation of temporary residence permit has also changed slightly. A sample notification form is published on the official website of the Ministry of Internal Affairs of the Russian Federation and other licensed resources. The new rules for submitting this document make it possible to do without a paper version. To send a notice of residence under a temporary residence permit, the 2021 form can be downloaded to your computer, filled out, signed with an electronic digital signature and sent through the State Services portal.

An electronic digital signature will be required every time you need to attach and send a temporary residence permit notification via the Internet. Whatever documents you have to submit to government agencies online, a client signature is required. Therefore, it is useful to take care of obtaining an electronic signature in advance. You can apply for it at the MFC.

Information on the proof of residence form must be entered correctly. If you submit a document online, it will be impossible to correct errors.

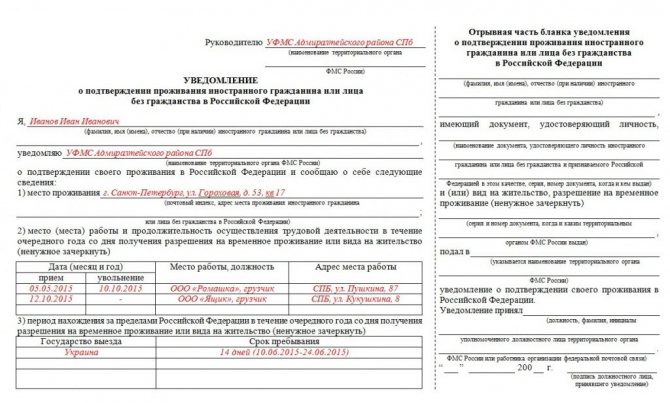

The notification on temporary residence permit - form 2021 - can be studied using the sample below.

How to fill out a notice correctly

The notification of residence under a temporary residence permit is filled out strictly according to the sample.

- Information is entered in Russian, on a computer or with a ballpoint pen.

- If there are any unclear points when filling out, it is better to print out the form and fill it out with the same pen in the presence of an employee of the migration department.

- Abbreviations and acronyms are not allowed.

- Errors, corrections and blots are excluded.

- Only reliable data is required. If incorrect information is discovered, the applicant will be held administratively liable.

What is included in the RVP confirmation form

To confirm the temporary residence permit, the annual report must contain complete information about the applicant. The following are entered in the appropriate columns:

- Full name of the migrant.

- Registration address in accordance with the information specified in the documents.

- If a migrant traveled abroad during the year, he must indicate the periods and directions of departure.

- Confirmation of annual income. According to the rules, it should not be less than 12 living wages.

- Confirmation of temporary residence permit 2021 requires entering information about the places and periods of work for the year and employers.

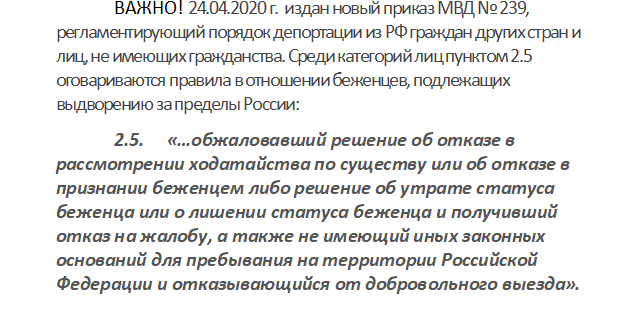

IMPORTANT ! On the part of the employer, a message is submitted to the Main Department of Migration Affairs of the Ministry of Internal Affairs regarding the acceptance or dismissal of foreign citizens within 2 months from the date of conclusion or termination of the employment contract. A separate notification is submitted for each employee indicating his status: arrived on a visa, without a visa, refugee, with a patent and work permit, etc.

A sample RWP notification and rules for filling out the form can be seen below in the picture.

When submitting documents, an employee of the migration department carefully checks the entered data and returns the detachable part of the form to the applicant.

How to confirm income when applying for a residence permit?

Income is confirmed by a 2-NDFL certificate (a sample can be viewed here). This is the main document required when applying for a residence permit.

Interesting article: Obtaining citizenship after a residence permit

In addition to 2-NDFL, it is allowed to provide:

- a regular certificate from work indicating salary;

- 3-NDFL (tax return);

- pensioner's ID;

- certificate of availability of a deposit indicating the account number and deposit amount (not lower than the subsistence level in the region).

If one salary does not reach the required level, then it is allowed to additionally attach documents about other sources of financing. You can choose from the above list.

It should not be overlooked that for able-bodied persons, children and pensioners, the minimum size differs, including by region. The level for pensioners, broken down by region, is available for reading on the website of the Pension Fund, for other persons - on the websites of local authorities.

What is your registration?

