General requirements for the employment of Ukrainians

In order to register in the OPS system, a Ukrainian must:

- fill out the Insured Person's Questionnaire at work;

- provide a copy of your identification document. If the document is not in Russian, a notarized copy may be required.

To understand the problem of insurance premiums, we will define three categories of foreigners, which can be:

- permanently residing in the Russian Federation with a residence permit

- temporarily staying in our country - for example, on a visa or on the basis of a migration card

- temporary residents with a temporary residence permit

After the employer provides a package of documents to the Pension Fund, such persons are entitled to SNILS.

Hiring a citizen of Ukraine (step-by-step instructions) in 2020

Ukraine is a country that is one of our closest neighbors. Be that as it may, quite close ties have been established with this country. However, citizens of Ukraine are foreigners in our country. How to hire a citizen of Ukraine who has a temporary residence permit in 2021, we will consider in the article.

What categories of foreign workers can be employed in our country?

Any foreigner who comes to the territory of Russia has a special status, depending on the purpose of the visit and the expected period of stay in our country. In accordance with Article 2 of Law No. 115-FZ of July 25, 2002, a Ukrainian citizen can be:

- Temporarily staying

(with a migration card); - Temporary residents

(with a temporary residence permit - TRP); - Permanent residents

(with a residence permit - residence permit); - Refugee

(with a certificate of receipt of refugee status).

A temporarily staying citizen has a migration card, and in order to get a job, you must have a special permit or patent to carry out a particular activity. The maximum patent term is 1 year.

A temporarily residing citizen already has a special permit to stay on the territory of Russia (he gets a job on the basis of a temporary residence permit). At the same time, no additional documents (patent) are required when applying for a job, and the employee has rights similar to the rights of Russian citizens

.

IMPORTANT!

A distinctive feature of having a temporary residence permit is that a foreigner in most cases has the right to work only in the region where the permit is issued.

Ukrainians who plan to obtain Russian citizenship have been living here for a long time and have obtained a residence permit. Such citizens are considered permanent residents. However, there are no restrictions on employment. This can be any region and any position held in the organization.

A refugee is considered to be someone who has an appropriate certificate or document granting temporary asylum. At the same time, the employment of such citizens is carried out in the same way as permanent residents.

Currently, no special benefits for employment are provided for citizens of the DPR and LPR.

It should be taken into account that a passport issued in one of the republics is an identity document on a par with a Ukrainian passport (despite the fact that Russia is among the countries that do not recognize the autonomy of the DPR and LPR).

A special category of workers are highly qualified specialists. As a rule, they are temporary residents, but they do not need to apply for a patent.

What is a RVP and why is it needed?

Any foreigner who comes to our country must be legalized, that is, formalize his status on the territory of Russia. If a foreign citizen decides to stay in Russia for a long time and intends to find a job, then he needs to obtain a temporary residence permit. Obtaining such permission is regulated by Article 6 of Law No. 115-FZ.

The maximum period for which a permit can be obtained is three years.

The validity period of the temporary residence permit depends on the duration of the employment contract concluded with the citizen of Ukraine.

During the period of validity of the permit, the foreigner must decide whether he wants to leave the country or stay here to obtain a residence permit or begin the procedure for obtaining citizenship.

This is due to the fact that the extension of the temporary residence permit is not provided for by law.

A temporary residence permit is just a stamp in a passport, but it is of great importance for citizens of Ukraine and provides the following opportunities:

- freedom of movement across the border, that is, you can both come to the Russian Federation and leave Russia without any obstacles;

- Additional documents (patent or permit) will not be required for employment;

- a big advantage of a temporary residence permit is that a citizen of Ukraine can open his own business by registering an organization or individual entrepreneur;

- Employed foreigners will be registered in the compulsory medical insurance system and will be able to receive free medical care in state and municipal medical institutions.

One of the most important disadvantages, as mentioned above, is the inability to work in a region other than the one where the permit was issued. It should also be remembered that if a Ukrainian is absent from Russia for more than six months, his permit will be revoked

.

A temporary residence permit is the first step towards obtaining citizenship. This is an important mark, with which a foreign citizen receives a lot of advantages.

