Home/Mortgage registration/Mortgage for foreign citizens

If a foreigner plans to live and work in the Russian Federation, he needs housing. Renting an apartment is not always advisable. It is much more profitable to take out a mortgage and make transfers to the bank. However, financial organizations prefer not to cooperate with foreign citizens due to increased risks. If a person leaves the country, getting the money back will be problematic. But a number of financial organizations are ready to accommodate foreigners who want to get a mortgage. However, the terms of cooperation may differ significantly from the classical ones.

Residence permit in the Russian Federation: basic rights, restrictions, opportunities

Foreign citizens and stateless persons receive residence permits in the Russian Federation. Reasons:

- citizenship of Belarus, Kazakhstan;

- availability of a temporary residence permit;

- official employment in the Russian Federation;

- belonging to highly qualified specialists;

- participation in resettlement;

- native speaker status.

The document gives the right:

- live in Russia for a long time;

- cross the border without obtaining an entry visa;

- enter into employment contracts without obtaining a work permit;

- conduct business activities;

- obtain Russian citizenship.

The residence permit is valid for a maximum of 5 years, but not longer than:

- valid passport;

- the contract is valid;

- 3 years for native speakers.

The residence permit can be extended without restrictions.

Mortgages for foreigners: can a non-resident get a housing loan

Due to the difference in loan prices, many non-residents postpone mortgages until they have Russian citizenship. However, it is not profitable to pay all this time for renting someone else's property. You can look for a bank that is more friendly to foreigners.

Citizens of Belarus are actively taking out mortgages in Russia. Banks treat Belarusians favorably: they speak Russian fluently, are hardworking and have extensive family ties in the Russian Federation. Further, among the most active borrowers are citizens of Kazakhstan, Uzbekistan, Ukraine and Moldova. They are also strong with their diasporas, but it is somewhat more difficult for them to get a loan.

Which bank in Russia gives mortgages to Ukrainian citizens

As for the residence permit, if the bank’s requirements for the borrower do not contain the line “citizenship of the Russian Federation,” then you can take out a mortgage with only a residence permit. However, remember: the usual criteria by which Russians receive loans may be tightened in relation to foreigners. If a person who has the right to permanent residence in the Russian Federation needs a mortgage loan, then the choice of bank cannot be limited only to attractive mortgage rates. It will be necessary to look for an institution that is ready to provide loans to foreign citizens on relatively acceptable terms.

- Residential complex "SolntsePARK" from 79,050 rub./m2

- Residential complex "Clear Sky" from 84,490 rub./m2

- Residential complex "Novoe Murino" from 79,339 rub./m2

- Residential complex "Civilization" from 80,500 rub./m2

- Residential complex "LEGENDA Heroes" ("Legend of Heroes") from 127,386 rubles/m2

- Residential complex YouPiter (“Yupiter”) from 76,500 rub./m2

- Residential complex Kingdom (“Kingdom”) from 150,400 rub./m2

- Residential complex "Tsarskaya Capital" from 102,142 rubles/m2

- Residential complex "MoreOkean" from 119,782 rub./m2

- Residential complex "New Peterhof" from 56,511 rub./m2

- Residential complex Ligovsky City “First Quarter” from 100,750 rubles/m2

- Residential complex “UP-quarter “Svetlanovsky” from 70,550 rub./m2

- Residential complex Neva Haus (“Neva House”) from 150,000 rub./m2

- Residential complex Ligovsky City “Second Quarter” from RUR 106,250/m2

Mortgages for foreign citizens with and without residence permits: which banks provide

- They permanently reside in Russia or intend to move here for permanent residence;

- Carry out labor activity in the Russian Federation for at least 6 months and pay all tax deductions;

- The average income of a foreigner is at least 40-50 thousand rubles.

In accordance with the current rules, citizens of Belarus are provided with concessions, since they do not need to obtain a migration card. However, key requirements of banks must still be met.

Is it possible to get a mortgage in Russia with only a residence permit?

