Special national wages in America

Traditionally, in the United States of America, there are three types of remuneration:

- time wages of an employee;

- annual salary of government and other employees;

- one-time remuneration for department heads.

However, American companies are constantly looking for new and better ways to pay their workers in order to reduce costs and stimulate productivity and quality of work.

If a company employee has a fixed salary, then his work can be stimulated with bonuses, which are calculated based on his personal contribution to the business. Flexible payment systems are widely used in industry, banking, health care and social services, and others.

US researchers divide incentive methods into two large groups, allowing to achieve different goals:

- to maintain the prestige of the company (pension and insurance contributions, the right to purchase shares of the company on special terms, increasing the level of qualifications of workers at the expense of the organization);

- to stimulate high performance (bonuses, promotions, moral encouragement).

Based on the extensive experience of American employers, the most effective methods are bonuses, especially for those holding responsible positions, ownership of company shares, participation in the management of the organization in various forms, etc.

The average salary in America, therefore, consists not only of direct wages, but also of various additional payments.

Features of employment in the USA

If you are planning to find a job in the USA, then you need to clearly understand that, unlike Russia, labor relations here are more market than labor. It is not always the case that an American employee can count on paid leave, the right to go on sick leave for a cold, or even on maternity leave. The Russian 3 years granted to women to care for a child is an unaffordable luxury for American women.

The undoubted advantage of American labor relations is their openness and continuous improvement. In America, much attention is paid to personal qualities and merits, and not to a diploma and other achievements on paper.

The average salary in America is quite high, and finding a job there is easier than in Russia. However, you need to read the contract very carefully, which should stipulate the terms of payment for processing. In addition, job responsibilities are divided into basic and additional, and, therefore, they are paid differently.

Weekends and vacations should also be specified in the contract, since not all American states regulate this issue, leaving it at the discretion of the employer.

Unfortunately, many American employers have a negative attitude towards migrants from Russia, forcing them to work more than they should and without paying extra. At the same time, Americans take advantage of foreigners’ poor knowledge of local legislation and their rights.

If a person has worked officially in the United States for more than 6 months and remains unemployed, he can count on benefits by filling out a special form on the official website of the Department of Labor.

After this, you need to be prepared for various checks and confirmation of your unemployed status. The amount of the benefit will depend on your last place of work. The benefit is accrued for six months, after which payments stop.

Is it possible for an immigrant to make money in the USA?

Every year, emigrants leave from many countries looking for better earnings and easy work. The USA is one of the countries that accepts immigrants from almost all over the world. After all, their highly qualified workers do not want to work as cleaners and loaders. Basically, doing dirty work for low wages.

Therefore, all the dirty and low-paid work here is done by Mexicans, Russians, Ukrainians, Belarusians and even some Europeans.

Minimum wage changes in America

Compared to native Americans, immigrants earn low wages. For example, if a resident came to America on a work visa and found a job as a cleaner in an American’s house, then he will receive $50 or more per day. In this case, the immigrant will be able to clean up to two houses a day, which doubles his earnings.

If a foreign worker wants to work in his profession and has all the necessary documents (diplomas, certificates), then he will need to go through a number of procedures before he can work. The immigrant will need:

- Learn English. The higher the level of English, the higher the salary. Language learning should be given one of the main roles back at home. After all, in the USA, there is a test on its knowledge: TOEFL (Test of English as a Foreign Language).

- Prepare all necessary documents confirming the worker’s qualifications (diplomas, certificates). Documents must be translated and notarized, preferably by an American lawyer.

- Make an agreement in advance about working with the employer, then he will be able to send an invitation, which will help open a work visa.

High and low paid jobs

As in all developed countries, the most in demand are the services of specialized specialists who have received a higher specialized education and have work experience. Sometimes, due to an acute shortage of one or another type of professional, their wages are artificially increased.

Thus, several years ago in the United States there was a shortage of qualified nursing services, so a special simplified procedure for obtaining a work visa was introduced for foreigners capable of working in this area.