Algorithm for employment of a citizen of Ukraine in Russia

Official registration for work of a citizen of Ukraine who has a temporary residence permit stamp is a little easier than for those who do not have such permission. The employment process consists of several sequential steps:

| Step number | Action | Explanation |

| 1 | Determining the status of a citizen of Ukraine | It is necessary to find out on what basis the citizen is on the territory of our country (migration card, temporary residence permit, residence permit, refugee or migrant certificate) |

| 2 | Collection of documents | A potential employee must provide a package of documents. If necessary, documents must be translated, and then the translation must be notarized. |

| 3 | Conclusion of an employment contract | The contract stipulates all the main points of working in the organization in a specific position. |

| 4 | Preparation of orders and personnel documents | Based on the application, an employment order is issued. It is also necessary to fill out a personal card and make an entry about the employee’s employment in the work book. |

| 5 | Submitting information on hiring a foreign worker to the migration service (in accordance with paragraph 8 of Article 13 of Law No. 115-FZ) | Notification must be submitted within three days of employment. This step is mandatory, otherwise the employer will face fines |

An example of employment of a citizen of Ukraine in the Russian Federation

A citizen of Ukraine is registered for work. When making an entry in the work book, you need to take into account that this is done in the same way as for Russian workers.

It is necessary to record which company or individual entrepreneur the employee is being accepted into, enter the serial number and date of entry, details of the order on the basis of which the entry is made, and also enter directly the phrase itself: “Hired for the position...”

If the Ukrainian is a highly qualified specialist, several additional actions are expected to be performed. First, you need to obtain permission to hire such a specialist from the migration service and issue an invitation for the employee

.

To obtain permission to hire an employee from abroad, you will first have to post a vacancy in Russia, and then prove that no Russian citizen is applying for the position. Or it is necessary to prove that not a single Russian can cope with work responsibilities. If a foreigner does not have a medical policy, it is necessary to take out additional insurance.

This also means registering the employee and interacting with the migration service.

Documents required when employing a foreigner

The list of documents that will be required for employment of a citizen of Ukraine with a temporary residence permit is small and practically does not differ from the package of documents for a citizen of Russia. The list of documents includes:

- application (it must be drawn up taking into account all the required details);

- passport or other identification document (for example, refugee ID);

- To confirm your status, you must provide a permission stamp (RVP);

- SNILS (despite the fact that SNILS is currently no longer issued, every employed citizen must have an account number in the Pension Fund system);

- work book (if the employee does not have a work book, it is necessary to issue one);

- For some employees applying for certain positions, it will be necessary to additionally provide a document confirming the level of education, as well as a certificate of no criminal record.

The list of documents is similar to that used when employing a Russian citizen. Entries in the work book are made in accordance with Russian legislation.

Interaction between the employer and the migration authority when hiring a foreign worker

Not every organization can hire foreigners, including citizens of Ukraine . For those companies that decide to hire foreigners, the necessary procedures are registration with the migration service and obtaining appropriate accreditation here

. Violation of these conditions risks huge fines.

In order to let the migration service know about the hiring of a foreigner, a notification is created, which sets out the intention to hire a foreign citizen. It is very important to comply with the law and do this within three days of hiring such an employee.

“The employer is obliged to notify the territorial body of the Federal Migration Service in the subject in whose territory the foreigner is located about the conclusion or termination of an employment contract or a civil service agreement.”

Victor Bocheev, lawyer-consultant, Moscow

Features of contributions for temporary residents from Ukraine

According to Russian legislation, Ukrainians who temporarily stay in the territory of our country are subject to the following types of insurance:

- Mandatory pension, regardless of what contract they work under, including individual entrepreneurs

- OSS for disability and maternity when employed under an employment contract or of a civil law nature, but not for individual entrepreneurs

- Compulsory medical insurance, regardless of the type of contract, including entrepreneurs, but not highly qualified foreigners

- OSS on injuries when performing work under an employment or civil employment contract.

Thus, from the income of foreigners registered under an employment or civil process agreement, the employer is obliged to transfer all types of contributions provided for by law, as well as for the income of citizens of the Russian Federation.

