Documents for obtaining citizenship

You can join the ranks of Russians in a general and simplified manner. Depending on the specific reasons for receipt, the list of required documents also differs.

According to Article 13 of Law No. 62-FZ, the following generally enter into force:

- foreigners with a residence permit who have lived in Russia continuously for 5 years or 1 year if they are refugees, have high scientific, technical, cultural achievements, a profession of state interest, or have been granted political asylum;

- having special services to the Russian Federation;

- citizens of states that were part of the USSR and undergoing military service in the Russian Federation under a contract for at least 3 years.

Anyone wishing to become a Russian will have to fulfill the income requirement to obtain citizenship - this is mandatory. Russia will not be able to accept a person without a means of support into its ranks.

In general order

Foreigners with a residence permit provide the following documents (original and notarized copy):

- Residence permit (original only);

- passport with translation into Russian;

- birth certificate;

- certificate of marriage or divorce;

- income document;

- certificate of proficiency in Russian;

- receipt of payment of state duty;

- TIN;

- a copy of the work book;

- autobiography.

Note! Since July 2021, the requirement to renounce existing citizenship has been abolished, but everyone still needs a certificate of income for Russian citizenship in 2021. And pensioners do not provide a document on knowledge of the Russian language (women - from 60 years old, men - from 65 years old).

Those who have high achievements in science and other fields are required to live in the Russian Federation under a residence permit for at least a year. They additionally submit a petition from the interested body to grant the person Russian citizenship.

Refugees and those granted political asylum provide a refugee certificate and a certificate of political asylum and submit documents without a residence permit.

Based on special merit, foreigners receive permission only upon application from the interested federal body or senior official.

Military personnel must collect the following documents:

- a petition from a military command authority;

- RVP or residence permit;

- identification;

- a copy of the military service contract;

- notarized copies of the passport with translation and birth certificate;

- marriage or divorce certificate;

- confirmation of Russian language proficiency;

- receipt of payment of state duty.

As proof of income, the most valuable documents are the 2-NDFL certificate or the 3-NDFL declaration for Russian citizenship, but there are also other papers.

Sometimes officials additionally require a copy of the TIN and autobiography, but neither one nor the other document is designated as mandatory in the legislation. The obligation to provide them varies by region. The exact list of required papers is indicated on the website of the Main Directorate for Migration of the Ministry of Internal Affairs of your region in the section “Citizenship of the Russian Federation”.

In a simplified manner

Everyone who receives citizenship through a simplified procedure is listed in Article 14 of Law No. 62. They provide documents depending on the grounds. The general list includes:

- Residence permit with registration in the region where documents are submitted;

- passport and birth certificate (noted copy and translation);

- certificate confirming knowledge of the Russian language;

- passport of the parent or spouse, depending on the basis for filing the application (original + copy);

- income document;

- 4 photos;

- application in 2 copies;

- receipt of payment of state duty.

If the foreigner is a former citizen of the USSR and has not acquired another citizenship, then instead of a passport he is provided with a USSR passport received in the past.

The disabled parent provides the child's birth certificate, a copy of all pages of his passport and a pension certificate. And the parent of a minor - a birth certificate or passport of the child - a citizen of the Russian Federation.

Those who graduated from a university in the Russian Federation and submit an application on this basis provide a diploma of completion and a certificate of accreditation of the university, information from the Pension Fund of the Russian Federation about the status of their personal account and a copy of their employment record, which confirms the experience of 3 years or more.

The individual entrepreneur provides an extract from the Unified State Register of Individual Entrepreneurs and information on taxes paid related to the activities of the individual entrepreneur and on insurance premiums for 3 years.

Native Russian speakers provide evidence of NRL.

Participants in the state resettlement program provide a migrant certificate and temporary residence permit.

Certificate of income for Russian citizenship

The process of obtaining Russian citizenship cannot be called easy; you need to obtain a residence permit, find housing, work, and confirm your knowledge of the language. Naturalization takes no less than eight years. When the time comes to collect documents to obtain a Russian passport, you will certainly need a certificate of income for Russian citizenship.

Required income level

There is a sparse line in the law on citizenship of the Russian Federation - you need to provide proof of having a legal source of livelihood.

In fact, before accepting another citizen into its ranks, the country has the right to know whether he will do anything illegal and whether he will be able to provide for himself.