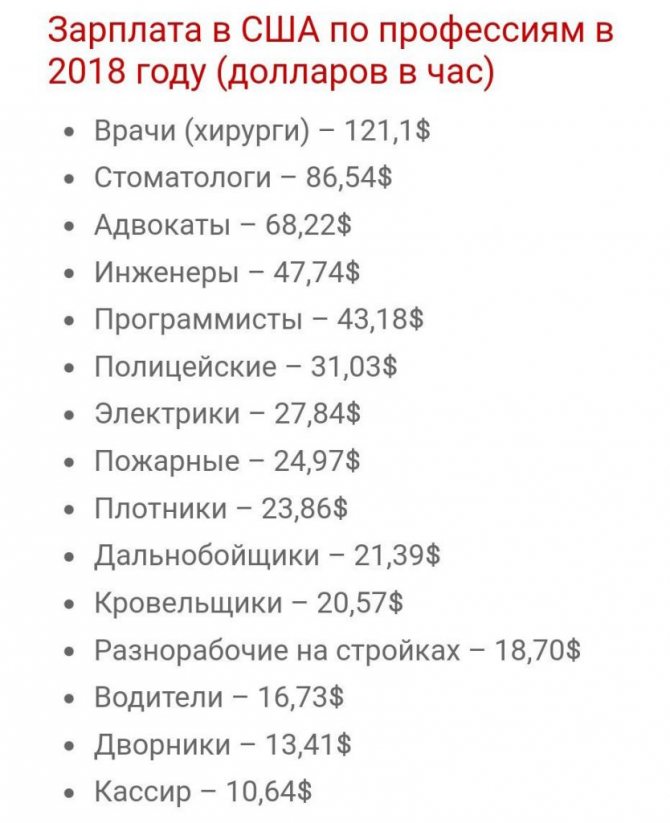

Medicine remains the most profitable field of activity today. The highest salaries are for surgeons and dentists. Their hourly wages are 12-15 times higher than the national average.

In second place in terms of income are lawyers and advocates, and experienced programmers and engineers close the top three.

Service personnel traditionally earn the least. Students often work part-time in cafes and restaurants, and their hourly wages are legally reduced (until their work experience exceeds 3 months or they reach 20 years).

The income of nurses, nannies, couriers and signalmen is also low. Low wages for agricultural and fishing workers due to the seasons.

How much money do you need to live

This question interests all immigrants, because you need to know the required living wage in order to predict whether it is realistic to earn it.

There are a number of main expense items that are worth considering:

- rental of property. It varies greatly by state and size of locality. For example, a good but small studio in the center of Los Angeles will cost $2,500, but in Texas for this money you can rent an excellent two-room apartment in a house with an equipped gym;

The average salary in America allows you to rent housing and enjoy a quiet life. - health insurance . In 2014, the United States introduced a mandatory requirement for everyone to have insurance, and a fine for not having it. Usually it is provided by the employer, but you will still have to pay for it, but it costs the employee less than buying it yourself, since the company pays most of it. There are a number of subsidies available for low-income people, which can be found on the Department of Health website. The lower the income, the more assistance the state provides in purchasing a medical policy;

- spending on food . This amount is purely individual and depends on the person’s food preferences and habits. On average, a family of two will have to spend about $1,000 a month, subject to expenses for fresh meat, fish, vegetables and fruits. If you eat in cafes and restaurants, you will have to save about 500-600 dollars extra for food. If you really want, this amount can be reduced by almost a third. For example, chicken in the US is inexpensive (about 2-5 dollars per pound). The average bill in a cafe (main dish with side dish, salad and coffee) is approximately $40 for two;

- car payments . The vast majority of Americans drive credit cars. The average monthly payment in this case is $300-400 per month. However, it should be taken into account that for newly arrived immigrants who do not have a positive credit history in the country, it is unrealistic to get a profitable car loan, and banks will offer an interest rate of 20% or higher. Therefore, it is better to save money and buy a used car in cash. Gasoline in the USA is quite expensive and refueling costs from $100 to $200 per month.