As for the residence permit, if the bank’s requirements for the borrower do not contain the line “citizenship of the Russian Federation,” then you can take out a mortgage with only a residence permit. However, remember: the usual criteria by which Russians receive loans may be tightened in relation to foreigners.

Several Russian banks today work quite actively with foreign citizens. The main requirements for such borrowers: they must pay taxes to the Russian treasury, and also be officially employed in the Russian Federation. Plus, you need to comply with conditions regarding work experience, age, income level and other things. It is worth noting that getting a targeted loan for a foreigner, including a mortgage, will be even easier than a consumer loan. The fact is that the fulfillment of mortgage obligations is secured by collateral - an apartment, which, if something happens, will become the property of the bank. In addition, guarantors are often needed to issue a mortgage, which is also an additional guarantee for the lending institution.

Attention!

Due to recent changes in legislation, the legal information in this article may be out of date! Our lawyer can advise you free of charge - write your question in the form below.

Is it possible to get a mortgage with a residence permit?

Banks are not prohibited from issuing loans to foreigners, which means it is possible to get a mortgage with a residence permit. However, many lenders require Russian citizenship. Why?

When considering loan applications, financial institutions evaluate projected income, as well as the likelihood of debt problems. Most Russian banks adhere to the tactics of issuing low-risk loans, avoiding potential litigation outside the Russian Federation. The exception is VTB mortgage with a residence permit.

Many credit institutions, especially those with foreign capital, do not attach importance to citizenship. It is enough for the borrower to confirm his financial solvency.

How does the client guarantee payment of the debt? Availability of permanent income and property. In the case of a mortgage, the bank will have real estate as collateral. Sometimes, getting a mortgage with a residence permit turns out to be easier than a consumer loan.

How to get a mortgage if your spouse is a foreigner

If one of the spouses in the family is a foreigner, there are several ways to apply for a home loan:

- if one of the spouses wants to be the sole owner of the mortgaged home and pay the loan only from their own funds, the husband and wife can sign a corresponding marriage contract. Then the bank does not consider the second spouse as a co-borrower, but the latter does not have ownership rights to the housing. In the event of a divorce, the spouse who was not the owner and co-borrower will not be able to receive a share in the mortgaged apartment;

- if they have sufficient income, the spouses are considered by the bank as co-borrowers with an equal degree of financial responsibility. Moreover, the chances of approval for a couple are higher compared to a single foreigner who wants to take out a mortgage;

- one of the spouses may act as a financially responsible co-borrower; the income of the second may not be taken into account. In this case, the bank in any case checks the documents and credit history of the co-borrower who does not pay.

Important: a family has the right to receive maternity capital if the mother and child have Russian citizenship. The right to maternity capital appears after the birth or adoption of the second and subsequent children. If the child’s father is a foreign citizen, this will not prevent the family from obtaining a certificate and using it to repay the principal debt and interest on the mortgage.

Mortgage for foreign citizens without a residence permit

In most cases, getting a mortgage without a residence permit is more difficult than with one. Let's look at the reasons.

When applying for a loan, the bank requests documents about employment and income. The main borrower criteria for a financial institution are:

- stable work;

- regular income;

- ability to pay on schedule;

- reducing the likelihood of debt problems.

A residence permit provides the right to stay in Russia for up to 5 years and official employment without obtaining a permit. However, this is not the only way to confirm your solvency.

Required documents

A mortgage is issued upon availability of the following package of documents.

- Application for a mortgage loan. Along with it, a form is filled out, in which personal data is entered.

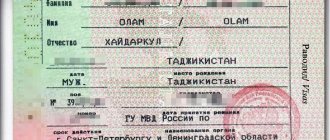

- Citizen's identity card. It is necessary to translate the passport data into Russian and have the document certified by a notary office.

- Permission to stay on the territory of the Russian Federation. You can provide a residence permit, migration card, visa.

- Permission for official employment.

