Can a foreigner be an individual entrepreneur in Russia?

The Constitution of the Russian Federation provides for equal rights of Russian citizens and foreigners. That is, foreigners have the same rights and bear the same responsibilities as Russians, with the exception of cases provided for by law. Also, the Civil Code of the Russian Federation states that an individual can engage in individual entrepreneurship only after passing the state registration procedure. An individual entrepreneur does not have the right to form a legal entity in the future.

Is it possible for a foreign citizen to open an individual entrepreneur in Russia? It is possible, because, according to the regulations of the Russian Federation, an individual entrepreneur in Russia can be a person who has reached the age of majority. Accordingly it could be:

- Russian citizen;

- citizen of a foreign country;

- Stateless person is a subject who does not have a specific citizenship.

The procedure for registering an individual entrepreneur for residents and non-residents of the Russian Federation looks almost identical. Like a Russian citizen, a foreigner undergoes the procedure of registration at the place of residence, in other words, “propiska”. In this case, it can be either a residence permit in Russia or a temporary residence permit.

Can a non-resident open an individual entrepreneur without temporary registration? No. Imagine a situation: an individual registered in Moscow wants to open an enterprise in St. Petersburg. It turns to the St. Petersburg branch of the tax service with a request to register it as an individual entrepreneur. He will be denied this request, since he is registered in Moscow. To open an individual entrepreneur in St. Petersburg, he needs to change his place of residence (registration) from Moscow to St. Petersburg. Same with foreigners. To register an individual entrepreneur in Russia, they need to obtain a temporary residence permit in a particular region of the state.

To become a full-fledged individual entrepreneur, any individual must collect the documents required for registration, in particular:

- Passport and its photocopy. If an individual sends these papers by mail, then the passport must be photocopied, after which its copy is stitched, and then only sent to the registration authority.

- Taxpayer identification code. It can be obtained from the branch of the Federal Tax Service of the Russian Federation or on its official website.

- Primary document (receipt form) confirming payment of the state duty amount.

- Registration of a foreign citizen as an individual entrepreneur, like registration of a citizen of Russia or a stateless person, is impossible without filing an application for state registration.

- Application for the transition of an individual taxpayer to a simplified taxation system. This statement will enable its owner to switch to a more convenient tax system and significantly reduce their tax burden.

The law obliges foreign citizens to obtain a work permit along with a certificate of state registration and a USRNIP number.

What to do if an Armenian citizen is denied registration of an individual entrepreneur in Russia

The grounds for refusal are specified in Article 23 of Federal Law No. 129-FZ. A common reason for refusal is the provision of an incomplete package of documents. Other reasons:

- the applicant is already registered as an individual entrepreneur or went through bankruptcy proceedings less than 12 months ago;

- the application for registration of an individual entrepreneur was not submitted at the place of residence of the citizen of Armenia;

- the application was filled out with errors.

If the applicant considers the refusal illegal, he can appeal it. Within 3 months, you need to draw up an application and submit it to the central office of the Federal Tax Service. If the decision remains the same, then you need to go to court.

The complaint is reviewed within 15 days. A decision made by a local court can also be appealed by appealing to the Supreme Court of Russia.

How to formalize and register an individual entrepreneur for foreigners?

Federal Law-129 provides a complete list of instructions on how individual entrepreneurs are registered by a foreign citizen. Registration of a non-resident of the Russian Federation can be carried out only at the place of his residence. The place of residence of a foreigner is the place of temporary residence, the mark of which is on the identity document.

For state registration of a foreigner as an individual entrepreneur, the following documents must be submitted to the local tax office:

- Application for state registration of an individual entrepreneur according to the model approved by law. Form P21001 occupies one of the main places in the list of registration documentation.

- A photocopy of a document that confirms the identity of a foreign citizen registered as an individual entrepreneur.

- A photocopy of a birth certificate or other document that contains information about the date and place of birth of a foreigner who is going to register as an individual entrepreneur.