- Many Americans do not buy a personal car , but use taxis and public transport. Whether it is convenient or not depends on where you live and where you work;

- Gym. In recent years, there has been a boom in healthy lifestyles in America and many Americans visit gyms, the subscriptions to which are expensive. There are both budget options ($30 per month) and more “promoted” gyms, where classes will cost 10 times more;

- travel and entertainment . A trip to the cinema for two will cost 10-12 $, the average cost of a ticket to museums is 5-10 $. Each state has its own attractions that can be seen almost free of charge. These are natural wonders and architectural creations;

- utility bills are usually paid by the owner of the property, and tenants pay for gas, electricity and internet, which averages $70-80;

For a comfortable life in the USA you will need from $2,000 to $4,000, excluding travel costs and major expenses (clothing and furniture).

Standard of living in the USA

The country's population is about 329 million people, among whom there are representatives of various nationalities from many countries of the world. In America, as in other capitalist countries, the stratification of society into rich and poor people is characteristically visible. The difference between them in terms of income is 8 times. But, despite the fairly high gap between the resources of the rich and the poor, the latter can afford a sufficient level of material support in everyday life.

In addition to current expenses, wages can be used to provide decent education for children, medical care, and the purchase of a car.

Purchasing housing for citizens in the United States also does not seem to be a difficult process, since the existing credit system makes it possible to obtain a mortgage and purchase housing in an affordable manner.

Average salary in the USA in 2021

Americans' wages directly depend on the amount of time worked during regular work hours and during overtime. The working week is 40 hours a week and does not differ from the Russian one.

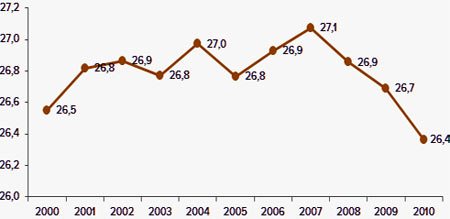

Americans are traditionally paid at an hourly rate. In 2021, the rate is $27 for regular work, double for overtime work. In annual equivalent, the average income of US citizens is more than 47 thousand dollars. If we translate the income of Americans into a monthly period, then its size before tax deductions is $3,916. In ruble equivalent, this is more than 250 thousand rubles - a sufficient amount by Russian standards for a comfortable life.

Americans' wages are directly affected by their level of education. Having a higher education allows you to earn an average of $33 per hour, a master's degree brings from $70 per hour.

Pay for men and women differs. Men earn more - on average more than $900, women from $730 per week.

Minimum wage in the USA in 2021

In America, a minimum hourly wage rate is established at the legislative level, below which the employer does not have the right to make payments for work. The official source of the minimum wage is the United States Department of Labor. The latest information shows that the minimum labor rate is $7.25 per hour. At the level of individual states, local laws set their own minimum rate, which should not be lower than the federal one.

According to statistical information posted on the Department of Labor website, the leaders among states in terms of the highest labor rate ($):

– Colombia – 14;

— New York – 11.10;

- Oregon - 11.

The outsiders in terms of the minimum rate for hourly labor are the states ($):

- Maryland - 9.25;

— Michigan – 9.48;

- Alaska - 9.78.

In large cities such as New York and Washington, the average minimum rate is higher than in the periphery.

What are the payroll taxes?

The country has a multi-level budget, which is divided into federal, regional and local. Depending on what level of the tax system the tax belongs to, deductions are made there.

The state strictly ensures that citizens report all information about their income to the tax authorities and strictly pay taxes on it.