Therefore, you should figure out what your income should be to obtain citizenship in Russia.

The fact is that the law itself does not directly indicate the amount of remuneration, but it is obvious that it cannot be less than the minimum amount, which as of January 2021 is 11,280 rubles.

At the same time, there is another indicator for determining the well-being of the people - the cost of living, it is calculated both for the country as a whole and separately in different regions.

For example, in Moscow at the beginning of 2021 it was about 16,463 rubles, and in Russia as a whole - about 10,444 rubles.

In addition, there are separate indicators for different categories of the population - working people, pensioners and children.

Thus, the minimum annual income to obtain Russian citizenship must be equal to twelve subsistence minimums for each person. What value to take into account depends on the region of residence of the foreigner and the composition of his family.

If the migration service employees require the applicant foreigner to confirm the presence of a much larger amount, this requirement is not legal and can be appealed to higher authorities (notify the head of the department or submit documents to the court).

How to confirm

The rules for verifying income for foreign citizens state that the following documents can be accepted as evidence:

- income certificate (2-NDFL);

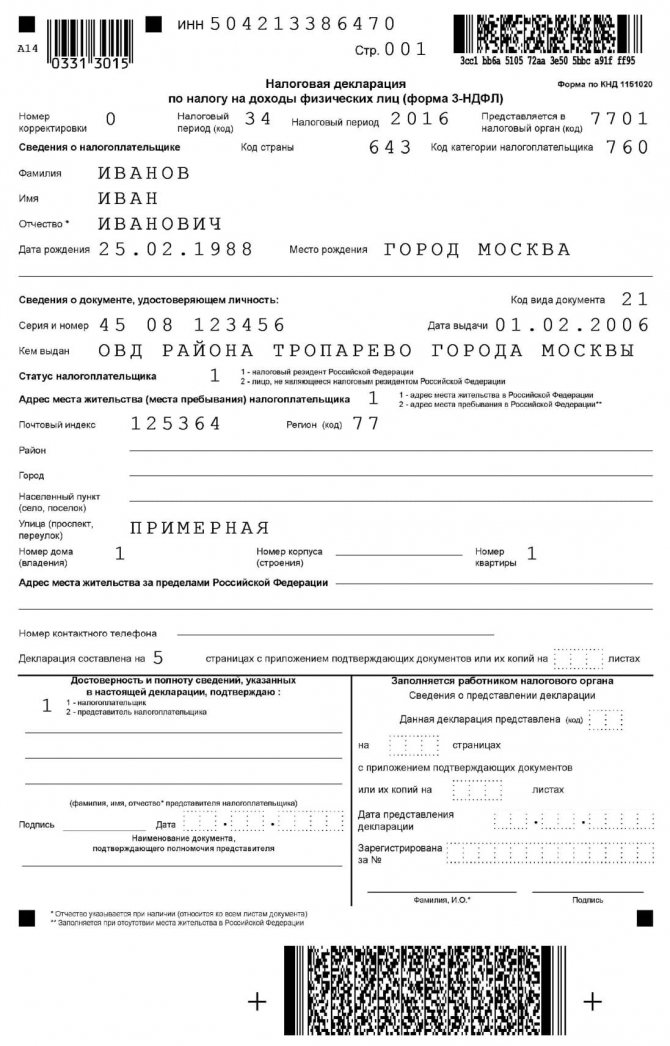

- tax return (3-NDFL);

- a certificate from the bank confirming the presence of a deposit;

- certificate of income of the person you are dependent on;

- pensioner's ID;

- confirmation of receipt of alimony;

- information from social security authorities about the payment of benefits;

- certificate of receipt of inheritance.

The migration authority inspector may accept a combination of these documents as confirmation of the required level of income if, for example, you receive alimony, have a bank account and work. The most common way to confirm a citizen’s income is an income certificate.

2-NDFL

If a foreign citizen works officially, the easiest way will be to submit Form 2-NDFL, which will be done by an accountant at his request. Of course, the salary should not be less than the subsistence minimum. The certificate is usually accompanied by an employment contract or a copy of the work record book.

In addition, it is worth considering that according to Russian laws, the property of spouses is jointly owned. This means that if your other half has Russian citizenship and a large “white” salary, you can use a certificate from her place of work.

Please note that the entire amount will have to be divided among all family members who are dependent on the worker.

