How to get an education

The most prestigious Israeli university specializing in training programmers is the Technion in Haifa. To obtain the first degree of knowledge, the student must complete three to four courses.

Technion building in Haifa

You can get here through a very high competition, having a school certificate with only “A” grades. Tuition costs about 10,000 shekels for one academic year, which is considered a high level even for Israel. Students in their final year have the opportunity to work part-time, compensating for part of the tuition fee paid by the employer.

After receiving a diploma, the student has a wide choice of vacancies provided to him in almost every company. The university, which trains good specialists, has a high reputation among employers.

To a greater extent, it is required for work in large, international corporations

In smaller ones, attention is often paid to the experience and actual knowledge of the applicant

Obviously, finding a job as a programmer in Israel will not be difficult. The only condition is good English and an appropriate level of knowledge and experience in this field.

What taxes are paid on wages in Israel?

The majority of employed citizens pay fees. Among them, the main one is considered to be “mass akhnas”, which is deducted by the employer every month. For example, 10% is deducted from a salary of $1,800 and then increases as income increases.

In addition to the main deduction, a certain amount of life insurance and contributions to the pension fund are deducted from the employee - 5.5%. These deductions also depend on the amount of profit.

What is the minimum you can guarantee in Israel?

The amount of the minimum wage is determined based on two criteria: the age of the employee (a teenager or a person over 18 years old) and the nature of the calculation of earnings. There are companies in the country that offer employees a fixed rate, others use hourly wages, and still others work on a piece-rate basis (they receive a percentage or a certain amount for each client). Moreover, all employees, regardless of nationality, have the right to remuneration for work not lower than the minimum level.

The state has established standards according to which the minimum wage per hour in Israel in 2021 is 26.88 shekels ($7.56). If a person works up to 43 hours a week, his rate will be NIS 5,000 ($1,405). The daily salary for a 6-day work week will be 200 shekels (56.23 US dollars), for a 5-day work week - 230 shekels (64.67 US dollars).

This table shows how the minimum wage for adults is calculated:

| Rate per month | Hourly | Daily salary | Daily salary |

| (up to 43 hours per week) | salary | at 5 working days | at 6 working days |

| 5,000 shekels | 26.88 shekels | 230 shekels | 200 shekels |

| US$1,405 | US$7.56 | US$64.67 | US$56.23 |

How does salary depend on the gender and age of the employee?

When talking about the wages of teenagers, you need to understand that their payments will be much lower. When setting the minimum wage for persons under 16 years of age, employers are guided by the criteria developed by the government:

- The work of a teenager under 18 years of age is paid at a rate of 83% of the wages of an adult.

- The work of a teenager under 17 years of age is paid at a rate of 75% of the wages of an adult.

- The work of a teenager under 16 years of age is paid at a rate of 70% of the wages of an adult.

Every employee knows what the minimum per hour is set in Israel from 2021, and if his rights are violated, he can file a complaint with the Ministry of Economy, and then specific measures will be taken to suppress such violations by the employer.

It should be noted that, despite the decent unemployment rate in the country (4.5%), as well as a fairly high percentage of people below the poverty line (more than 20%), foreigners are actively attracted to work in Israel. Thus, immigrant men are predominantly hired for jobs that require attentiveness, endurance and physical strength. At the same time, workers are often provided with housing, food, and transportation to their place of work. Of course, you can’t count on living in luxury apartments and expensive meals.

Women over 40 also have a good chance of getting a job. Mostly we are talking about housework: cooking, caring for the sick and elderly, raising children. The average monthly salary of a teacher in Israel by specialty is 5,000-6,000 shekels (1,400-1,687 US dollars), while food and accommodation are often free.

Minimum salary in Israel

According to official information from the Israeli National Insurance Institute (Bituach Leumi), the minimum wage in Israel in 2021 is 5,300 shekels per month (about $1,600). Local workers employed 5 days a week must receive a minimum of 244.62 shekels ($75) per day, and 6 days a week 212 shekels ($65).