The following mandatory taxes exist:

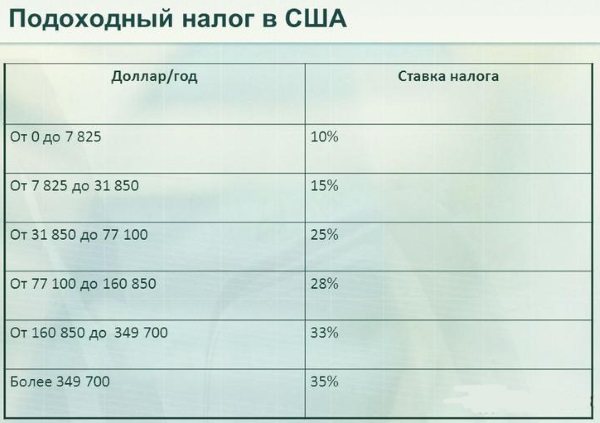

— income tax, which depends on income and ranges from 10 to 37% of income;

— social payments from wages – 6.2%:

— medical fee is 1.45% of income, and in the case of income over 200.0 thousand dollars, it is reduced to 0.9%;

— local taxes (for example, environmental tax), set independently in each state, the rate is up to 11%.

All contributions to the country's budget are made on a progressive scale and are set in such a way that the higher the income, the higher the tax. Tax preferences have been established for families with children, disabled people and military veterans, which allows reducing the tax burden for this group of the population.

Despite the fairly large total amount of tax deductions, after paying all taxes, state citizens are left with, on average, more than $3,620 per month or 231 thousand rubles.

US salaries by occupation in 2021

America is an attractive country for migrants from all over the world. The most motivating factor when choosing a country is the salary level. It depends on knowledge, professional skills and practice. The best-paid professions predominate in the banking, medical, business and aviation sectors. The least paid professions in the service sector.

The remuneration of medical workers, unlike Russian ones, occupies a leading position in the ranking of professions. Medical personnel work on high-quality modern equipment, are highly qualified and receive decent remuneration for their work. Thus, doctors receive an average of 170-200 thousand dollars a year, and average medical staff - 40.0 thousand dollars.

Teaching work in America is in great demand, since the country has a widely developed network of educational organizations. The industry needs a large number of professionals. A teacher's salary averages 40-50 thousand rubles per year and depends on the length of teaching experience, the prestige of the educational institution and its location, depending on the state.

Engineering professions top the ranking of the most in-demand professions. Holders of technical education are required in the construction industry, information communications, manufacturing sector, and oil industry. The average salary of engineers reaches up to 250 thousand per year and depends on the state and industry.

The American state is a world leader in the production of IT technologies, which requires highly qualified personnel in this industry. Employers compete for highly skilled programmers, which increases their pay ratings. The average income of IT specialists is about 150 thousand dollars per year.

The wages of blue-collar workers are lower than those of holders of vocational education. Welders and drivers earn on average up to 50 thousand per year, turners and miners up to 70 thousand, loaders and low-skilled workers up to 25 thousand dollars per year.

Thus, the salary of the lower sector of the level in excess of 100 thousand rubles per year makes any profession attractive for migrants, even low-paid by American standards.

Cost of living in the USA per month in 2021

Necessary daily expenses per person average 1400-1500 per month. The amount of spending depends on the US state and the degree of distance from the center.

The cost of renting a small apartment or studio is $800. Meals, provided you buy groceries in a store and prepare your own food, require up to $400.

Other costs include (average dollars):

— transport or gasoline — 100;

— mobile communications – 50;

— medical insurance – 200.

Leisure expenses are: $11 for a movie, $50 for a concert. The cost of a glass of beer is 8 dollars, a cocktail is 10.

Thus, the most expensive part of the average American resident is renting an apartment or paying off mortgages for housing, followed by food costs.

Salary by field of activity

If we consider wages in the USA, they vary depending on professional level, work experience, and education. Wages vary greatly among people in different professions.

Thus, doctors (especially narrow specialists) earn tens of times more than unqualified personnel. The most promising areas in 2021 are real estate rental, insurance, programming and legal services.

Don't miss the most popular article in the section: The Atlantic Ocean - geographical data, interesting facts, inhabitants, organic world.