Personal income tax and VAT issues

Income tax on foreign income in the current year was 18%, while non-residents earning in Ukraine must pay at the rates determined in the relevant chapter of the code (“Income of non-residents”). The income tax rate, which is associated with any result of labor activity, is also 18%.

Personal income tax (NDFL)

Income tax is not paid by the winners of any competitions on a global or European scale, by pensioners who participated in the war, and in some cases related to movable and immovable property.

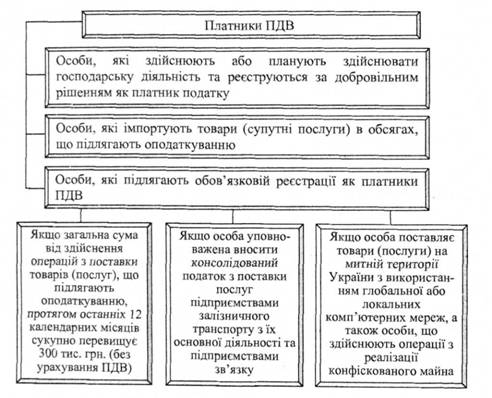

Value added tax on the territory of Ukraine belongs to the group of indirect taxes. It is believed that VAT is paid by entrepreneurs engaged in trade and production processes, but in reality the fee is paid through the sale of goods to customers, since its size and the cost of the product have a direct relationship with each other.

The tax system in Ukraine, as in any other country, with the introduction of VAT quite significantly replenishes the state budget. The peculiarity of this type of taxes is the allocation of the value in question at absolutely every production stage. The same applies to the sale of services or goods.

Value added tax (VAT)

All entrepreneurs or other persons (individuals or legal entities) engaged in trade, etc. are required to pay VAT to the state. The rate is the same for everyone, equal to 18%, while previously the level fluctuated around 30%.

Insurance premiums for temporary residents

For temporarily staying foreigners, there are their own rules for transfers, since highly qualified specialists are selected from among them, whose income under any of the contracts is not subject to any contributions, except for injuries. The income of other foreign workers registered under the contract will not be subject to contributions to compulsory health insurance, but will be subject to payments to compulsory health insurance and compulsory health insurance.

Tariffs for them will generally be equal to:

- on OPS - 22% on income not exceeding 876,000 rubles, and 10% on income above this amount;

- for OSS for disability and maternity - 1.8% from income not exceeding 755,000 rubles; contributions will not be accrued above this income.

At the same time, situations may arise for the contribution payer when he has:

- the obligation to apply additional tariffs due to the special working conditions of a foreign employee;

- possibility of using reduced tariffs

- Contribution rates for injuries will depend on the type of activity carried out by the employer.

How are payments paid for highly qualified specialists?

A foreigner can obtain the status of a HQS employee, provided that his salary is over two million per year. Hiring such an employee adds additional responsibilities to the employer, namely:

- It is necessary to inform the Federal Migration Service about the conclusion or termination of an agreement to work with such citizens no later than three days.

- Confirm monthly that the salary of a valuable employee has remained at the proper level, otherwise administrative liability may be incurred.

Payment conditions for refugees

To obtain refugee status, you must provide a number of documents to the migration service. The main condition is persecution in the homeland or a threat to health and life. The status is assigned for 3 years; if after this time the threat to the person does not disappear, the period is extended.

Refugees have a number of privileges compared to other foreigners (for example, those who have received temporary asylum or temporary residence permit): they have almost completely equal rights with Russians, can receive benefits and pensions, have social benefits, and use free medicine. The personal income tax rate for such persons is 13%. But as soon as a person loses his status, personal income tax is calculated on a general basis.

Taxation of Ukrainian citizens in 2021

04.04.2019

As part of the process of liberalizing Estonian labor market regulations, changes to the Aliens Act (Välismaalaste seadus, hereinafter referred to as VMS) will come into force from the beginning of 2021, providing third-country nationals with the opportunity to work in Estonia as hired labor.

1 Article 207 of the Tax Code of the Russian Federation). The employing organization as a tax agent is entrusted with calculating and withholding personal income tax. In order to understand what tax rate to charge, you must first figure out whether he is a tax resident. Let us remind you that an employee, regardless of citizenship, will be considered a tax resident if he has been in Russia for at least 183 days during the last 12 months.

