Even the vast expanses of your native country are not a very good reason to refuse to travel abroad. And if some CIS countries are ready to receive their neighbors on a visa-free basis, then most tourists from the post-Soviet space will need visas to enter the countries of the European Union. Not least in the list of documents required for its registration is a bank statement for a Schengen visa in 2021.

Brief definition of Schengen visa

The Schengen zone has existed since 1985. This agreement implies simplification of passport control at state borders, as well as police and judicial cooperation. As the list of participating countries expanded, 26 powers entered the Schengen zone, albeit with varying degrees of involvement.

For those who cannot present a passport of a citizen of an EU country at the Schengen border, a visa is provided. In general, it is a special type of document that allows not only entry into the territory of the state that issued it, but also further unhindered movement within at least 26 other countries. Only Great Britain and Ireland stand out from the general series, which retained the right to admit people only on national visas.

The article “What is a Schengen visa” will tell you more about how to obtain permission to enter the territory of most of the united European countries.

Requirements of different countries for the content of the document

Schengen countries may have different requirements for the form of proof of solvency. We list the requirements of individual countries:

They often require a certificate of cash flow for a certain period of time.

- Austria – bank statement with a full reflection of all transactions for the last 6 months;

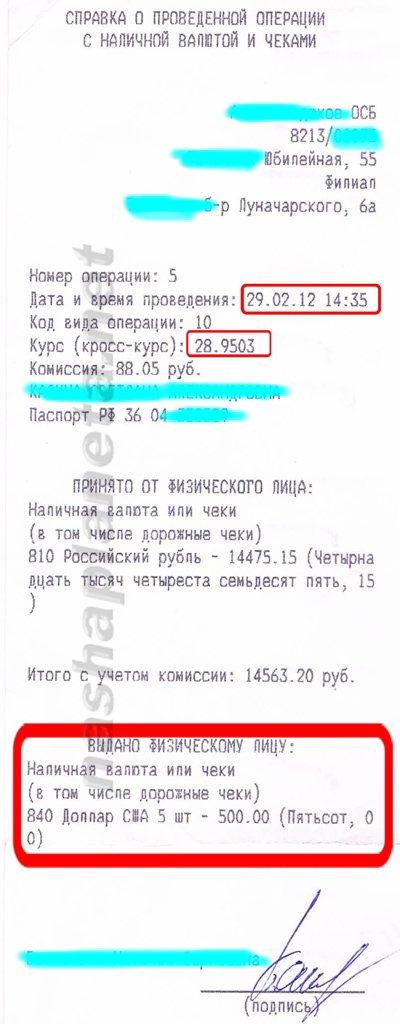

- Belgium – currency purchase receipt;

- Hungary – a document confirming the account status;

- Germany – statement from the card account, which should indicate the balance of funds that the citizen can use during the trip;

- Greece - a certificate stating that the citizen has opened a bank account and there are available funds in the account;

- Spain - receipt for the purchase of currency, scan of the card, bank statement about the balance of the account;

- Italy does not impose specific requirements for documents; to confirm solvency, you can provide any document, including a scan of a card, an account statement or a receipt for the purchase of euros.

- Latvia – agreement on opening an account, bank account statement;

- Netherlands - bank account statement and certificate of currency purchase.

Rules for issuing a bank certificate for obtaining a visa

In order for a certificate from a banking institution to be accepted and serve as a sufficient basis for issuing a visa, you need to ensure that it is completed correctly. Basic rules for registration that will help satisfy the requirements of consulate employees:

- The document is issued with the seal and signature of the head of the department.

- The account can be either a debit or a credit account with a sufficient available limit of funds.

- The balance amount is usually indicated in the account currency and, at the client’s request, in the euro equivalent on the date of issue of the certificate.

- The document must not be older than 30 days.

These are the basic requirements, but there are a couple more nuances that are worth taking into account:

- the certificate is issued, most often in the state language (for example, Russian), but this may not be suitable for the visa department of the consulate, which means that the document will also need to be translated into English and certified;

- they will not approve a visa if a potential tourist provides information about his deposit account, since such deposits usually cannot be withdrawn ahead of schedule, that is, the person will not be able to spend this money abroad.

Take a sociological survey!

[yop_poll id=”13"]

Certificate from Sberbank for obtaining a visa

For example, one of the largest credit institutions - Sberbank of Russia - offers its clients several options for obtaining the required document on the account status:

- personally;

- by mail;

- mini-statement from an ATM;

- through an electronic account.

The electronic online service, of course, saves a lot of time, but since a certificate from Sberbank for a Schengen visa, printed at home, will not be stamped, you still need to visit the bank branch. Moreover, the balance on the card can be confirmed at any office, and information about the movement of funds can only be confirmed at the branch where the account was opened.

The applicant may ask to have the certificate sent to him by mail, but this should take into account the loss of time. After all, no one will need expired paper.