Minimum salary in the States 2021

The low hourly salary in the USA, translated into Russian currency, is 474 rubles. About 40% of states keep the minimum wage in the range of $9.2–$10.5 per hour. Trainees, students, migrants have the opportunity to earn within these rates even with part-time work from $120 per week.

In 2009, federal authorities set a national minimum wage of $7.25 per hour. The figure we are circulating, 7.50, is, to put it mildly, not true.

After this, all states had to raise wages, but... The USA is a heterogeneous country, and the federal minimum wage is not a decree for anyone. As a result, approximately 3-4% of Americans earn less than the legal minimum.

Even within the same state, the minimum wage may differ depending on the city. For example, Wyoming and Georgia are earning $5.15 an hour this year, in contrast to “rich” California and Washington.

We recommend reading these articles:

Work in Singapore for Russians vacancies 2021 without knowledge of the language

Work in Russia for citizens of Uzbekistan in 2021

Work in China for Russians vacancies 2021 without knowledge of the language

Interestingly, this summer a record holder appeared in the United States; San Francisco reached a record minimum wage of $15 per hour.

In December, New York will catch up with it, in 2021 - Los Angeles and Washington. By 2022, the minimum wage will be $15 in Minneapolis, Minnesota.

According to current “state” laws, the minimum wage in the USA varies from 5.15 to 12.50 dollars per hour.

As you can see, the notorious “federal” minimum wage is absolutely not respected. What’s interesting is that it is not observed both to a greater and lesser extent.

In large cities, the standard minimum wage is $12 per hour, and in small cities it is about $10-11.

If in Russia wages grow only after an increase in the federal minimum wage, then in the United States the opposite is true. Legislation follows the growth of wages. First, wages rise, then a state law appears to fix the minimum wage. The most interesting thing is that in some states the minimum wage is approved through a referendum.

Maximum and average salary in the USA in 2021

| Name of profession | Income level per year (in thousand $) |

| Anesthetist | 266 |

| Surgeon | 252 |

| Gynecologist | 235 |

| Orthodontist | 229 |

| Pharmacist | 217 |

| Psychiatrist | 216 |

| Director of company | 196 |

| Dentist | 180 |

| Nurse anesthetist | 169 |

| Airline pilot | 161 |

| Petroleum engineer | 155 |

| Lead coder | 150 |

| Orthopedist | 158 |

| Financial Manager | 144 |

| Advocate | 142 |

Monthly income in 2021: table by profession

The average salary in America depends on the profession and work experience.

| Salary level | Field of activity |

| High | Medicine (surgery, dentistry), law, banking |

| Average | Insurance, education |

| Short | Maintenance and working personnel |

Minimum wage

In the United States, the minimum wage is set at the federal level. Typically, an employer cannot pay employees less than this level.

As of December 2021, this minimum is $7.25/hour. The issue of increasing the minimum wage is often discussed at Congressional budget meetings, but is met with many objections due to the fact that such a measure would entail significant costs for the state.

The average salary that allows a family of 3 to live comfortably in America is $100,000. It is necessary to take into account the fact that this figure is very average. So, for residents of Oklahoma this is simply a great income, but for New York it is the most ordinary.

List of occupations with data on average salary in the United States per hour in 2021:

| Profession | $ per hour |

| Doctors (surgeons) | 121 |

| Dentists | 87 |

| Lawyers | 66 |

| Engineers | 48 |

| Programmers | 43 |

| Policemen | 31 |

| Electricians | 28 |

| Firefighters | 25 |

| Carpenters | 24 |

| Truckers | 21 |

| Drivers | 17 |

| Wipers | 13 |

| Cashier | 11 |

Starting salary differs depending on the field of activity.

If a person who has just arrived in the country does not have special knowledge in medicine or engineering, then he can start his working career as a waiter, bartender or office worker with a starting rate of $250/week.