Hiring Ukrainian citizens in 2021: step-by-step instructions

The validity period of patents varies: not less than a month, but not more than a year. If the patent is expired, the Ukrainian cannot work until his documents are renewed. Therefore, it is very important to supervise your employee in this matter and carefully ensure that the person does not go to work with an expired patent. You don't want to fall under administrative liability, do you?

- the profession or position for which a citizen of Ukraine is applying is included in the list of the Ministry of Health and Social Development of Russia (order dated July 28, 2010 No. 564n);

- The period of work outside the region (in total for the year) does not exceed 90 calendar days if the work is related to travel and is done on the road, and this is clearly stated in the employment contract - or 40 calendar days when it comes to business trips.

Employment of foreign citizens: features of 2021

The changes in 2021 are related to the abolition of the service responsible for registering migrants. Currently, all powers of the FMS have been transferred to the Ministry of Internal Affairs. And patents issued to persons without a visa are issued for a period of one to twelve months. The form of this document remains the same (approved by order of the migration service number 638 in December 2014).

It should be recalled that such unscrupulous actions can result in large fines for the employer and harm to his business. Therefore, one should not forget about the legal status of foreigners and the legal rules for their employment, taking into account the latest changes made to legislative norms.

What is the taxation procedure for foreign citizens?

It is believed that if a citizen spends a significant part of the year in another country, the center of his financial interests is located here. For such cases, taxation of foreign citizens involves the payment of taxes to the budget of a given state. For foreign citizens located on the territory of a foreign state, the legislation establishes the mandatory payment of income tax.

In most countries, to determine permanent residence, a stay of more than 183 days is taken into account. In some states, the period is not the calendar year, but the tax year, which may entail dual residence. To avoid such misunderstandings, other indicators are used, such as citizenship, location of permanent residence and place of permanent residence.

Tax social benefit for citizens of Ukraine

- The amount of monthly earnings should not exceed a certain amount established at the beginning of the year and valid throughout its entirety.

This value is recalculated every year and is obtained by multiplying the cost of living for able-bodied persons (established on January 1 of the current year) by 1.4, after which it is rounded to 10 hryvnia. In 2021, the NSL value is 2690 hryvnia. Consequently, an employee who received a monthly salary in an amount less than the specified value has the right to use the non-taxable minimum. In 2021, the restriction applied to UAH 2,470 earned, in 2021 to UAH 2,240, in 2021 to UAH 1,930, and in 2015 to UAH 1,710. - The tax benefit does not apply if the employee is paid a scholarship or provided with property support as a student, student, graduate student, resident, assistant or military personnel.

- The non-taxable minimum is calculated from only one salary.

Therefore, an employee working in several companies must choose which of them to apply for the application of the non-taxable minimum, based on the most profitable option. - To take advantage of the non-taxable minimum, the employee must submit an application at the place of work and present documents certifying the right to use the NMDG.

In this case, the application will be taken into account from the date of its submission. To illustrate, the employee was hired in February 2021 but applied in May. In this case, the non-taxable minimum will be calculated only from the May salary.

We recommend reading: Receipt for receipt of alimony sample

The tax-free minimum (NTM) was approved simultaneously with the Tax Code and remains unchanged to this day. Its amount is the same 17 hryvnia, which is taken into account when calculating various fines, damages and legal costs in accordance with the law.

Hiring a citizen of Ukraine in 2021

- When inviting patent applicants to work, the employer is first of all obliged to verify the availability of an issued patent, as well as the compliance of the positions or area of work specified in the patent with the vacancy.

In addition, a patent is issued and is valid exclusively on the territory of one subject of the Russian Federation, and if it is necessary to change the position of an employee or move to the territory of another part of the country, it is also necessary to replace the patent. - In addition to the patent itself, the employer is also obliged to check that the applicant has a migration card and documents confirming the availability of medical insurance or medical support from an accredited medical institution. It is prohibited to employ Ukrainians who do not have a residence permit or temporary residence permit without insurance.

To get a job for refugees from Ukraine in Russia, a special procedure is also provided. In particular, first of all they need to obtain a refugee certificate, which will be the only confirmation of their actual status.