The hourly minimum wage in Israel is 28.49 shekels, which is equivalent to $8.5. Note that this is higher than in the United States, where the federal rate is set at $7.25 per hour. In general, over the past 24 years, the minimum wage in Israel has more than doubled. In 1997, Israeli workers received 2,348.88 shekels, and in 2021 they earn 5,300.

Important. The monthly minimum wage in Israel will not change as of December 1, 2021.

In accordance with the law, workers at least 18 years of age who are included in the staffing table on a full-time basis can count on the minimum wage in Israel. Note that in case of employment of 182 hours per month, the minimum wage is 29.12 shekels per hour, and not 28.49 shekels, as with the standard 186 hours.

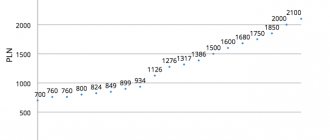

Data history (ILS/month) by year

Data Period Date

| 5300 | 2020 | 26.05.2020 |

| 5300 | 2019 | 02.04.2019 |

| 5300 | 2018 | 11.03.2019 |

| 5300 | 2017 | 19.01.2018 |

| 5000 | 2017 | 11.08.2017 |

| 4825 | 2016 | 01.07.2016 |

| 4650 | 2015 | 01.04.2015 |

| 4300 | 2014 | 01.01.2014 |

Minimum Wage in Israel by presidents

| Name | Period | Beginning | Con. | Max. | Min. | Change% start/end |

| Reuven Rivlin | 24.07.2014 — | 4650.0000 | 5300.0000 | 5300.0000 | 4650.0000 | 13.98% |

| Shimon Peres | 15.07.2007 — 24.07.2014 | 3710.1800 | 4300.0000 | 4300.0000 | 3710.1800 | 15.90% |

| Moshe Katsav | 01.08.2000 — 01.07.2007 | 2964.9500 | 3710.1800 | 3710.1800 | 2964.9500 | 25.13% |

| Ezer Weizman | 13.05.1993 — 13.07.2000 | 2348.8800 | 2964.9500 | 2964.9500 | 2348.8800 | 26.23% |

Data history (ILS/month) by year

Data Period Date

| 11064 | Feb. 2020 | 09.05.2020 |

| 10933 | Dec. 2019 | 14.03.2020 |

| 10852 | but I. 2019 | 08.02.2020 |

| 10891 | Oct. 2019 | 11.01.2020 |

| 10810 | Sep. 2019 | 07.12.2019 |

| 10792 | Aug. 2019 | 09.11.2019 |

| 10847 | Jul. 2019 | 29.10.2019 |

| 10789.4 | Mar. 2019 | 08.06.2019 |

Salary taxes in Israel

High economic growth is greatly facilitated by the progressive income tax applied in Israel. This means that people with lower earnings pay a tax rate of 10% to the treasury. And wealthy citizens are forced to pay up to 50% of their total income to the state every month. This high rate applies to persons whose income reaches 560 thousand shekels per year.

Today the average income tax is 40%. An increase in salary for every 1,400 shekels entails an automatic increase in tax contributions by 1%. At the same time, citizens of the country can enjoy certain tax benefits. However, there are no tax breaks for immigrants. Foreign specialists have to make deductions in full.

The country has an officially approved division of taxpayers into categories depending on the size of their salary. Each category has a specific tax rate:

- 1st category – 10%;

- category 2 – 14%;

- category 3 – 21%;

- category 4 – 30%;

- category 5 – 34%;

- Category 6 – 48-50%.

In Israel, all business owners and employees must pay wage taxes if they are tax residents, that is, they permanently reside in the country for at least 183 days a year. Any tax evasion is strictly prosecuted by law, so even the highest paid specialists, forced to give half of their earnings to the state, do not risk receiving their salaries unofficially.

Israel is an economically stable and developed state that attracts labor resources from all over the world. Foreign specialists are welcome in this country. They are provided with jobs in a variety of fields of work. However, when planning to go to the Middle East, you should remember that only highly qualified specialists can apply for European-level salaries. Handyman services in Israel are paid at minimum wage rates.