Average salary by industry

| Industry | Average salary per month |

| Public utilities | 1690 |

| Financial activities | 1300 |

| Mining | 1500 |

| Information Technology | 1420 |

| Wholesale | 1190 |

| Construction | 1170 |

| Professional activities and business services | 1160 |

| Production | 1100 |

| Transportation and storage | 940 |

| Education and health services | 890 |

| Leisure and Hospitality | 410 |

| Retail | 580 |

| other services | 770 |

Maximum

There is no upper limit on what Americans can earn, and it is not for nothing that they say that America is a country of great opportunity. The elite list of professions is headed by show business, the income in which can be simply stunning. Famous athletes, writers, corporate executives, bank executives and political party leaders also earn hundreds of thousands of dollars a month.

If we consider more mundane professions, then the annual income of a cardiologist is about 8-10,000,000 Russian rubles. Dentists and anesthesiologists earn a third more.

By area

Americans' income levels can be tracked by occupational category. Working in different fields may involve certain nuances.

- Those wishing to work in medicine should expect salaries above the average in the United States. Anesthesiologists and surgeons live richer, since the outcome of a person’s treatment most depends on their qualifications. General practitioners receive an average salary of 30-40 thousand per year.

- Working as a police officer is very dangerous. In America you can freely carry weapons, so they shoot there quite often. Due to increased professional risks, law enforcement officers receive 1.5-2 times the average salary.

- Significant amounts of money circulate in the IT sector. However, remuneration will greatly depend on the skills and qualifications of specialists. Many do not receive a fixed salary, but sign contracts for projects. Profitability in this area averages from 100 to 130 thousand per year.

- Those who devote themselves to teaching in the USA receive not only honor and respect, as in Russia, but also excellent earnings. Already a young specialist who gets a job in a high school can count on an acceptable income in the region of $40-50 thousand annually.

- In the realm of science, the stakes are even higher. A qualified university teacher receives $150,000. Moreover, those leading promising developments are provided with contracts, grants and broad sponsorship support. Thus, American scientists may consider themselves wealthier than members of the middle class.

In each area of employment, preferential conditions have been adopted to encourage employees to improve their skills and theoretical knowledge. Most current programs provide after-hours training and pay at overtime rates. Those who complete courses within the company are provided with material bonuses, and their chances for promotion and other preferences are significantly increased.

Salary level for migrants

Considering that wages in America are very decent, not all migrants manage to get a job there. This is due to the high level of competitiveness and risks associated with moving abroad. Lack of American citizenship does not give employers the right to discriminate against migrants.

Despite this, many migrants take unofficial jobs, thereby depriving themselves of many prospects and social guarantees:

- double wages;

- injury benefits;

- health insurance;

- pension benefit.

In addition, illegal migration is punishable by law in the United States and is fraught with deportation from the country without the right to re-enter for 10 years. Also, illegal business borders on criminal activity. It is not uncommon for a young girl to come to the United States to work as a maid or caretaker, but instead ends up working as an escort.

How to get a job as a truck driver in the USA

To get the desired vacancy, you will have to collect a lot of documents and go through several circles of bureaucratic hell. Whether it's worth it or not - decide for yourself.

What documents are needed

To get a job in a large company, you will need a green card or visa. International firms protect their reputation, so they flatly refuse to work with illegal migrants. You also need a work permit.

Please note! Working as an illegal truck driver in America is possible. However, if you are caught, you will have to pay a serious price.

After this, you need to get a “passenger” American license. Drive your car for at least 1 year and apply for a CDL - a license for truckers. But it doesn’t end there - transporting any dangerous goods will require a special license.

Finally, if you travel in your own car, you will need to insure it. Insurance prices start at $800 per month.

Obtaining rights

To obtain a CDL license, you must schedule an exam with the U.S. Department of Motor Vehicles in your area. You can submit your application online. However, please review your state's regulations carefully before taking the exam. Somewhere they require that before working as a truck driver, a person must drive a passenger car for at least 1 year.

Truckers must obtain a CDL license.

If you have only recently moved, it makes sense to take training courses. Traffic rules in Russia and America are very different from each other.

The exam consists of two parts:

- Written test. You can take the theory test directly at the department. There will be no relaxations, even if you have traveled tens of thousands of kilometers in your homeland.