- A photocopy of a document that confirms the legal right of a non-resident of the country to reside on its territory. Most often, such a document is a temporary residence permit. For foreign citizens it is placed in the form of a stamp in identity documents. If the individual entrepreneur is a stateless person, then this permit takes the form of a separate document. A residence permit for both is a document that confirms the right of its owner to permanently reside in the territory of the Russian Federation.

- Opening an individual entrepreneur by a foreign citizen is impossible without him submitting to the tax authority an original or a copy of a document confirming the place of permanent residence of this individual;

- Original receipt for payment of state duty.

Many people are interested in how much it costs to open an individual entrepreneur? Based on the information described above, it follows that to open it you need to spend money on photocopies of the necessary documents and pay a state fee of 800 rubles.

A sample filling out, as well as a blank form of primary documents can be found on the official website of the Federal Tax Service. You can download them absolutely free.

The “registration package” can be submitted to the tax service yourself, submitted through a third party, or sent by mail. If you cannot personally submit the documentation, then in this case the application for state registration and the application for transition to the simplified tax system will have to be certified at a notary’s office. Certification of each document can cost from 20 rubles per copy. These applications can also be sent via email.

Common mistakes on the topic “How to open an individual entrepreneur in Russia for an Armenian citizen in 2021”

Error:

When drawing up an application for registration of an individual entrepreneur, the Armenian incorrectly indicated OKVED.

The four-digit code written in the application encrypts the type of activity of the entrepreneur. It must be selected according to the OKVED system. You need to focus on the type of activity of the company. But he is not always able to describe everything that the organization does. For example, an Armenian citizen wants to enter the beauty industry and has the intention of opening a salon. This will be one code. But if the salon employs not only hairdressers and manicure/pedicure specialists, but also specialists in therapeutic massage, then this will be a different code (86.90.).

Error:

An Armenian citizen living in Novgorod applied for registration of an individual entrepreneur to the Moscow department of the Federal Tax Service.

The appeal must be strictly territorial. If an Armenian lives in Novgorod, then there is no need to apply for government services to Moscow.

Video: How to register a foreigner as an individual entrepreneur?

How does registration work?

If you are not a resident of the Russian Federation, this does not mean that the conditions for registering your business on the territory of this state are more difficult than for Russian citizens. The state seeks to stimulate the growth of small and individual enterprises registered by both Russians and other individuals. The conditions are almost the same. The only thing you should take special care of before registering an individual entrepreneur for a foreign citizen is the place of temporary or permanent residence, without which opening an enterprise is impossible.

Language issue

Can a non-resident register as an individual entrepreneur if his application and other documents are not prepared in Russian? Answer: no. According to the law, every foreign citizen planning to register an individual entrepreneur on the territory of the Russian Federation must not only make a competent translation of all documents prepared for registration, but also have them notarized. Translation of documents is carried out by special organizations. And notarization of documents translated into Russian will not take much time and money.

Legal entity or individual: which is preferable in which cases?

Entrepreneurial activity involves not only the receipt of material benefits by the business entity, but also the satisfaction of certain socio-economic needs of society. According to Russian legislation (Civil Code of the Russian Federation and Federal Law-129 of August 8, 2001), not only citizens of Russia, but also citizens of other countries, as well as stateless persons, can engage in entrepreneurship in the Russian Federation (upon reaching the age of majority).

To carry out such activities, it is necessary to undergo state registration. Federal Law No. 129 “On State Registration of Legal Entities and Individual Entrepreneurs” provides for the possibility of choosing the method of doing business: as a legal entity (LLC, CJSC, etc.) or as an individual entrepreneur.

To make the right choice, you need to have a clear idea of what the entrepreneur will do and know all the pros and cons.