Wages in Israel by presidents

| Name | Period | Beginning | Con. | Max. | Min. | Change% start/end |

| Reuven Rivlin | 24.07.2014 — | 9413.1000 | 10456.7000 | 10456.7000 | 9413.1000 | 11.09% |

| Shimon Peres | 15.07.2007 — 24.07.2014 | 7714.0000 | 9400.0000 | 9400.0000 | 7714.0000 | 21.86% |

| Moshe Katsav | 01.08.2000 — 01.07.2007 | 7301.0000 | 7720.0000 | 7750.0000 | 7186.0000 | 5.74% |

Interesting How to get a Spanish residence permit in 2021 and EU citizenship in another 2 years?

What are the salaries in Israel for different industries?

Workers in the extractive sector, mainly energy and mining workers, earn the most, with earnings of 27,000 shekels (7,600 in dollars).

Among qualified workers, teachers have the lowest salaries, and they are growing quite slowly: 8,500 shekels ($2,300). Therefore, the beginning of the school year in Israel is often accompanied by teacher strikes.

A worker’s salary depends on his qualifications; sometimes his earnings exceed the guaranteed minimum several times, especially with piecework wages and increased efficiency.

The salary of builders and other representatives of blue-collar professions reaches 9 thousand shekels. The demand for such skilled workers as turners, adjusters, and welders is very high.

How much can you earn in Israel depending on the industry:

- social workers receive 5,300 shekels ($1,500);

- educational workers - 7.5 thousand shekels ($2,000);

- in the field of health – 8.7 thousand shekels ($2,500);

- in the financial sector - 21.5 thousand ($5930);

- public sector workers – 15.5 thousand ($3,800);

- in mining - 28 thousand shekels ($7,630);

- industry – 15,650 ($4,300)

- agricultural workers – 5,900 shekels ($1,400).

Earnings in the field of information technology and communications are quite high: the salary of a programmer is 23,300 shekels (6,400).

The income of tourism industry workers reaches 15 thousand shekels, for example, a guide’s earnings are 16 thousand shekels ($4,000).

Income of the Israeli population by profession (values in dollars are indicated in parentheses):

- doctors – 15,800 shekels (up to 4,500);

- residents, nursing staff: nurses, orderlies - from 5,000 shekels (1,400);

- lawyers – 11,000 shekels (3315);

- nannies, nurses, waiters, maids - 6,000 shekels (1,400-1,700);

- cooks - 6800 shekels (1900);

- builders, electricians, welders, loaders - up to 11,000 shekels (from 1,500 to 3,000);

- guides – 18 thousand shekels (5000);

- policemen, firefighters, military – 10,000 shekels (2800);

- accountants – 11,000 shekels (3,300);

- sellers – 7,500 shekels (2,000).

The salary of an engineer at the initial stage does not exceed 16 thousand shekels (4800 dollars), an experienced specialist receives up to 30 thousand shekels (more than 9 thousand dollars).

The driver's salary depends on experience and is, for example, for a truck driver more than 11 thousand shekels (3 thousand US dollars).

The average income of an Israeli resident reaches 10 thousand shekels before taxes. Despite the stable and constant increase in wages in most areas, the level of earnings has different values in different industries.