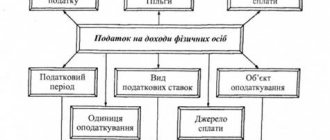

- Documents reflecting work experience and level of permanent income. The employer can issue a certified copy of the work book, employment contract, or a certificate in form 2-NDFL.

- Characteristics compiled by the employer. The document is not required, but will not be superfluous.

- Documents for the purchased property.

In some cases, lenders ask to provide temporary registration, a diploma, documents confirming the property they own, and a bank account statement.

Additional requirements

The debt is secured by the property. However, it is more profitable for banks to receive stable payments under the agreement rather than to engage in litigation with the debtor. Credit institutions may impose additional conditions on mortgages for foreign citizens with a residence permit. For example:

- attracting a guarantor/co-borrower;

- increasing the amount of the down payment;

- reduction of loan term;

- interest rate increase;

- the financial burden of the borrower, taking into account the payment on the requested loan, should not exceed 30-40% of income;

- insurance against the risk of insolvency.

Banks providing mortgages to foreigners

Today there are not many banks willing to provide a loan for the purchase of a home to a foreigner.

Basically, loans to foreign citizens secured by real estate are provided by large commercial credit organizations and banks with foreign capital.

| Name of the bank | Bet size | Down payment amount | Loan submission period | Notes |

| Raiffeisenbank | from 9.5% | 15% | up to 25 years | Required work experience – 3 months, without guarantors |

| DeltaCredit | from 15% | 15% | Up to 25 years | The minimum rate applies to a down payment of 50% |

| Alfa Bank | from 13% | 15% | Up to 30 years old | The borrower's age is 64 years old on the date of full repayment of the mortgage |

| VTB 24 | from 12% | 20% | Up to 30 years old | Home insurance is required |

| UniCredit Bank | from 16% | 20% | Up to 30 years old | Additional income may be considered, a guarantor is required |

| Rosbank | from 12% | 15% | Up to 25 years | The rate depends on the size of the down payment - 50% |

Which bank can I get a mortgage loan from?

Still, which banks are ready to provide a mortgage with a residence permit? Let's get acquainted with the requirements for borrowers from top banks that are ready to issue mortgages for foreigners with a residence permit.

Alfa Bank

- age from 21 at the time of filing, to 70 at the end of payment;

- total experience from 1 year, in the last place from 4 months;

- any registration at the place of residence;

- up to 3 co-borrowers without presenting any relationship requirements.

Raiffeisenbank

- age from 21 at the time of issue, up to 65 years old to repay in full;

- living and working in the Russian Federation;

- several options for length of service requirements, depending on the general and last place, in any case, the borrower must work for at least six months;

- for entrepreneurs, a report on financial activities for 3 years;

- The minimum salary in hand is from 20 thousand rubles. for Moscow and other million-plus cities, 15 thousand rubles. for other regions;

- no bad credit history;

- There must be no more than one existing mortgage loan when submitting an application;

- Spouses, cohabitants, and close relatives can be co-borrowers.

VTB

- total experience from 1 year, when changing jobs - from 1 month, not counting the probationary period;

- there are no requirements for the place of registration of the applicant;

- place of work in the Russian Federation.

UniCredit

- the place of registration of the applicant and the property is the territory of the Russian Federation, except Crimea;

- place of work in Russia, except for the territory of Crimea;

- confirmation of the level of income sufficient to repay the requested loan;

- no negative credit history.

Home Credit, Rosbank, Rusfinance Bank, Deltacredit

The Societe Generale group is represented in Russia by financial organizations Rusfinance Bank, Rosbank, Deltacredit. The latter cooperates on mortgage products with Home Credit Bank. The listed lenders have general requirements for borrowers:

- minimum age is 20 years, maximum at the time of payment is 64 years;

- employment, and the official requirements do not indicate mandatory employment in the Russian Federation;

- co-borrowers/guarantors – up to 3 people without any requirements for relationship.

Which banks provide mortgages with a residence permit?

Of the market leaders, only three banks issue mortgages. The rest strictly require borrowers to have a Russian passport.