When choosing, the following should be taken into account:

- type of proposed activity. A complete list of types of economic activities can be found in OKVED-2. An entrepreneur must select one or more types (but not more than 30) that he will engage in. It should be taken into account here that for individual entrepreneurs some types of activities - the production and sale of alcoholic beverages, the production and sale of weapons and ammunition, banking, space activities and others - are prohibited. If the planned activity is a closed type for individual entrepreneurs, then the only way out will be to register an LLC;

- presence or absence of a foreign citizen or in Russia. Registration at the place of residence may also influence the choice. Without legalized residence on the territory of the Russian Federation, application will be denied (registered at the residence address in the Russian Federation of an individual entrepreneur). In this case, the choice will be made in favor of an LLC (residence in the Russian Federation is not necessary for a foreign individual; a legal entity is registered at the address of the executive body or the person authorized to represent it);

Read more about how this happens.

- source of financing. This question is very important - does the future businessman plan to finance all expenses on his own, resort to bank loans or investor funds. If a businessman relies only on his own capital, then it is definitely more profitable for him to register an individual entrepreneur. In other cases, if you want to receive investments or loans, you must provide guarantees to banks and investors and register an LLC. It is easier for a legal entity to find people willing to invest in its activities, it is easier to take out a bank loan;

- registration costs. will cost less than registering an LLC. The amount of state duty is in the first case 800 rubles, in the second – 4000 rubles. Also, to open an LLC, it is necessary to form an authorized capital and be sure to open a current account.

There are a number of pros and cons of individual entrepreneurs and LLCs that should also be taken into account:

| IP | OOO | |

| Sale, reorganization, business expansion | Impossible. You just have to close the IP | Possible to sell at any stage |

| Fines for administrative violations | Several times less than in LLC | High fines, often imposed on the legal entity and employees |

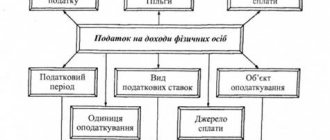

| Income | Used for personal purposes or invested in business | Distributed among LLC members, with them paying 9% income tax |

| Accounting | There is no obligation to lead it | Strict accounting requirements |

| Cash payments | No limits | No more than 100 thousand rubles. within one contract |

| Liabilities | Responsible with all his property | Bear obligations within the limits of contributions to the authorized capital |

| Large contracts with serious companies | The probability of signing a contract is zero | Preference is given |

Thus, when considering what is more profitable - an LLC or an individual entrepreneur for citizens of Ukraine in Russia in 2021 - it should be noted that an individual entrepreneur (albeit more risky) will be a simpler and more convenient option at the initial stage of doing business. As your business grows and expands, it would be advisable to think about attracting partners.

Submission of documents

After all permits have been received, documents have been translated and certified, applications have been drawn up, you can safely go to the tax authority to submit documents for registration. Recommendation: just in case, in addition to paper versions of documents, take electronic ones with you. This is not necessary, but it may be useful.

If all documents are completed correctly, then after 5 working days you will be able to pick up from the registration authority your certificate of state registration of an individual as an individual entrepreneur with the assigned Unified State Registration Number of an individual entrepreneur, an extract from the State Register of Individual Entrepreneurs.

Typically, after the tax authority officially registers an individual entrepreneur, he is obliged to transfer all the necessary data about the new business entity to the authorities of the Pension Fund and the Federal Compulsory Medical Insurance Fund. However, exceptions do occur. If, after 7 days from the date of receipt of your registered documents, you have not received notification that you have been registered with these authorities, then you will have to send all the documents yourself. It is necessary. If you do not register with these authorities, then such inaction will entail punishment provided for by the law of the Russian Federation.

Remember, if you, as an individual entrepreneur, are going to hire workers, then you are obliged to pay insurance premiums not only for yourself, but also for your subordinates.

Required condition: permission to reside in the Russian Federation

In order for foreign citizens (including citizens of Ukraine), they must first legalize their stay in the Russian Federation or, in other words, obtain a temporary residence permit or residence permit. This procedure is not quick; it is impossible to register an individual entrepreneur immediately upon arrival in the Russian Federation, so you should worry about this in advance.

Ways to get RVP

Registration of legal temporary residence in Russia already gives a foreigner the right to register an individual entrepreneur. It is best to apply for a temporary residence permit in Ukraine – at the Russian Consulate (this will save time). The application can also be submitted upon arrival in the Russian Federation.