You may wonder how long you need to work to prove your income. After all, a person could work unofficially for some time or change several jobs. Often inspectors require information about wages for the last year.

The text of the law does not require income to be received for any period prior to the filing of documents. We are talking only about having a source of livelihood at the time of applying for citizenship.

Therefore, if a citizen has worked officially for at least three months, it is already considered that he works constantly, and therefore receives a salary constantly.

However, this situation is a bit like applying to a bank for a loan - the more experience you have (and your salary), the better.

What problems may arise

Difficulties with confirming income may arise for foreigners who are unofficially employed or receive a “gray” salary. Unfortunately, this is not so uncommon in our country.

If it is impossible to obtain at least one of the above-mentioned certificates, care should be taken to find another way to confirm solvency. For example, open a bank account.

Or think about another way to obtain citizenship. Thus, participants in the Compatriot Resettlement Program are not required to provide proof of their income.

You can find out under what conditions you can obtain Russian citizenship here.

Many applicants for citizenship are faced with the following demands from employees of the Main Directorate for Migration Affairs of the Ministry of Internal Affairs:

- the bank account must be opened a certain period before submitting the application, for example, a year;

- the amount in the account must be such that the monthly interest accrued constitutes a living wage.

Both of these demands are illegal. It is enough to have the amount necessary for living at the time of submitting the application, that is, the account can be completely “fresh”. And the size of the deposit must correspond to twelve subsistence minimums per person. And, of course, after receiving a certificate from the bank, you can use this deposit, because that’s what the funds are intended for.

Problems may also arise if you are dependent on someone who is not your close relative or spouse.

Even if the size of his salary or other type of income allows him to support you, migration service employees may have a legitimate question as to why he is doing this and whether he will do this in the future.

It is possible that such a fact of dependency will have to be proven in court.

What level of income is required?

According to the law, sufficient income when applying for citizenship is equal to the subsistence level in the region of residence. According to Article 7 of Law No. 115 “On the Legal Status of Foreigners...”, if this is not the case, then the temporary residence permit has the right to cancel. Despite the fact that this article is about temporary residence permits, the amount of earnings indicated in it is also relevant for applying for citizenship.

If the income is below the subsistence level, then it is possible to calculate the average monthly income for the calendar year. Another option is to calculate the average per capita income of each family member. In terms of 1 month, the amount allowed is not less than the subsistence minimum.

How to confirm your income level

There are several ways to confirm income for Russian citizenship in 2021 for the applicant to choose from:

- certificate 2-NDFL;

- 3-NDFL;

- bank account statement;

- application for dependency from a third party.

If you have official employment, then a 2-NDFL certificate is required. If you have income of another type, then 3-NDFL. And if you don’t work at all, you have the right to provide either an account statement or an application. Before you verify your income for citizenship, determine which of these methods is available to you.

Confirmation of income for acquiring Russian citizenship

The most convenient and suitable for quick verification is considered to be 2-NDFL - a document that reflects information about the source of income, wages and withheld taxes. It is a form filled out in the accounting department at the place of work. If your income is greater than the subsistence level, then the likelihood that the document will not have to be redone is almost 100%.

We recommend reading: When Selling a Dacha Do You Need Land Surveying in 2021

If unemployed

It is important to have an official source of income to obtain Russian citizenship. The most common difficulty is considered to be the impossibility of a citizen to confirm his income or its level is too low. This is due to the fact that many foreigners in the Russian Federation work unofficially or receive most of their earnings “in an envelope.” You can get out of this situation, for example, by opening a savings account in a bank and providing an extract from it, or you can go another way, which can be a simplified procedure for obtaining Russian citizenship, where the amount of income is not important.

As for confirming income with a spouse’s 2-NDFL certificate: you can confirm it with such a certificate, even if the amount does not reach the subsistence level for two. At the same time, the amount of income should still be adequate, and not 3,000 rubles.

The declaration must be submitted by the end of April. Payment must be made before July 15 to avoid paying fines and penalties. For example, you need to confirm income for 2021, therefore you need to submit a declaration by the end of April, and pay tax by July 15, 2021.