- Training at a truck driver school. It lasts about a month and at the end you take a practical exam.

With a certificate from school and a form for passing the written test, come to the department to get your long-awaited license.

Are you planning to go abroad?

Driver categories

All truck drivers in America are divided into six broad categories. Namely:

- Less than Truck Load , for transporting light loads throughout the USA. The only category that does not require an additional license.

- Tanker Drivers , for transporting gasoline and flammable goods in special tanks.

- Reefer , for transporting chilled and frozen products using refrigerated trucks.

- Flat Bed Drivers , for transporting large, similar cargo. Received for transporting metal sheets, logs, pipes and so on.

- Dry Van Drivers , for transporting large quantities of product with a long shelf life. Needed when working with wholesale warehouses.

- Auto Haulers , for transporting cars, motorcycles, household appliances and so on.

Working as a truck driver in the USA is hard work, but with a very high salary.

Pavel works in California as a truck driver. In the video, Pavel talks about how a working day goes while driving.

Subscribe to Migrantu Mir: Yandex News.

Features of salaries by state

Income levels in different regions of the country can vary greatly.

Recent studies indicate that the most stable situation and high wages are observed in the following states:

- Washington;

- Virginia;

- Alaska;

- Maryland;

- Connecticut;

- New Jersey.

In the listed states, the average wage per hour is (translated into rubles) from 700 rubles, and this minimum is prescribed at the legislative level. The US Labor Code prohibits any discrimination against workers based on race, religion or gender. Professional rights are the same for everyone.

How are salaries determined in the USA?

Residents of the United States practically do not calculate wages in monthly equivalents. This is a feature of their national wage system. When answering a question about the amount of their earnings, they will either state the annual amount of income or give an hourly rate.

In the employment contract, the employer indicates the amount of wages for 12 months. The Russian Federation takes a different approach. Here the employer and the applicant agree on the amount of monthly income, not annual income.

Formula for calculating “dirty” wages

The size of wages in America depends on the following key factors:

- profession;

- the level of education;

- location;

- industry;

- employee gender;

- race, ethnicity.

Work performed overtime is paid double.

US residents looking for work first find out the average income of other people in the profession they are interested in in their geographic region. This information will be useful to them in the process of negotiating with the employer about the amount of wages. It will also be useful for busy citizens who want to negotiate with their boss on an increase in wages.

To determine the average salary, Americans use online calculators and other Internet services to compare material rewards for work.

Cost to income ratio

A person’s comfort is largely determined by his level of income. In Russia, everyday life is much more accessible and profitable than in the United States, but American politics and the social sphere make it much more profitable to save and make deposits. If we compare the wages of these two countries, then in the same field of activity the difference in income can be tens of times.

However, Americans' expenses in everyday life exceed Russian ones by 250-300%.

Monthly loan payments, health insurance, education and medical services are very expensive. Also, about 10% of the salary is spent on servicing personal vehicles.

Housing is a separate expense item. American realities are such that even a person with a low income can afford to buy real estate. If you have a positive credit history, most banks offer mortgages on very favorable terms.

Income and expenses

Of course, the ratio of the American average wage cannot be compared with Russian wages: in the USA, a qualified worker receives about $25 per hour of work, and in Russia this figure is just over $3. But the economic system is of great importance here.

The fact is that the United States has a completely different taxation system; there are different tax rates and deductions for different specialties. In addition, medical insurance is required (the compulsory medical insurance system simply does not exist in the USA), car insurance, and so on. An American pays about a third or a quarter of his income to the government in taxes and insurance.

The next question is housing. American realities make it possible for even a person with a small salary to buy small housing in a small college town in 2021.

If the credit history is good, the loan rate is acceptable and various coefficients and indicators of a person’s creditworthiness (even in conditions of his small salary) are acceptable, then you can buy an apartment.

One of the strongest segments of the labor market, according to the National Job Portal, is the sphere of qualified services to the population. There are various professions that do not require higher education and at the same time allow you to earn an income of $40,000 per year.