A temporary residence permit is issued for three years (without the right of extension), giving the opportunity to work without a patent or engage in individual entrepreneurship. In this case, you should take into account:

- RVP is issued (in 2021, 110,880 quotas were allocated throughout the Russian Federation). Quotas do not apply to participants, but they can live and work only in those regions that participate in the program;

- You can find a job and do business only in the region where the temporary residence permit was issued;

- You cannot leave the Russian Federation for a period of more than 3 months.

To learn more about the procedure for Ukrainian citizens to obtain permission to temporarily reside in Russia, what documents are required for this and what deadlines are determined, we recommend reading the information about.

Residence permit in the Russian Federation for Ukrainians

Having a residence permit in Russia gives a citizen of Ukraine the right to apply for an individual entrepreneur. Submission of an application and all necessary documents (with a notarized translation of all Ukrainian-language texts) for a residence permit in the Russian Federation is possible after the first year of temporary residence in Russia (but no later than six months before the end of the temporary residence permit).

You are also required to pay a state fee (RUB 3,500). In case of a positive decision, the residence permit is granted for five years with the right to extend for another five years (without a limit on the number of extensions). To extend a residence permit for a foreign entrepreneur, you must:

- submit to the Main Internal Affairs Directorate of the Ministry of Internal Affairs evidence of permanent housing and business;

- annually report on place of residence, income, payment of taxes, departures from the Russian Federation (staying abroad for more than 6 months a year will lead to the cancellation of the residence permit).

Read more information about.

Do I need a current account?

Many people are interested in whether a foreigner can open an individual entrepreneur in Russia without a bank account. The rules for registering individual entrepreneurship for Russian citizens and foreigners are the same in terms of opening bank accounts and obtaining a stamp. More detailed information about opening a current account for an individual entrepreneur can be found here

According to the law, every individual entrepreneur registered in Russia is not required to open a current account. It is necessary to open it only if you are going to carry out transactions with your partners and clients for amounts greater than 100,000 rubles. If you realize that such amounts are not expected in your business activity, then it is not necessary to do this, although it is advisable. It's difficult to predict how far your business will go, who you'll partner with, and how much revenue it will generate.

Question answer

Question 1. Can I create an individual entrepreneur in Russia in my own name if I am a citizen of Armenia and do not intend to change my passport yet?

You have this opportunity; Russian legislation does not limit the possibility of creating an enterprise for foreign citizens. You need to contact the branch of the Federal Tax Service of the Russian Federation at your place of residence in Russia to receive a list of papers provided for filling out and submitting for registration as an individual entrepreneur.

Question 2. My family and I are planning to move to Russia from Armenia. We have relatives there. Can I open my own enterprise if I am still very far from receiving a Russian passport?

You can apply to open an individual entrepreneur if you have a temporary residence permit or residence permit.

To do this, you just need to provide proof of your legal stay in Russia. The application form can be obtained from your local tax office. Rate the quality of the article. We want to be better for you:

Is printing required?

A foreign citizen represented by an individual entrepreneur also does not have to issue a stamp unless absolutely necessary. However, it is worth noting that if you plan to open an account in a bank convenient for you, it may ask you to provide a stamp. This, of course, is an exception to the rule, but you also need to be prepared for it.

The seal of an individual entrepreneur brings many advantages, not disadvantages, to its owner. It gives its owner solidity and reliability in the eyes of his partners, competitors and clients. It protects the documentation. In any case, whether or not to have a seal is up to you to decide.

Become an author

Become an expert

Opening an individual entrepreneur for stateless persons

Stateless persons in their position are equal to foreigners. Therefore, registration of individual entrepreneurs is carried out taking into account the same features. They must submit to the Federal Tax Service an application in form P21001 and a package of papers confirming their identity and place of registration.

In this case, a residence permit or temporary residence permit is also used. These papers will confirm your legal status on the territory of the Russian Federation.

Read: Online cash register for an individual entrepreneur - rules of application