Other labor market and unemployment indicators in Israel

| Indicator | Period | Fact. meaning | Prev. meaning |

| Retirement age for men | 2020 | 67 | 67 |

| Unemployment rate | May 2020 | 4.2 % | 3.5 |

| Number of vacancies | May 2020 | 42.747 thousand | 26.982 |

| Economic activity level | Mar. 2020 | 62.7 % | 62.8 |

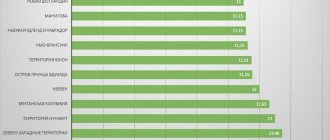

| A country | Period | Fact. meaning | Prev. meaning |

| Bangladesh | 2017 | 156.356 USD/month | 152.099 |

| Kyrgyzstan | Apr. 2020 | 225.581 USD/month | 243.816 |

| Mongolia | Q3/19 | 411.598 USD/month | 409.833 |

| Tajikistan | Apr. 2020 | 132.222 USD/month | 137.655 |

| China | 2019 | 1077.844 USD/month | 981.518 |

| Georgia | 1 sq./20 | 391.857 USD/month | 429.967 |

| India | 2014 | 115.31 USD/month | 108.53 |

| Israel | Feb. 2020 | 3209.142 USD/month | 3178.397 |

| South Korea | 1 sq./20 | 3321.82 USD/month | 3158.647 |

| Taiwan | May 2020 | 1683.286 USD/month | 1631.338 |

| Vietnam | 4 sq/18 | 258.011 USD/month | 252.101 |

| Armenia | May 2020 | 394.022 USD/month | 403.959 |

| Hong Kong | 1 sq./20 | 2187.412 USD/month | 2191.411 |

| Japan | May 2020 | 2816.227 USD/month | 2871.574 |

| Kazakhstan | May 2020 | 474.203 USD/month | 475.813 |

| Macau | 1 sq./20 | 2004.334 USD/month | 2129.605 |

| Malaysia | 2018 | 723.081 USD/month | 674.36 |

| Philippines | 2016 | 200.58 USD/month | 189.61 |

| Singapore | 1 sq./20 | 4416.032 USD/month | 4153.857 |

| Thailand | 1 sq./20 | 457.264 USD/month | 452.371 |

| Azerbaijan | Apr. 2020 | 432.941 USD/month | 437.647 |

| Bahrain | 2 sq./19 | 1410.766 USD/month. | 1442.588 |

| Uzbekistan | 2018 | 178.972 USD/month | 142.726 |

| Mauritius | 2018 | 747.361 USD/month. | 718.184 |

What payroll taxes are required to be paid?

Israel has a progressive taxation system, meaning the higher your income, the higher the tax rate. At the same time, the country has a preferential tax payment system for Israeli citizens.

The income tax rate (in shekels) is:

- for salaries up to 5220 shekels – 10%;

- from 5221 to 8920 shekels - 14%;

- from 8921 to 13860 – 21%;

- from 13861 to 19800 – 31%;

- from 19801 to 41410 – 34%;

- from 541411 to 66960 – 48%;

- over 66960 – 50%.

In addition, contributions are paid from the salary for:

- social and health insurance – 12% of salary;

- pension contributions – from 2.5%.

Consequently, almost half of Israelis’ earnings are eaten up by taxation, the maximum amount of earnings remaining in hand is 75%.

In addition, the following taxes are provided:

- VAT – 18% (for everyone except tourists);

- on income from property – 35%;

- for capital – 45%;

- for the purchase of a car - sometimes up to 125% of the cost of the car.

About 20% of the population (1.5 million people) live below the poverty line. That is, their monthly income is no more than 3,000 shekels ($800). Certain categories receive benefits from the state.

We recommend these articles:

How to send money to Israel to an individual?

How to find a job in Israel without intermediaries?

Work in Tel Aviv for Russians

There is no need to pay such companies for help. All you need to do is leave your details, discuss your desired position and pay level.

If the agency manages to employ the applicant, it will take money from the employer for its services. The Zebra agency, which cooperates with several hundred employers throughout the country, enjoys a good reputation among Russian migrants. Government organizations can also provide assistance in finding work:

- Labor exchange. Employees undergo career reorientation. They issue benefits, organize courses, and offer assistance in finding a job vacancy.

- Ministry of Absorption. They advise applicants, give lectures, and direct them to appropriate courses.

- Youth centers. They conduct consulting seminars and help small businesses.

Jobs in Israel can be divided into high and low paid.

The following can count on quick employment and a comfortable life in Tel Aviv:

- Representatives of construction specialties with high qualifications;

- Programmers;

- Doctors;

- Experienced financiers.