Registration at the place of residenceRegistration at the place of stay

The types of official income papers that are suitable vary. Commonly used forms are described below:

- Certificate of income. A salary certificate in form 2-NDFL includes information about the place of work, position held, income for the entire period of work from the date of receipt of a temporary residence permit (TRP), and employer contacts. The usual validity period for a certificate is 1 month.

- Tax return. 3-NDFL also reflects information about income. It is suitable if there is no official work, but there is an inheritance, money for sold housing, etc. 3-NDFL can be found here. When declaring income, you will need to pay an income tax of 13%.

- Statement from the bank. The deposit certificate works as an auxiliary document in the presence of 2-NDFL. The account must have 4 subsistence minimums for the region (exactly for 4 months of consideration of the application). If there is no other proof of income, it is advisable to increase the amount as much as possible (at least to 12 subsistence levels). The bank certificate is valid for several weeks. Available at any branch upon request.

The deposit can be made not only in rubles, but also in foreign currency. In this case, you need to indicate the equivalent amount in rubles at the exchange rate of the Central Bank of Russia on the date of filing, and obtain a certificate from the bank about the exchange rate.

What are the consequences of delays?

Failure to comply with deadlines is considered a violation and faces a fine of 2 to 5 thousand rubles or deportation from the country. According to the regulations of Art. 18.8. of the Code of Administrative Offences, if a notice of temporary residence permit in Moscow or St. Petersburg is not submitted on time, the amount of the fine is from 5 to 7 thousand rubles.

If the deadline for submitting documents to confirm the temporary residence permit is repeatedly missed (notification a year later was submitted late) or other administrative violations, the sanctions may be more stringent. This is possible if the migrant violates the law and public order, the rules of residence for foreigners of the Russian Federation, does not work or violates the procedure for labor activities, etc. In such cases, the migrant is forced to leave the country. For five years he will not have the right to enter the Russian Federation.

In addition, it is possible to cancel the residence permit and deportation of a foreign citizen. If a migrant traveled to another country and did not return for more than 180 days, and therefore did not submit an annual notification under the temporary residence permit, the residence documents are automatically canceled.

How to confirm your annual temporary residence permit if you are not working

of the Russian Federation, on the territory of which this foreign citizen carries out labor activities, on the conclusion and termination (termination) of an employment contract or a civil law contract with this foreign citizen for the performance of work (rendering services) within a period not exceeding three working days from the date of conclusion or termination (termination) of the relevant agreement”, see paragraph 8 of Art. 13 Federal Law “On the legal status of foreign citizens in the Russian Federation”.

For failure to notify of the conclusion/termination of a contract or violation of the deadline for submitting a notification in Moscow and the Moscow Region, a fine of five thousand to seven thousand rubles is provided for citizen-employers, see clauses 3-4 of Art.

If a foreign citizen has an account containing a certain amount of money (at least 12 minimum wages) and interest is accrued on this amount annually, which is also at least 12 minimum wages, then this account can be used as confirmation of financial status. Since annually accrued interest is a stable income for a foreign citizen of the Russian Federation.

Four options for confirming income under temporary residence permit

The most “problem-free” way is to submit a 2NDFL certificate. It is suitable for those who, immediately after receiving a temporary residence permit, got an official job with a white salary. Your monthly income must be at least the minimum subsistence level in your region. For example, in Moscow this figure is 19,351. If you have children, then the cost of living for each child should be added to this amount (+14,647 rubles).

The second most popular method is a 3NDFL certificate (tax return). It is suitable for individual entrepreneurs, employees with whom a civil contract has been concluded, those who live on funds from the sale of movable and immovable property, those who have won the lottery, etc.

You can submit your 3NDFL declaration for last year no later than April 30 of the current year. If you, say, have registered an individual entrepreneur and rent out an apartment, then annually you report your income using this declaration. And you can provide it when confirming the temporary residence permit. The same can be done if you sold a car that you owned for less than 3 years: you submit a declaration and confirm your income with it.

Dependency confirmation is an option for those whose close relatives have good official jobs. For example, a foreign wife can indicate her husband’s salary as a source of income. In this case, a 2nd personal income tax certificate of the spouse is submitted. But this option only works for parents, children and spouses. If you want to declare that you are supported by, say, your brother, you will have to issue a notarized consent to dependency. But it is not a fact that it will be accepted.

No valid reason: forgot to submit the form

Let's say that you forgot to confirm your residence in Russia within the required time frame. Or maybe they thought that this procedure was not very important. In this case, the foreigner falls under the sanctions of Part 1. Art. 18.8 Code of Administrative Offenses of the Russian Federation. Such a violation entails a fine of RUB 2,000. up to 5,000 rub. and, possibly, even deportation from the Russian Federation. Of course, such an extreme measure as deportation is unlikely, but possible in some cases.

Unfortunately, there are times when our plans are changed by unforeseen circumstances. In this case, the law allows for filing a notification at a later date. This must be done no later than 6 months from the end of the next year. That is, the foreigner is given an additional 4 months to solve the problems that arise.