Even the largest bank, Sber, which has always been loyal to foreigners, does not issue them long-term mortgage loans. Some lenders also require registration (temporary or permanent) in the region where the bank operates.

Lending conditions of leading banks in the mortgage market:

| Bank's name | Citizens of which countries are ready to issue loans? | Is registration required in the Russian Federation? |

| Alfa Bank | Russia, Ukraine, Republic of Belarus | optional |

| Raiffeisenbank | any foreigners with a residence permit | |

| VTB | ||

| Sber | only for Russian citizens | required |

| Absolut Bank | ||

| Gazprombank | ||

| Opening | ||

| Bank Dom.RF |

Documents from the borrower

Basic package of documents for approval of the amount:

- application (questionnaire);

- passport + translation;

- marriage certificate, its translation;

- consent to the processing of your data by the bank;

- documents confirming the legality of residence and work in the Russian Federation;

- confirmation of employment and income (tax returns, salary/pension certificates, copy of the contract with the employer, account statements).

Translations must be notarized. Credit institutions reserve the right to require additional documents. For example, a client may be asked for notarized translations of contracts under which he worked before arriving in Russia.

Documents confirming regular income may not be required when contacting the bank where the salary account is opened.

Read more about the requirements for mortgage documents in another article - Requirements for online mortgage documents

Requirements for premises on the secondary market

The main characteristics that the finished object must meet:

- connected to communications;

- if the room is finished, plumbing, doors, and windows are required;

- condition - not dilapidated, not in emergency condition, not subject to resettlement;

- reinforced concrete foundation, stone or brick;

- there are no encumbrances or interests of third parties.

Raiffeisenbank is the most demanding in terms of real estate. In order to lend, the following conditions must additionally be met:

- the seller is not a legal entity whose work does not comply with the legislation of the Russian Federation, or a close relative of such;

- the premises must have its own kitchen and bathroom;

- there are requirements for the number of storeys of a building depending on its age and region.

Documents for the property when purchasing a finished home

Scroll:

- title documents - according to which the premises were given to the seller (possible: purchase and sale agreement, share participation in construction, donation, exchange, certificate of inheritance, court decision, etc.);

- assessment report;

- cadastral/technical passport – check the need for a specific bank;

- extract from the Unified State Register/United State Register;

- certificate of persons registered in the premises/absence of registered persons;

- certificate from your personal account;

- if there is a marriage contract, a copy of it;

- the notarial consent of the spouse is required for the buyer or seller if the property is sold/bought during marriage, but without the use of a general joint right of ownership and without a marriage contract;

- if the seller is an individual, a copy of all pages of the passport;

- if the seller is a legal entity, a copy of the constituent documents, as well as a document confirming the right to sign;

- the minor seller will need permission from the guardianship authorities and related documents;

- if a representative of the party is involved in the transaction, a notarized power of attorney.

Buying a secondary apartment with a mortgage: step-by-step instructions will help you understand the transaction in detail.

Requirements for a facility under construction

The legislation of the Russian Federation regarding mortgages for housing under construction is at the stage of serious changes. Bank requirements are also changing.

The best option for the client is to have the facility accredited by the bank. In this case, you do not have to delve into the intricacies of the law. If you are buying an apartment in a multi-storey building, it is advisable to ask the developer which banks the building is accredited with. There may be a financial institution on the list that suits you.

If the building is not accredited by the bank from which you want to get a loan, you will have to collect a package of documents for approval (licenses, permits, etc.). Check with your lender for current requirements.

Basic requirements for borrowers

Conditions in a particular bank depend on the internal credit policy of the financial institution. The law does not prohibit a creditor from establishing its own requirements, including for citizens of other states.

Some conditions can be classified as general conditions that a client will encounter in any bank:

- Age – from 21 to 70 years. The limit is set with the condition that by the time the client reaches the maximum permissible age, he will make the last payment.

- Sufficient level of income.

- Positive or neutral credit history.

- Contact phone number.

- Attracting guarantors or co-borrowers.