- Engineers;

In addition, thanks to the large number of representative offices of international concerns, trade and industrial enterprises, many vacancies for office workers are open in the city:

- Clerks;

- Employees of call centers and technical customer support services.

- Secretaries;

At the same time, the chances of getting a job are significantly increased for those applicants who speak English and can speak Hebrew. A good job for Russian women who do not speak foreign languages is their employment in Jewish families as:

- Caregiver;

- Nian;

- Housekeepers.

The advantage of such vacancies is that the owners provide housing and food, which costs a lot of money. Unskilled work for men is associated with vacancies:

- Cleaner;

- Gardener;

- Waiter.

- Handyman at a construction site;

Without

What are the taxes in Israel?

Taxation of Israeli and Russian citizens who are Israeli residents is carried out according to a two-tier system: the country has both state and municipal taxes. State taxes include all income taxes, customs duties, value added tax, land sales tax, and so on.

“Arnona” belongs to the municipal ones. Not everyone knows what “arnona” is in Israel: it is a type of municipal tax that replaces the unified real estate tax. It finances the activities of local authorities.

In addition to territorial differentiation, Israeli taxes are traditionally divided into direct and indirect. Direct taxes are those levied on profits or capital gains, adjusted for a person's ability to pay. For example, the same income tax in Israel or any property tax. Typically, such taxes usually take into account the personal characteristics of the taxpayer, such as marital status, age and health.

Indirect charges usually include charges that burden consumption or costs already incurred. A classic example of an indirect tax is VAT.

In addition, fees can be differentiated depending on the payer: they are paid by both individuals and legal entities.

Taxation of individuals

Taxes for individuals are determined by the composition of the property and the types of activities of the subjects. As a reminder, Israeli residents generally pay taxes from both Israeli and foreign sources.

| Type of tax | Bid | Note |

| Income tax | 10-50 % | Income tax in Israel is levied at a progressive rate within 7 steps, applied depending on the level of welfare of the payer. |

| Tax on dividends | 0.25 | For some government-approved dividend-paying entities, the tax rate is set at 15-20%. |

| Tax on interest income | 0.25 | Interest income from investments in listed securities is taxed at a rate of 15%. |

| Royalties (income from the sale of the right to use intellectual property) | 0.265 | |

| Rental income tax | 31-50 % | A progressive scale is applied depending on the amount of income received. Preferential rates of 10% on residential apartment rentals in Israel also apply |

| Car tax | ≈ 92 % | The car tax in Israel depends on the cost of the vehicle. |

| Municipal tax "arnona" | Set as a fixed amount by each municipality separately | It is paid in the form of a derivative tax rate per 1 m 2 of housing and its area. For example, in Tel Aviv and Bat Yam it is 49 shekels, in Haifa 63 shekels and so on. |

| Dog tax | 338 shekels | The dog tax in Israel is collected exclusively for unneutered pets. |

Taxation of legal entities

Companies are also tax payers. The types of taxes paid by enterprises depend on the type of their activities. Let's look at the most common ones.

| Type of tax | Bid | Note |

| Corporate income tax | 0.23 | A preferential tax rate is applied to partnership participants, which is 15% of the profit of each partner. |

| VAT | 0.17 | For certain areas of activity, the VAT rate in Israel may be changed, for example, for real estate and tourism. |

| Tax on the purchase and sale of land | 0.025 | + 1.2% is charged for the purchase of buildings on land |

| Insurance premiums | 0.125 | Paid on the employee's salary as a pension contribution |

There are no taxes levied on companies involved in agriculture.

Salary taxes

All income above is before taxes. There are several of these in Israel, and their amount can be quite high.

Income tax

Income tax is considered progressive, rising from 10 to 50% depending on the size of wages. There is a preferential tax system for Israeli citizens.