Certificate from the bank for a Schengen visa

The financial document provided to the consulate must fulfill its main function, namely to show that the visa applicant is able to pay all his travel expenses independently and has no intention of staying in a foreign country. To do this, the applicant must have a clear connection with his homeland - a job with a good salary, real estate, a bank account. After all, if a person has enough money, then he is unlikely to have thoughts of illegally emigrating to Schengen countries. At least, if he has such a desire, he will carry them out using accessible business schemes, and not hiding on a tourist visa. The more money a person can confirm, the more respectable he looks in the eyes of an embassy inspection officer. European countries are interested in wealthy tourists who will come to them to spend their hard-earned money. This means that such people have a much greater chance of getting a visa for several years.

In addition to the certificate, one of the following documents can be used as a financial guarantee:

- the original statement of the applicant’s account, certified by the bank’s seal and the signature of the person who issued the document. The statute of limitations for the statement must be no more than 30 days;

- original and photocopy of the passbook;

- photocopy of the front side of the card (the card must indicate the owner's first and last name) + ATM receipt (ATM receipt is valid for 3 days from the date of receipt);

- bank guarantee from the inviting party (private person). It consists in the fact that the bank blocks a certain amount in the inviting person’s account in the name of the applicant. As a rule, such a document is drawn up by large world-famous banks. Insurance companies also prepare a similar document.

The latter type of confirmation is used extremely rarely. Basically, applicants provide the consulate with an original bank statement about their account balance. Please note that the embassies of some countries require not just a statement reflecting the amount as of a certain date, but a document showing the flow of funds for the last 3-6 months. Personally, I also always submitted extracts and even if the embassy did not require it, I showed the flow of funds. Of course, if you deposited the entire amount on this day, then it is better not to show the movement so as not to raise unnecessary questions. In addition, making an extract is quick and easy. It is issued immediately upon the client’s request by a bank employee. Some banks charge an additional fee for issuing a certificate, but not for an extract. In this case, the bank in which you have an account does not matter and does not affect the issuance of a visa. Whether it is Sberbank, Tinkoff or Alfa Bank - it doesn’t matter. You can keep your money in the financial institution you see fit. Even if it is a small local bank.

Most Russians provide documents confirming their financial status in ruble equivalent. But this is optional. You can open an account in dollars, euros, or pounds sterling. Some embassies, in the case of currencies other than those I listed above, require the bank to display the currency conversion rate on the certificate at the time of issue.

Amount of financial support for a Schengen visa

Those planning their first trip to an EU country often find it difficult to decide how best to obtain financial proof of solvency for a Schengen visa. There are several popular options: traveler's checks, a bank statement, a letter of guarantee from the host party, or sponsorship of a person accompanying the trip.

Those who can afford to travel without first obtaining visas can present cash or a cash balance statement from a nearby ATM to border officials.

Of all the former Soviet republics, with the exception of those that have already joined the EU, only citizens of Moldova, Georgia and Ukraine have the right to visa-free entry into Schengen.

Holders of passports from other countries need to know exactly what amount must be in the account to obtain a Schengen visa, even before the date of submitting documents to the embassy.

Contrary to the stories of tourists and even some careless travel agents, there is no agreement between the Eurozone countries on the minimum amount of financial security for travelers. According to a widespread version, 50 euros per day is enough to safely cross the border. This information is only valid for Greece.

Since the price level in each country is different, then, accordingly, each member of the European Union has its own requirements for how much money you need to have in your account to obtain a Schengen visa. For example, France suggests that a visitor should be able to spend at least 120 euros per day, and Hungary has reduced this norm to a symbolic amount of less than 4 euros per trip.

Option for calculating the minimum amount to obtain Schengen

Not every tourist can afford an air tour. The most popular way to save money and visit several countries at once is to travel by bus. For those who choose this route, travel agents most often offer entry through Poland, Hungary or Slovakia.

Before submitting documents, for example, to the Polish embassy, you can calculate the amount required to secure your trip yourself.

For a short-term visit (up to 3 days), you can confirm your financial solvency by having the equivalent of 100 euros on your card. For a longer stay you need 24 euros per day. Thus, a ten-day trip will require the presentation of a certificate with a card balance of at least 240 euros or their equivalent in the currency of the bank account.