Proof of income when applying for citizenship

Recently in Moscow, one applicant managed to confirm his income using this method. When submitting, the application was accompanied by notarized copies of the specified agreements and acts, as well as the original certificate of income 2-NDFL of the donor for that period. Read more >>>

According to Part 1 of Art. 13 of the Law “On Citizenship of the Russian Federation”, foreign citizens who are eighteen years old at the time of filing the application, have full legal capacity and, among other things, have a permanent and, most importantly, legal source of income, are accepted for Russian citizenship.

Filling out 2-NDFL

2-NDFL is received in your personal account on the website nalog.ru, in person at the tax office by registration or in the employer’s accounting department. An individual is not required to fill it out.

If a foreigner is offered to buy 2-personal income tax for citizenship, then either he is being deceived or is being offered an illegal scheme to confirm earnings. A false form will be identified during verification and the application will be rejected. Falsifying the form will also lead to criminal charges under Art. 327 of the Criminal Code of the Russian Federation. Due to the availability of other ways to confirm earnings, the risk of providing a fake is not justified.

In 2021, the Federal Tax Service, by order No. ММВ-7-11/ [email protected], approved a new form of certificate 2-NDFL for citizenship, it looks like this:

Filling out 3-NDFL

Declaring your own profit under 3-NDFL in order to obtain Russian citizenship is necessary for those whose earnings are related to:

- with entrepreneurship;

- rental of premises;

- profit from the sale of property (real estate, cars);

- receiving fees;

- income outside the Russian Federation (if the person himself is a tax resident of Russia).

IMPORTANT! Until 01/01/2021, the form approved by the Order of the Federal Tax Service of Russia dated 10/03/2018 No. ММВ-7-11/ [email protected] [email] comes into force protected] , which approved the new 3-NDFL form.

When manually filling out the 3-NDFL certificate for citizenship, you must accurately fill in the year and tax period code. If the declaration is for 1 year, then the period code is always 34. To find out the tax authority code, contact the Federal Tax Service service using the link.

Next, the form contains information about the taxpayer, passport details and address, data on the profit received.

In section 2, subsection “Calculation of the tax base”, select the type of income:

- 1 and 2 - if these are dividends or income from foreign companies;

- 3 - if it is another profit.

If the declaration is submitted on foreign income, then clause 5.1 must be completed. The tax base in paragraph 6 is equal to the same amount. For other income, fill out paragraphs 1 to 6, taking into account the right to a tax deduction, if any.

The tax amount in the subsection “Calculation of the tax amount...” is equal to 13% of the amount that was obtained in paragraph 6 of the first section.

Filling example:

You can also confirm your earnings with a bank deposit; to obtain citizenship, the minimum subsistence level multiplied by 12 months is sufficient. Depending on the basis for acquiring Russian citizenship, they may require documents confirming the amount of income for the period of residence in the Russian Federation from January 1 to December 31 of the year preceding the date of application.

Confirmation of income: bank account or personal income tax certificate for Russian citizenship

All other applicants are required to explain in one way or another what they are going to live on after receiving the status of a citizen of the Russian Federation. For minors, financial security papers are submitted by their parents. Pensioners and the disabled , in turn, provide certificates from the pension fund or certificates of disability confirming receipt of benefits.

We recommend reading: What to do if your garden house is still not registered

Who will not need to confirm income?

Paying taxes is not only the responsibility of a resident of the Russian Federation, but also evidence of his reliability and financial viability. Therefore, tax certificates are the easiest way to confirm income. In general, there are two types of tax documents suitable for this purpose:

Note! On the other hand, foreign investors and entrepreneurs who have received the status of Russian citizens have a number of advantages over other businessmen from abroad. Registration of citizenship by investment is a mutually beneficial transaction between the state and a businessman.

Amendments to the law, which oblige the submission of notifications of confirmation of residence of a foreign citizen under a residence permit, were introduced by law not so long ago, but they provide for fines and sanctions.

Features of receiving

Good day! I have the following question: I received a residence permit by marriage in March 2021. In July 2021, 3 years have passed since I was married, now in October 2021 I have the right to submit documents to acquire Russian citizenship. To do this, the Federal Migration Service requires confirmation of the official source of income for the year preceding the application and for the current year. I am officially employed from July 1, 2021 to the present day. time, so I can provide 2NDFL only for this period of time. The Federal Migration Service told me that I must confirm my income for the first half of 2021. There are certificates from the bank that there were funds in the account (more than the subsistence level, if summed up from the second half of 2021). They said it won't fit. They suggest waiting until next year 2021.