It is no secret that many foreigners visit Russia not only for the purpose of tourism. Residents of other countries often come to the Russian Federation for official employment for a very long time. Domestic legislation strictly obliges such people to acquire special patents. Without such permission, a migrant worker will not be able to work legally in Russian jurisdiction. In addition, without obtaining a patent to work in Russia, a resident of another state will not have access to social assistance and provided benefits. You need to figure out where you can get such a permit, what is needed to obtain it, and how much it costs. You should also figure out how to pay for a patent online so that the payment received is received as intended.

TIN for a foreigner: to pay or not to pay?

This innovation significantly complicates the life of a migrant worker who is poorly versed in the nuances of the legislation of the Russian Federation, raising a number of questions:

- Is it possible to pay an advance for a patent without a TIN?

- Where can I find out my TIN?

etc.

Some companies did not fail to take advantage of this circumstance, offering migrant workers a paid service in obtaining a taxpayer number, citing the fact that payment of an advance without a Taxpayer Identification Number (TIN) is impossible, and therefore a previously issued patent will be revoked. However, in reality, unscrupulous company representatives simply mislead their clients.

How to pay for a patent

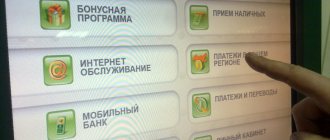

How to pay for a patent through Sberbank online step-by-step instructions:

- The first step is to log into your personal account and confirm authorization using SMS protection. This can be done from a computer, mobile phone or tablet.

- While in the main menu, you should select the “Transfers and Payments” tab, and then go to the “Traffic Police, taxes, etc.” item.

- Next, the “Federal Tax Service” should be indicated as the recipient (not to be confused with the “Federal Migration Service”, otherwise the payment will be misdirected and will not be credited).

- In the next window, you should indicate the region (if it is automatically determined incorrectly, you can change it) and click on the “Payment for patent” link, after which a form will open to fill out.

- Next, you need to enter the payer and card information. Please note that the payer’s data should not be entered from the card, but taken from the details of the patent itself. There is also a limitation for the card - credit and corporate cards are not suitable for performing this operation.

- The last thing to fill out in the payment form is the TIN (individual taxpayer number), which is also taken from the patent and OKTMO (All-Russian Classifier of Municipal Territories), which can be clarified at the tax service or reference office.

- After everything is filled out and sent, all that remains is to confirm the transfer with an SMS code. You can also print a receipt, which must be presented to the tax office as proof of payment.

The information you fill out will be saved, so you won't have to enter it again next time. It is also possible to connect the auto payment function.

How to pay a fine through Sberbank Online

How to pay for the Internet through Belagroprombank Internet banking?

Alfa-Chek service: what is it?

Paying for a patent without problems: how to do without a TIN

In fact, everything is much simpler than it seems, and our company’s specialists are ready to provide comprehensive information on the issues raised above, which is fully consistent with the requirements of current legislation.

- You can pay an advance on a patent without an INN number, but not in the terminal (where the code is actually required), but by contacting an operator at the cash desk of any bank.

- Anyone who applied for a work permit or patent in 2014 and earlier will find their TIN code on the front side of the 2015 patent.

- Labor migrants from among those who arrived in Russia only in 2015 and have already managed to get a patent will find out their TIN number by going to the tax service website https://service.nalog.ru/inn-my.do in the online.

We remind you that an outstaffing agreement is still relevant for legal entities, which allows you to insure against problems with the Federal Migration Service and calmly develop your business.

If you still have questions, please contact, here you will be provided with professional advice that you can trust.

How to pay for a patent without a tax identification number in Sberbank

This period is required for funds to be credited. If you carry out the operation on the last day, the money may not have time to arrive in the recipient’s account, and therefore the document will simply be cancelled. Find out how to pay for a patent for foreign citizens through Sberbank online.

Here you will find step-by-step instructions from our experts and user tips on how to pay in a Sberbank terminal. Also, a patent can be issued not only for a month, but also for three months at once, but each time it will have to be renewed until its validity period reaches 12 months, after which it is necessary for the migrant to redo the document. Paying for a patent without a TIN: nothing is impossible Since October 1, 2015, new changes in legislation have come into force - now, in order to pay advance payments for a labor patent, every migrant must know his identification number (TIN). TIN for a foreigner: to pay or not to pay? This innovation significantly complicates the life of a migrant worker who is poorly versed in the nuances of the legislation of the Russian Federation, raising a number of questions:

- Is it possible to pay an advance for a patent without a TIN?

- Where can I find out my TIN?

etc. Some companies did not fail to take advantage of this circumstance, offering migrant workers a paid service in obtaining a taxpayer number, citing the fact that payment of an advance without a Taxpayer Identification Number (TIN) is impossible, and therefore a previously issued patent will be revoked. However, in reality, unscrupulous company representatives simply mislead their clients.

Despite the fact that the migration policy of the Government of the Russian Federation is quite loyal and aimed at the most comfortable procedure for the legalization of foreign nationals, their employment in our country involves the issuance of a number of permits, the main of which is a patent. At the stage of preliminary preparation of the necessary papers, the candidate will require quite a lot of effort and, of course, knowledge of legislative norms and rules in this direction.