These are teachers and trainers in sports disciplines, manicurists and hairdressers. This type of income is not low-skilled; it brings a stable income and allows you to maintain your desired standard of living.

Wage fluctuations by gender and race

Despite the fact that labor legislation directly prohibits discrimination against workers based on gender, race, nationality and religion, employers often infringe on the rights of foreigners and women. Of course, they do this not openly, but in various veiled ways.

So, despite the assurance that America is the most feminist country in the world, statistics show that the average salary of women is approximately 21% less than that of men. Also, income levels still depend on the race of workers. Thus, Latinos and African Americans earn several times less than their “white” colleagues.

Asians are recognized as the richest race in the United States, who are traditionally more hardworking and strive to obtain a quality education in their chosen field of activity. The level of income also depends on the age of the person.

Persons under 25 years of age and over 65 years of age earn less than an average-aged employee. Workers aged 26-64 earn significantly more, but they also work longer.

Social contributions and other taxes in the USA

The United States has a taxation system that is different from Russia. Different professions and specialties have their own tax rates and deductions. The average American pays about 1/3 of his salary to the government.

Residents whose income is subject to taxation are those living in the United States for more than 180 days. They are subject to various taxes, including income taxes. Federal tax is 15-35% of income, social security tax is 6%, old age health insurance is 1.7%, state tax can range from 0 to 11%.

Late payment of taxes is fraught with a fine equal to three times the amount of tax. It will be very difficult to prove in court that the defendant could not pay the tax due to some personal circumstances.

Income taxes

The US fiscal system is multi-level:

| Type of tax | Bid | Notes |

| Income federal | 10-37% | Paid by the employer. The rate depends on the income and marital status of the taxpayer. |

| State-level income | 3-10% | Paid by the employer. The rate is set by the state authorities: in some territories the tax is flat, in others it is progressive. |

| Social Security | 12,4% | Half (6.2%) is paid by the employer, half - by the employee themselves. Entrepreneurs pay 12.4% in full. |

| Health insurance | from $180 (11,727 ₽) | Contributions are fixed and sometimes covered by the employer. The amount varies by state and type of insurance. |

| Property tax | 0,18-1,89% | The rate depends on the state and the property or lot size. |

Each state may introduce additional regional taxes and benefits for certain categories of citizens.

Income tax

An American is required to file a correctly completed tax return each year. The deadline for paying income tax is until the end of April of the year following the reporting period.

Persons who hold American citizenship are subject to tax burden even if they reside permanently in another country.

Unemployment rate and migrants' prospects

Gradually, the unemployment rate in the country is declining, but the rate of creation of additional jobs has also slowed down. The United States willingly recruits highly qualified specialists from other countries. Every year, the best graduates of world universities come here with knowledge in the field of nuclear physics, programming, medicine, etc.

The government is interested in the influx of young personnel by providing them with financial support.

If a migrant does not have special knowledge in a particular in-demand area, then he can count on working in the service sector. The average salary for all skilled professions in Russia is significantly lower than in America, which is why the USA is a dream country for many of our compatriots.

Foreigners may be surprised by the high level of taxes and large expenses for medical care and insurance.

Before deciding to move to the USA, you need to carefully weigh all the pros and cons of living in a foreign country. It is important to have a financial safety net that will allow you to live in a foreign country for several months and, if such a situation arises, to return back.

Article design: Oleg Lozinsky

Average salary in the States 2021

Salaries in the USA vary by location and depend on qualifications and prestigious education. If you look at the statistics for the country, the American average rate is $850 per week ($780 for women and 920 for men).

See also: Work in South Korea for Russians vacancies 2021 without knowledge of the language

If a newly minted resident of the United States does not have unique abilities and is not an example of a valuable specialist, then you can earn about $250 a week as a maid, waiter, bartender, or office clerk.

The most promising areas in the labor market in 2021 are: rental housing, insurance agents, programmers, lawyers.