The maximum figures are given in the table.

| Salary in shekels | Bid |

| up to 5220 | 10% |

| 5221 – 8920 | 14% |

| 8921 – 13 860 | 21% |

| 13 861 – 19 800 | 31% |

| 19 801 – 41 410 | 34% |

| 41 411 – 66 960 | 48% |

| 66,961 and above | 50% |

Social contributions and other taxes

Contributions to social and health insurance are approximately 12% of income. There are also payments to the pension fund (at least 2.5% of salary).

Of the “dirty” salary, 75% remains “in your hands”, and this is the maximum. Typically, taxes eat up about half of your earnings.

Tax is imposed on the purchase of real estate if the seller is not the developer. The amount of the fee reaches 10% for the value of the object over 1 million US dollars. The contribution to the property in the property is determined by the municipality. The starting rate is 200 shekels monthly. Donation and transfer of ownership of an apartment are not subject to tax.

Only tourists are exempt from paying 18% VAT. The tax on income from property is 35%, capital tax is 45%. The tax on the purchase of a car, according to various sources, can reach up to 125% of the cost of the car.

Health care taxes are most often paid by the employer. For an unemployed person, it can be approximately 100 shekels per month.

Average salary by region of the country

| City in Israel | Salary in shekels | Salary in Russian rubles |

| Jerusalem | 13 000 | 221 000 |

| Tel Aviv | 12 000 | 204 000 |

| Haifa | 11 000 | 187 000 |

| Rishon Lezion | 10 500 | 178 500 |

| Petah Tikva | 10 000 | 170 000 |

| Ashdod | 9 500 | 161 500 |

| Be'er Sheva | 9 000 | 153 000 |

| Holon | 9 000 | 153 000 |

| Netanya | 8 500 | 144 500 |

| Bnei Brak | 8 000 | 136 000 |

| Ramat Gan | 7 500 | 127 500 |

| Bat Yam | 7 500 | 127 500 |

| Rehovot | 7 500 | 127 500 |

| Ashkelon | 7 000 | 119 000 |

| Herzliya | 7 000 | 119 000 |

| Kfar Sava | 7 000 | 119 000 |

| Beit Shemesh | 7 000 | 119 000 |

| Hadera | 7 000 | 119 000 |

| Modiin-Maccabim-Reut | 7 000 | 119 000 |

Who finds it easier to find a job in Israel?

The most in demand in Israel today are construction workers, seasonal agricultural workers, service sector specialists, nurses, and hotel business workers.

The most often offered work in Israel for Ukrainians is in construction. Construction is actively underway in the country (in 2021, the Knesset approved the construction of more than 3,000 projects in Samaria alone). The involvement of builders from Ukraine, in addition to Romanian and Chinese specialists, indicates an intention to replace the Palestinians who previously dominated in this sector.

Construction vacancies can be applied for by men aged 25 to 45 years, with work experience and in good physical shape. Working as a bricklayer in Israel for Ukrainians is one of the most popular and well-paid jobs. There is also a great demand for workers to carry out road repair work. Knowledge of Hebrew is not required for them, but knowledge of English will be considered an advantage.

For general construction workers, no experience is required.

In addition to the construction of new buildings, repair and construction work is actively carried out in the country, so the jobs in demand include the work of a painter, plasterer, plumber, as well as work as a tiler in Israel.

Qualified welding specialists are always required. Welders are required at auto and ship repair enterprises, in mechanical engineering, and in the agricultural sector. As practice shows, this is one of the highest paid specialties. Welding vacancies in Israel are the most suitable for Ukrainians, since employers provide their employees with a full social package, provide transportation to work, food and accommodation, and if this is not possible, they are paid additionally for accommodation and food.

Interesting Goals of Russian migration policy

Industrial enterprises require technicians, mechanics, mechanics, pipe fitters, crane operators (men from 28 to 55 years old with work experience).

Working in Israel as an electrician also has good prospects for Ukrainians - subject to confirmation of a diploma and completion of a three- or five-month language course in Hebrew, you can count on a salary above average.