- Mandatory conclusion of insurance agreements.

- Residence in the locality where the bank operates.

Co-borrowers and guarantors must meet the same requirements.

Documents for a property under construction

The basic package of documents usually looks like this:

- draft agreement on shared participation in construction or assignment of claims;

- valuation report;

- power of attorney for the signatory of the agreement on behalf of the legal entity.

Buying a new building with a mortgage: instructions with a detailed description of each stage will help borrowers understand all the nuances in advance.

Mortgage for pensioners with a residence permit

According to general rules, all banks have requirements for the applicant’s employment and age. At the same time, they draw attention to the fact that all loan applications are considered on an individual basis.

So is it possible for a pensioner with a residence permit to take out a mortgage? If he confirms his solvency, there is a chance of getting approval. A number of features should be taken into account:

- The loan term will be short.

- The down payment will be higher than for general requirements.

- With age, the risk of insolvency increases; it will be included either in the insurance commission or in the interest on the loan.

- There is a high probability of a requirement to attract co-borrowers/guarantors.

Applying for a mortgage requires time and money. As a result, the premises are pledged to the bank. When purchasing real estate as a pensioner, it is advisable to evaluate and compare the benefits of attracting mortgage and consumer loans.

Can a Belarusian get a loan in Moscow or St. Petersburg

Of course, citizens of CIS countries can get a loan on the territory of the Russian Federation, but, unfortunately, not every bank lends to foreigners. But if you are officially in Russia, don’t worry, you won’t be left without a loan.

What documents does a Belarusian need to prepare:

- Passport;

- Work permit;

- A copy of the work book or contract;

- Certificate of income;

- Temporary registration for the entire loan term.

If you have movable or immovable property on the territory of the Russian Federation, you can provide documents. The collateral will not only increase the chances of getting a loan, but will also significantly increase the possible loan amount.

The best thing they give to Belarusians is mortgages. Since the lender retains the property as collateral. The larger the down payment you make when applying for a mortgage, the better conditions you will receive. For example, if you make a contribution of more than 50% of the cost of the apartment, then the bank will automatically set you the lowest rate. Be prepared that if you are not a citizen of the Russian Federation, then you will be required to make a down payment of at least 20-30% of the cost of the apartment.

When applying for an apartment on credit to a Belarusian, it is not necessary to obtain temporary registration for the entire term of the mortgage.

How to Apply for a Mortgage Online

Banks provide the opportunity to submit an application through the website. The filling procedure is usually clear intuitively. Please indicate/provide:

- Personal Information;

- contacts;

- desired loan amount;

- income level;

- consent to the processing of personal data;

- consent for the bank to receive information from the credit history bureau.

If you have already paid off a loan in Russia, online applications will help you contact several banks in a short time and compare their offers. For those who do not have a credit history in Russia, it is better to apply in person. A mortgage with a residence permit for citizens of foreign countries requires a detailed analysis of the available documents. A bank employee will help you collect and prepare them correctly.

Can a foreigner get a mortgage in Russia?

The attitude of Russian banks towards lending to foreigners

Since working with foreigners for Russian financial institutions is associated with certain risks, many banks are more wary of mortgage lending to foreign citizens, tightening requirements for borrowers and lending conditions. It is too early to talk about a unified approach of banks to working with foreigners. Some credit institutions prefer not to cooperate with foreign citizens on mortgage issues at all, indicating Russian citizenship in their requirements.

Another part of the banks actively offers mortgage loans to residents of other countries. There are financial institutions in Russia that do not believe that providing a home loan to foreigners is a risky deal. Such banks work with foreign citizens on the basis of proven and proven programs. At the same time, the lending conditions in most of them are practically no different from the mortgage conditions for Russians.

Some banks use providing mortgages to foreigners as one of the ways to develop and strengthen themselves in the banking services market. It is precisely these credit institutions that are interested in cooperation with foreigners, considering this category of clients as the most reliable borrowers. When working with foreign citizens, banks are guided by the fact that the majority of them are successful and law-abiding people with a significant level of income.