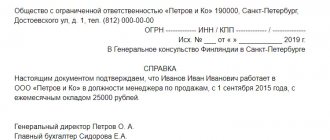

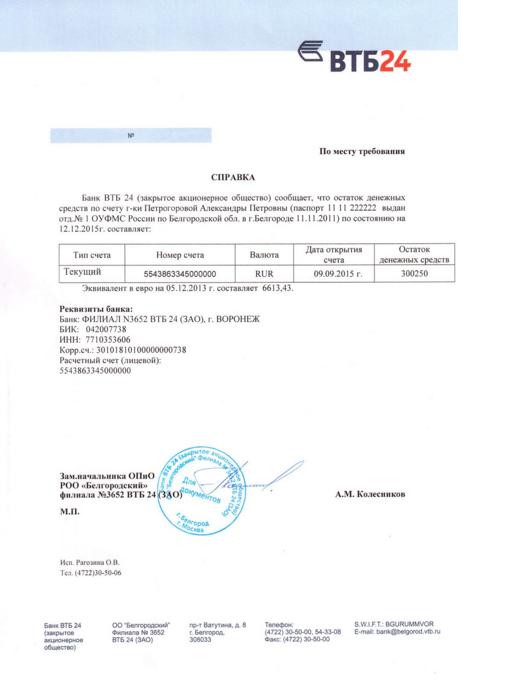

Sample certificate from a bank for a Schengen visa

You are unlikely to need the provided sample certificate for a Schengen visa, since the bank prepares the certificate independently upon your request. There are no strict requirements for the wording of the embassy. The period for issuing the certificate should be no more than 30 days.

A bank certificate or account statement for a Schengen visa is required to confirm financial solvency. Now you will have no doubts about how to get them and how to process them correctly.

Have a nice trip!

About the author: Ekaterina

On the pages of my blog you will find information about the places I have been, secrets and life hacks of independent travel.

- Related Posts

- Schengen visa: what is it and what is it for?

- How to get a Schengen visa yourself

- Visa-free countries for Russians 2021: complete list

Provided by SendPulse

« Previous entry

Alternative methods of financial verification

It happens that a person’s account balance certificate or statement doesn’t work out at all. This does not mean that the path to Europe is barred to him.

There are several ways to get by without checking accounts:

- ask for a salary certificate at work;

- purchase traveler's checks;

- take advantage of the support of a sponsor (accompanying person or host);

- buy from the bank the necessary amount of currency sufficient to ensure your stay in a foreign country.

Certificate of salary and position

If a person is officially employed and the salary for the last six months causes optimism, then you can safely contact your superiors with a request to issue a certificate confirming this fact. It is clear that the amount of the salary should also seem convincing to the embassy. If the certificate indicates the minimum possible income, then it is not worth submitting.

A document issued at the place of work not only confirms the fact of solvency, but also guarantees that the person will not leave a prestigious place for the opportunity to illegally stay in another country.

That is why it is additionally better to make a note that for the duration of his stay abroad the employee is retained a place and is expected to return.

Traveler's checks: types and methods of acquisition

It must be said right away that this type of confirmation has practically lost its relevance with the beginning of the active distribution of bank cards. This is natural, because the card is more convenient and safer to use, its contents do not need to be declared at the border, and losses on the exchange rate will be more modest.

However, some countries still believe that travel checks from Visa, Thomas Cook or American Express are the best proof that a foreigner will not have financial problems in their country. You can buy checks at any large bank that provides such services, but it is better to choose the most reliable one. This will allow you not to be afraid of sudden bankruptcy or other problems of the financial institution.

You can also use checks as a means of paying for goods or services. Along with ordinary banknotes, they are accepted in 150 countries around the world.

Currency purchase document

There is an option that to obtain a visa it will be enough to provide the original receipt for the purchase of a pre-calculated amount of foreign currency. It is clear that these must be euros, dollars or national currencies, the circulation of which remains in the host country (zloty, kroons or forints).

The buyer must be the person who issues the visa. The amount in the receipt cannot be less than the minimum amount of security based on the requirements of the receiving EU member. The date of the exchange transaction should be as close as possible to the time of application for the visa.

Trip with a sponsor

In order not to waste time and not lose money on currency exchange or buying checks, you can get a letter from a sponsor. Any person who can confirm their financial well-being and desire to support a potential recipient of a Schengen visa can be recognized as such. This person can:

- accompany a tourist on a trip;

- be a close relative;

- become a host in the destination country.

They won’t take anyone’s word for it, so you will need a properly drafted sponsorship letter and supporting documents about the sponsor’s solvency.

Basic information provided in the help

Before requesting a certificate from the bank, check what form it should be in

Document requirements for obtaining a visa change from time to time, so before contacting the bank, check the information on the consulate’s website. Find out what documents are needed to obtain a visa and in what form they should be provided. Sometimes a simple printout from an ATM is enough, and in some cases a full statement showing cash flow is required.

The certificate can be obtained from any deposit or current account. The document must be drawn up on the organization's letterhead, signed by the head of the bank branch and certified by a seal, in addition, it must contain information about the employee who prepared the statement (last name, initials, signature, telephone number).

The document must contain the following information:

- last name, first name, patronymic of the account owner, his address;

- name of the banking organization;

- the balance of funds on the client’s individual account on the day the statement is issued;

- date of signing the agreement with the bank;

- date of issue of the certificate.