How to pay for a patent online?

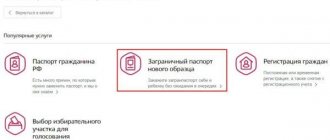

When paying for a patent online, a foreign citizen must:

- Go to the official website of the Federal Tax Service via the link nalog.ru;

- In the pop-up window, a foreign citizen must enter the following details: taxpayer identification number, his last name, first name, patronymic (if available);

- After entering all the data, you need to go to the next page of the online receipt by clicking the “next” button;

- The next page is called “Individual Taxes”;

- In the “Tax” line, a foreign citizen must select “Income tax for individuals”;

- In the “Address” line you need to enter the address of permanent registration or actual residence (temporary registration);

- In the “Type of tax” line, you need to select the most recent option, which is called “Tax for individuals paid by foreign citizens employed by individuals on the basis of a patent.”;

- In the “Contribution Type” line, you need to select the “Tax” option;

- In the “Amount” line you need to indicate the amount - four thousand two hundred rubles (in numbers);

After filling out all the listed lines, you can proceed to the next page of the online receipt by clicking the “next” button;

- The last page is devoted to the method of payment for the patent: at your discretion, you can choose a cash/non-cash method of payment for the patent;

If you use cash payment, the site will offer to print out a receipt with the patent details and then pay for it at a convenient bank branch.

If you use a non-cash payment method for a patent, the site will offer to go to one of the sites of partner banks.

How to pay the state fee for a patent without an identification number

Such people must definitely go through the patent registration procedure - without it they will not be officially hired, nor will they be provided with the necessary benefits and social support. Therefore, it is very important to complete the documents and purchase a patent on time.

All this confusion with the date of payment for a patent arises due to the fact that there is no law that would clearly indicate the date when it is necessary to pay for a patent and each migrant pays as a friend, acquaintance, relative or someone else told him... We consulted with several lawyers and they all state that the correct payment for a patent should be based on the date of issue of the patent! A patent is a monthly fee (tax) that an individual employed by another individual or legal entity must pay every month. For example, a foreign citizen received an invitation from a Russian employer. Upon arrival in Russia, he filed a patent. After the patent is revoked, you will need to re-apply for a work patent since it will not be possible to restore the old one!

What to do if you have lost your previous patent payment receipts?

We will NOT help you obtain a work patent in Moscow or a work permit or make temporary registration in Moscow for CIS citizens. In the first case, everything is quite simple. We come to the bank and ask the employee to process the payment. We indicate the required amount and a minute later we receive a payment receipt.

Moscow in. citizen." Attention! Before selecting an operation, you must make sure that the correct region is indicated next to the page title “Payment: Federal Tax Service”.

After filling out all the listed lines, you can proceed to the next page of the online receipt by clicking the “next” button;

- The last page is devoted to the method of payment for the patent: at your discretion, you can choose a cash/non-cash method of payment for the patent;

TIN for a foreigner: to pay or not to pay?

Fortunately, there are many ways to send funds. One of the most convenient options is to pay for a patent through Sberbank for foreign citizens. We will consider the features of such payments in the article.

Despite the fact that the migration policy of the Government of the Russian Federation is quite loyal and aimed at the most comfortable procedure for the legalization of foreign nationals, their employment in our country involves the issuance of a number of permits, the main of which is a patent. At the stage of preliminary preparation of the necessary papers, the candidate will require quite a lot of effort and, of course, knowledge of legislative norms and rules in this direction.

You should take paying for a patent very seriously and never forget to do this, since if you are late in payment even by 1 day, your patent may be revoked. To do this, you need to: Register on the Sberbank Online website and connect to Mobile Banking, as well as print out a special login password (read our publications for details).

Consequences of late payment for a patent

Use the service on the website of the Federal Tax Service of Russia. To do this, you need to: 2. Fill in the required fields: indicate your full name, date of birth, and identification document. 3. Click the “Send request” button. If all the data you entered is correct, your TIN number will appear at the bottom in the issuing line.

Otherwise, the required service will not be displayed in the search results. The next step is to fill out all the required details. The first step is to select a write-off card, and the set and amount of other requested data varies depending on the specified region of the payer. The system may ask you to fill out the following details: select a service (you need to select the “payment for a patent” option, in some cases you also need to indicate the area where it was registered); full name of the patent owner (NOT the payer); payer's TIN; code “IFTS” - federal tax service inspection; tax period (optional); “OKTMO” is the All-Russian Classifier of Municipal Territories, can be found on the websites of the Federal Tax Service or the Ministry of Finance.

In fact, at the moment, the TIN must be indicated when paying for a patent! The fact that it is mandatory to indicate the TIN is stated in the SMS message that comes to your phone, and your TIN is indicated there in the same SMS.

Payment options are one of the most pressing issues for migrant workers, since most work patents expire precisely due to late receipt of current payments. There are several ways to do this:

- cash desk of any financial institution;

- cash via terminal;

- on the Gosuslugi website - by non-cash transfer of the required amount from a bank card.