Speaking about which banks can be applied to for a mortgage for foreigners, it should be noted that their number is very small, and most of them are represented mainly by financial institutions with foreign capital (Societe Generale, GI Money Bank, Home Credit). Among Russian banks, only the largest of them are ready to provide mortgage loans (VTB 24, Deltacredit, Alfabank, Unicredit). It makes no sense for non-Russian citizens to apply to small banks for a mortgage loan.

At the same time, despite the different positions of Russian credit institutions and their attitude towards mortgages for foreign citizens, today nothing prevents a foreigner from leaving the territory of the Russian Federation without repaying the debt to banks. Therefore, the high requirements and conditions of financial institutions due to the highest risks are completely justified.

Which banks and on what conditions issue mortgages for foreign citizens?

Scheme of purchase and sale transaction and mortgage insurance

Let us highlight the main stages of buying real estate with a mortgage.

Contacting one or more banks to approve the amount

The client submits documents confirming his creditworthiness, as well as preliminary information about the purchased property (primary/secondary housing, estimated cost). The bank reviews the application, informs about the possibility of providing a loan, the approved amount, and the interest rate.

Collection of documents for the object

The client (or his realtor, representative) collects documents for the premises, the seller, and documents that are missing for himself (for example, the consent of the spouse). The exact list depends on the bank - the client receives it as a separate list.

At this stage, the parties enter into a preliminary agreement in which they state their intentions. Based on this, the buyer usually transfers the deposit to the seller against receipt.

Approval of the object by the bank

When the documents for the transaction are collected, the buyer gives the package to the bank. If all information is complete and correct, without violating applicable laws, the object receives approval.

Making a deal

The parties meet at the bank to sign a loan agreement. A purchase and sale agreement or share participation in construction/assignment agreement can also be concluded here.

If the transaction requires notarization (for example, shared ownership), the parties, together with the creditor, draw up a draft agreement and send it to the notary. Or the contract is drawn up by a notary and its terms are agreed upon with the bank.

Based on the signed purchase and sale/equity/assignment agreement, the buyer transfers (or transfers) the amount of the down payment minus the deposit. The seller writes a receipt for the money received. This document is usually drawn up by the bank taking into account all the requirements.

How to confirm the down payment on a mortgage - read in another publication.

Registration of a transaction

The buyer carries signed contracts, a receipt (or receipts) for the amount of the first payment, an extract from the Unified State Register from the seller for registration in Rosreestr. You can submit documents through the MFC. The maximum period for issuing documents is 2 weeks. Usually it takes significantly less time. The applicant picks up the contract with a registration mark.

Crediting money to the seller

The buyer provides the bank with a registered agreement. Based on this, the money is transferred to the seller.

Risk insurance

The loan agreement provides for mandatory insurance of the purchased object. A residential mortgage may also include additional insurance.

Read the loan agreement carefully. Insure the specified risks within the agreed period and provide copies of the policies to the bank. There are usually high fines for violating the conditions.

Call several insurers. The cost of the policy may vary significantly. When applying, provide a loan agreement so that the insurance agent accurately indicates all the data.

Mortgage insurance – what is required?

Mortgage repayment methods

When applying for a mortgage loan, you will receive account details into which you need to deposit money for repayment. You can top up in any convenient way:

- at the bank's cash desk;

- via bank transfer;

- Most credit institutions offer a bank card (often free) for replenishing via an ATM.

Ask your bank about existing commissions, free replenishment methods, as well as the timing of crediting funds to your account using different methods.

It is often recommended to deposit money at least 2-3 banking days before the scheduled payment.

Early repayment of mortgage

Russian banks usually do not charge fees for full or partial early repayment. The basic rules are specified in the contract. Please note that in order to write off a payment ahead of schedule, an order/application is required. Each bank sets the filing deadline at its own discretion. It can range from 1 day to a month. In addition, some organizations prohibit early payment of the amount.

Early repayment of a mortgage: is it more profitable to shorten the term or payment?