The certificate has a limited validity period, 30 days; if you do not have time to submit documents within this period, the certificate must be ordered again.

Consulates of Schengen countries do not impose requirements to freeze money in accounts until a decision is made on issuing a visa.

Important! If consular officers decide that the funds in the applicant’s account are not enough to confirm solvency, they may offer to provide additional documents. These can be securities, documents on ownership of real estate, vehicles.

Additionally, pay attention to the following points:

In order for the certificate to be accepted, you must pay attention to the correct execution of the document.

- To submit a certificate to the consulate, you will need to translate it into English and have the translation certified by a notary.

- often they refuse to issue a permit to those who provide an extract from a deposit account; If withdrawals from such an account are limited by certain conditions, you most likely will not be able to use them abroad.

Compliance with the requirements of the consulate increases the chance of receiving a positive decision on issuing a visa.

How to increase your chances of getting Schengen

Each of the documents listed above can serve as a convincing basis for issuing a one-time permit to enter the European Union. Unfortunately, this is not enough to obtain a multiple visa.

You can increase the likelihood of success in this matter if you provide documents on the need for regular trips to Europe for business, education or scientific activities: commercial contracts, invitations from educational institutions or an agreement to conduct a course of lectures, for example.

But even for a one-time visit, it is better to provide a couple of convincing papers at once. Alternatively, the work certificate can be supported by an account statement for a Schengen visa.

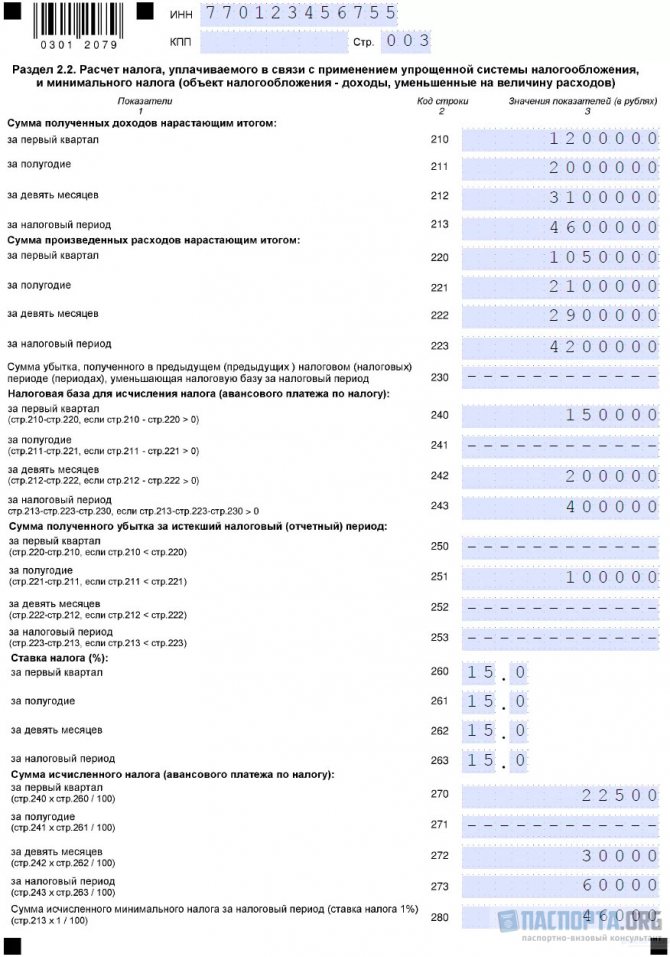

Confirmation of solvency for individual entrepreneurs

Individual entrepreneurs cannot provide a certificate of employment, so they need to provide a tax report for the last six months of individual entrepreneurs for a Schengen visa

In addition to a bank account statement and data on the flow of funds, private owners must provide evidence of the legality of their activities: a copy of the registration certificate and tax report for the last six months.

If an individual entrepreneur does not officially bring in sufficient income, the availability of credit cards and travel checks for currency exchange can confirm their solvency.

Bank cards themselves are not provided; photocopies are made of them. It is also not advisable to give away original travel checks. They may be needed when confirming the official purchase of currency.

Documents for visa

In addition to the account statement, you will need to submit documents to the visa center or consulate, the list of which depends on the country issuing the Schengen visa. Must have:

- Passport of a citizen of the Russian Federation.

- International passport.

- Certificate of employment on official letterhead.

- A certificate of bank account balance corresponding to the minimum security of the country for which you are applying for a visa.

- 2 photos.

- Paid tickets (airplane, train or ship).

- Confirmation of hotel reservation (not required for all countries).

- Insurance.

- Completed application form.

In addition, a number of states have restrictions. For example, in France, if you are staying with a private party, you will still need an additional amount for each day of your trip, which depends on the total length of your stay in the country.