If you have this certificate, the procedure for hiring such persons will be the same as for Ukrainians with a residence permit and will not require any additional actions on the part of the employer, except for notifying the Department of Internal Affairs of the Ministry of Internal Affairs.

How to hire a citizen of Ukraine with a temporary residence permit in 2021

The cost of obtaining such a permit is 3,000 rubles - this is a state fee. The payment receipt is also attached to the documents and sent to the migration authorities. You will have to pay a state fee for each foreign employee of the company, but you only need to pay it once, when hiring a Ukrainian for a job.

As serious military conflict broke out in eastern Ukraine in 2014, many residents of these regions fled their cities in a hurry, most of them going to Russia to seek political asylum.

Due to the large influx of migrants from Ukraine, the authorities were forced to simplify the process of providing citizens with refugee status with the opportunity to find work. For other categories of migrants the process remained the same.

Payments for foreigners with a patent

In order to find employment in the territory of the Russian Federation, a foreigner who arrived without a visa must apply for a work patent. During the period of validity of the patent, the migrant pays fixed advance payments for personal income tax. Their size is different for each region; for example, for the Moscow region, the monthly payment amount for 2021 was about 4,634 rubles. The employer also calculates personal income tax from the migrant’s wages and reduces its amount by the amount of advance payments transferred by the foreigner himself.

No accruals will be made on the income of highly qualified specialists temporarily located in the Russian Federation and working under a contract (labor or civil employment contract), except for contributions for injuries. And the income of other foreign workers temporarily staying in the Russian Federation and working under a contract must be subject to contributions to compulsory health insurance and compulsory social insurance, applying a special rate for compulsory social security for disability and maternity.

Hiring Ukrainian citizens in 2021 - step-by-step instructions - Business

Despite the existing political differences between Russia and Ukraine, there are no obstacles to the employment of Ukrainian citizens by Russian employers.

As for other foreigners, when applying for a job, Ukrainian citizens are subject to the standards established by Russian legislation.

However, there are some nuances that an employer must take into account when concluding an employment contract with a citizen of Ukraine.

From the article you will learn:

- which citizens of Ukraine have the right to find employment in the Russian Federation;

- what documents are required from Ukrainian citizens when applying for a job;

- what to pay attention to when hiring a citizen of Ukraine;

- what are the features of concluding employment contracts with citizens of Ukraine.

Which Ukrainian citizens can work at Russian enterprises?

Before requesting from a citizen of Ukraine the documents necessary for employing a foreign national, you must make sure that his status allows you to formalize an employment relationship with him.

Ukrainians do not require a visa to enter Russia, but their migration cards must indicate “work” as the purpose of entry.

Registration of labor relations is possible both with those citizens of Ukraine who reside in the territory of our country temporarily with the appropriate permit, and with those who reside permanently and who have a residence permit.

Read about the topic in the e-zine

Citizens of Ukraine who have a temporary residence permit (TRP) or residence permit do not need to apply for a work permit (patent).

This also applies to those citizens of Ukraine who have officially confirmed refugee status.

There are no restrictions on employment for permanently residing foreigners and refugees, and the procedure for their employment is no different from that applied to Russians.

| From the book you will learn how to hire, replace, and fire the head of an organization. We will consider in detail conflict situations with pregnant women, what guarantees need to be provided to employees with children, how to employ minors. We will look at how to hire foreign citizens, what documents are required and what restrictions there are. |

| Download a book |

Citizens of Ukraine staying temporarily will need to apply for a patent and, at the same time, they will be able to work under it only within the region in which this document was issued.

They will be able to work only at those enterprises that have officially been allocated quotas for hiring citizens of foreign countries.

Foreigners residing temporarily on the territory of the Russian Federation are also limited in their employment - they have the right to formalize labor relations only within the subject of the Federation in which they are allowed to reside temporarily.

What documents will be required when applying for a job from a citizen of Ukraine?

In addition to documents confirming their status, citizens of Ukraine will need to present to the HR department when applying for employment the same documents that are required for Russians. In accordance with the requirements of the Labor Code, this list includes:

- passport or any other document by which a person’s identity can be identified;

- a policy of the state pension insurance system with the SNILS number (except for cases when a foreigner enters work for the first time or is employed on a part-time basis);

- employment history;

- documents confirming education, specialty or qualifications.