The migration service is responsible for issuing patents. Today, multifunctional centers have also appeared, through which you can issue a document much faster and more conveniently.

Where can I find out my TIN? Some companies did not fail to take advantage of this circumstance, offering migrant workers a paid service in obtaining a taxpayer number, citing the fact that payment of an advance without a Taxpayer Identification Number (TIN) is impossible, and therefore a previously issued patent will be revoked.

Payment for a work patent through a Sberbank terminal - instructions. Payment for a work patent through a Sberbank terminal - detailed instructions. To pay for a work patent through a Sberbank terminal, you will need the details for which you need to make the payment. Instructions for generating a receipt with details for paying for a patent are here. You can find the nearest terminal or branch where you can pay for a patent on the official website of Sberbank.

Do I need to keep payment receipts?

Yes, in order to find the tax identification number of a foreign citizen in the tax database, you need to enter his passport data into the form fields on the tax or government services website (see.

Many foreign citizens come to Russia not only as tourists, but also as future employees of domestic enterprises.

Attention! If a foreign citizen left the Russian Federation and did not pay for the patent for the period of absence, upon returning to the territory of the Russian Federation he must obtain a new patent. If you were unable to find out the TIN using any of the above methods, then you need to obtain the TIN yourself. To do this you need: Step 1.

Paying for a patent without problems: how to do without a TIN

After the patent is revoked, you will need to re-apply for a work patent since it will not be possible to restore the old one! How to pay for a patent without a TIN? Many foreign citizens are wondering how and where to pay for a patent without a TIN.

Attention After all, in addition to the fact that failure to pay the next advance or making it in violation of the payment procedure entails the cancellation of the document and the need to draw up a new one, this also results in administrative sanctions.

When you forgot to renew on time (make a monthly payment), even for 1 day, it immediately becomes invalid and there is no longer any reason for a foreign citizen to stay on the territory of Russia. The legislator does not care how long the document was overdue.

Click CONTINUE (BASIS OF PAYMENT) TAX PERIOD, enter today's date, for example 09/05/2014 and press ENTER Find the line REFUSE TO PROVIDE DOCUMENTS in the list and click CONTINUE Enter the payment amount in digits 1216 and click CONTINUE Click CONTINUE Click PAY Click AGREE Click CONTINUE Select your mobile operator communication (the change will be transferred to the specified mobile phone number) Dial in numbers (without

How to pay for a patent without a tax identification number in Sberbank

Patents are valid for citizens of Azerbaijan, the Republic of Moldova, Tajikistan, Uzbekistan, Ukraine, and non-citizens of Latvia and Estonia can also apply for a patent in 2021 (see Federal Law No. 357-FZ). At one time, a foreign citizen will be able to make a fixed advance payment of personal income tax on a patent for a period of 1 to 12 months. Paying for a patent without a TIN: nothing is impossible Since October 1, 2015, new changes in legislation have come into force - now, in order to pay advance payments for a labor patent, every migrant must know his identification number (TIN). TIN for a foreigner: to pay or not to pay? This innovation significantly complicates the life of a migrant worker who is poorly versed in the nuances of Russian legislation, raising a number of questions: Is it possible to pay an advance for a patent without a TIN?

Sberbank offers its clients the opportunity to pay tax fees - both through a personal visit to the nearest branch of the company, and to do this without leaving home. Your patent is valid only if the advance payment for personal income tax (NDFL) has been paid. From 01/01/2018, the personal income tax payment for a patent in Moscow is 4,500 rubles for 1 month of patent renewal. Only one person must be included in the patent payment receipt - the one to whom the patent was issued and his TIN. The TIN is needed so that the money is received specifically for your patent, and it is automatically renewed. If you do not know your TIN, check its availability using one of the methods indicated here. You must pay for a patent regularly, complying with the specified payment requirements, otherwise the patent will cease to be valid.

Paying for a patent without a tax identification number: nothing is impossible

Please also note that the legislation allows you to pay for a patent not one month at a time, but for several months at once or for the entire validity period of the patent - 12 months, but no more!

From a legal point of view, the purpose of the form is to legalize the process of employment of non-residents and control the situation on the vacancy market. The document is required for those who came to Russia under the visa-free regime.

Source: https://auction63.ru/khozyaystvennoe-pravo/6669-kak-oplatit-gosposhlinu-za-patent-bez-inn.html

What is a patent?

A patent is a monthly fee (tax) that an individual employed by another individual or legal entity must pay every month.

For example, a foreign citizen received an invitation from a Russian employer. Upon arrival in Russia, he filed a patent. When registering, he is required to pay tax (personal income tax) in order to start the validity of the patent.

The specifics of this document are as follows:

- The validity period of one patent is thirty calendar days;

The countdown for the validity of a patent begins from the moment it is issued. However, many claim that the countdown begins from the moment the first payment is made to pay for the patent, but this is false information.

- Payment frequency: every thirty days (at least three days must remain before the patent expires);

- A foreign citizen can pay for a patent either every month or for the entire period for which the patent is issued;

The maximum number of months for which payment can be made is twelve months.