What to consider when hiring Ukrainian citizens

Applicants from Ukraine with refugee status do not present a passport when applying for a job, but they will have to present a certificate that they have been granted temporary asylum, or a refugee certificate, in accordance with paragraph 7 of Art. 7 of the Federal Law of February 19, 1993 No. 4528-1 “On Refugees”. According to clause

3 of the Regulations on the registration, issuance and exchange of a refugee certificate, approved by Decree of the Government of the Russian Federation of May 10, 2011 No. 356; the certificate is issued for a period of no more than one year, and the certificate is issued for a period of no more than three years, in accordance with paragraph.

12 of the Procedure for granting temporary asylum on the territory of the Russian Federation, approved by Decree of the Government of the Russian Federation of April 9, 2001 No. 274.

Find out about

card T 2

If, upon hiring, this job turns out to be the first for a foreigner, he may not have a SNILS certificate, so the employer will have to issue it independently, since foreign workers, except those who are in Russia temporarily or belong to categories of highly qualified specialists are insured persons, in accordance with paragraph 1 of Art. 7 of the Federal Law of December 15, 2001 No. 167-FZ “On compulsory pension insurance in the Russian Federation.” In addition, according to paragraph 2 of Art. 11 of the Federal Law of April 1, 1996 No. 27-FZ “On individual (personalized) accounting in the compulsory pension insurance system”, data on them must be included in quarterly personalized reporting.

From January 1, 2015, employers are required to notify the migration service of the Ministry of Internal Affairs about the fact of employment of each foreigner , regardless of his status, without exception. The notice must be sent within three working days after the foreigner has been hired.

| From the book you will learn how to check the data of employees when applying for a job, how to check the tax identification number, criminal record certificate and other documents when applying for a job. Let's take a closer look at how to process personal data when hiring. Let's look at how to safely refuse a job to a candidate. |

| Download a book |

Work books issued on the territory of Ukraine do not have official status in Russia, therefore, in the absence of a work book of the standard standard in the Russian Federation, the employer will need to draw up this document on a new form independently, according to the standard form as given in Government Decree No. 225 of April 16, 2003 . Information from a work book issued on the territory of Ukraine does not need to be transferred to a new document, therefore the record of hiring a citizen of Ukraine in this case will have serial number 1.

Read more about hiring here:

It should be noted that an agreement on mutual recognition of educational documents without additional procedures was signed between Russia and Ukraine.

Therefore, documents on education received in Ukrainian educational institutions of any level have the same status as Russian ones.

If necessary, the employer has the right to require that the education document be accompanied by a notarized translation, but, as a rule, this is not required.

As with other foreign citizens, workers arriving from Ukraine do not require confirmation of military registration, since they are not Russian citizens and, accordingly, are not liable for military service.

But, as in all other cases, when hiring a citizen of Ukraine, it is necessary to familiarize him with the provisions of the collective agreement, local regulations of the organization, including internal labor regulations, as well as instructions on labor protection.

The procedure for concluding an employment contract with citizens of Ukraine

Both fixed-term and open-ended employment contracts can be concluded with foreigners who are citizens of Ukraine. In accordance with Art. 67 of the Labor Code of the Russian Federation, the parties must sign this document no later than 3 days after the foreign employee begins to actually perform his work duties.

A foreigner may be hired subject to a probationary period. But this condition, as in the general case, does not apply when it comes to:

- pregnant women and women who at the time of hiring have children under the age of one and a half years;

- minor foreign citizens;

- persons who have received secondary or higher education and are entering work in their specialty for the first time;

- persons with whom a fixed-term contract is concluded for a period of up to two months.

Employment contract with a foreign employee (form).docDownload in .doc

Employment contract with a foreign employee (sample).docDownload in .doc

Registration journal for foreign workers (form).docDownload in .doc

An employment contract concluded when hiring a citizen of Ukraine is drawn up and signed in two copies - one for the employee and one for the employer.

The employee must sign both copies, thereby confirming that he has read the text of the document. An order to hire a citizen of Ukraine is issued on the basis of an employment contract signed by the parties.

The employee’s order should be familiarized with his signature no later than three days after he starts work.

The personnel service employee responsible for maintaining personal cards of employees must issue such a card and transfer into it all the necessary information from the documents presented by the employee when joining the job. An example of making entries in a personal card is presented below.

other materials:

Taxation of Ukrainian citizens in 2021

04.04.2019

As part of the process of liberalizing Estonian labor market regulations, changes to the Aliens Act (Välismaalaste seadus, hereinafter referred to as VMS) will come into force from the beginning of 2021, providing third-country nationals with the opportunity to work in Estonia as hired labor.

1 Article 207 of the Tax Code of the Russian Federation). The employing organization as a tax agent is entrusted with calculating and withholding personal income tax. In order to understand what tax rate to charge, you must first figure out whether he is a tax resident. Let us remind you that an employee, regardless of citizenship, will be considered a tax resident if he has been in Russia for at least 183 days during the last 12 months.

Hiring a Ukrainian citizen with a temporary residence permit in 2021

Hiring a Ukrainian citizen for work begins with determining his status. This could be working on a work visa, having a temporary residence permit or residence permit. We are interested in temporary residence permits, and therefore we will talk about employment of this category of Ukrainian citizens.

Today, many Ukrainian residents work in the Russian Federation. There is a procedure according to which the employment of foreign citizens who have a temporary residence permit or residence permit occurs.

However, this is not an easy process, so instead of official registration, employers quite often hire illegal immigrants, which is a violation of the law. This option may cause problems, so we will not consider it.

How to hire a citizen of Ukraine with a temporary residence permit in 2021? We will talk about this in our article.

» » Back to Not only our compatriots, but also citizens of other countries have the right to work on the territory of the Russian Federation, and therefore they have certain obligations to pay income tax on their earnings. The specifics of its payment and calculation are specified in the Tax Code of the Russian Federation. The amount of personal income tax withheld from foreigners in 2021, as before, is determined not by the country of citizenship, but by the tax status in the country.

About the patent, recalculation of personal income tax when changing the status of a foreign worker and taxation when paying for housing - in the article.

Let us recall that the personal income tax rate in relation to the income of an individual does not depend on his citizenship, but on the presence or absence of his status as a tax resident of the Russian Federation.

If this status does not exist, the tax rate for income received from labor activities will be 30%.

Complete list of activities of self-employed citizens in 2020

It is better to choose a patent if a person does his work alone, without involving assistants. But it should be remembered that the cost of the document is recorded in the reports. If a citizen earns very little, for example, 1,000 rubles per 30 days, he will still have to pay for a patent an amount exceeding his annual income, that is, 20 thousand. No reporting is required.

- The issuance of patents is one of the most permissive methods of legal entrepreneurship. To obtain a patent, you need to make a single contribution of 20,000 rubles per year. After the 2nd term of the agreement has expired, a person is obliged to register an individual entrepreneur or cease his activities. If a citizen issued a patent in 2016, then he is already obliged to re-register it as an individual entrepreneur for the self-employed in 2020.

- Issue a working patent for 24 months. The only difference from option 1 is that the issuance is free.

- It’s easy to register self-employed people with the tax office without organizing a patent, but with the possibility of not paying money to the state for the next 2 years.

We recommend reading: Law on peace and quiet of citizens

Insurance premiums from citizens of Ukraine in 2021

In order to find employment in the territory of the Russian Federation, a foreigner who arrived without a visa must apply for a work patent. During the period of validity of the patent, the migrant pays fixed advance payments for personal income tax.

Answers to common questions

Question No. 1. I am an individual entrepreneur from Ukraine, what will be my payment for compulsory pension insurance?

If your income for the year did not exceed three hundred thousand, then you will pay twelve times the minimum wage multiplied by 26% in your region, but if it exceeds this amount, you will additionally have to pay 1% on the amount that exceeded three hundred thousand

Question No. 2. What is the health insurance premium for an entrepreneur?

Calculate the annual payment for compulsory medical insurance as 12 times the minimum wage at the beginning of the year multiplied by the rate of 5.1%.