Traditionally, seasonal workers are required in the agricultural sector to collect and process crops. At the same time, agricultural specialists are not in great demand (due to different climatic conditions, the use of other technologies and other features).

Working as a driver in Israel for Ukrainians is not highly paid, but the demand for truck and car drivers is constant.

One of the best offers for women over 40 years old is to work as a caregiver or nurse in rehabilitation centers, hospices, hospitals, as well as in families (such work in Israel for Ukrainians, living in the employer’s house, will be more profitable, since it will save on housing) . In order to occupy such a vacancy, a diploma of secondary medical education and an international certificate of completion of special courses may be required.

There is also a demand for unskilled female labor: saleswomen, cleaners, housekeepers, workers at gas stations and car washes, etc.

There are also constant vacancies in the resort and hotel business. Work in Israeli hotels for Ukrainians is offered as vacancies for maids, waiters, dishwashers, cooks, etc.

Only IT sector specialists, computer scientists, programmers who have the opportunity to get a job in international companies in Israel can apply for more qualified work without knowledge of Hebrew (but English is required).

Taxation of business in Israel

Every company doing business in Israeli territory is required to provide a full tax report once a year. Documents are submitted to the Tax Office and the National Insurance Institute annually before the end of April. The company's business expenses are deducted from the total tax required to be paid.

Along with income tax, all Israeli businesses pay VAT. The percentage rate of value added tax for all companies is 17%, with the exception of real estate, tourism and banking. The acquisition of land for construction is subject to a tax of 2.5% of the cost of construction. There is no duty for the acquisition of land for agricultural activities. The tax on dividends ranges from 25 to 32% and can be reduced to 15% if the company’s activities fall under the law “On Promotion of Investments”.

For businessmen and investors, there are developed programs to encourage entrepreneurial activity in Israel. The goal of the initiative is to reduce the level of tax payments. Companies operating in government-defined areas, such as construction, can receive benefits for 10 years or complete exemption from income tax.

List of the most in-demand professions

Israel is a country with low unemployment, but new arrivals have difficulty finding good jobs. To achieve this in the short term, it is necessary to master one of the professions that the Promised Land is currently in dire need of. The most popular occupations in Israel in 2021 were:

- programmer;

- marketer;

- Web Designer;

- content creation specialist.

Returnees arriving in Israel can count on quick employment if they have a profession:

- Cooks;

- waiter;

- welder;

- crane operator;

- engineer

Job openings for such specialists are almost always available.

Without knowledge of the language

To get a respected and well-paid job in Israel, you must speak Hebrew. Persons who do not speak the state language are forced to perform low-paid work that does not require contact with other citizens. Usually work without knowledge of the language is only temporary. Those who did this simultaneously attended special courses and, having mastered Hebrew, moved on to more prestigious positions.

With accommodation

Many Russians prefer to choose a job with which they want to live. The most common type of housing for Russians is elderly care. In this case, caregivers live directly in the home of the person they are caring for. This type of activity is mainly preferred by middle-aged women who come to Israel for several years to work on a contract basis.

Medical workers

The quality of Israeli medicine is known throughout the world. There are many treatment and diagnostic centers in the country, so there are many vacancies for those who are doctors or nurses. However, to work in a medical specialty, a candidate must undergo a state examination to obtain a medical certificate.

Working specialties

There are many vacancies in Israel for men who are well acquainted with work. The country's cities are constantly growing, and people with construction experience can find work in them. Welding and crane work are especially in demand. Additionally, many companies and organizations are in need of drivers, and those with a driver's license and skills can expect to get hired quickly.

Teachers

Russian women with a teaching diploma are attracted by the opportunity to become highly paid teachers. The country has a large number of educational institutions with regular vacancies. However, in order to accept one of them, it is necessary to prove knowledge of Hebrew.

Nurse

Many Russian women who are looking for Israel and do not have a sought-after specialization become nannies. In addition, those interested in working as a nurse can also look forward to working - in many families, it is mainly newcomers who care for the elderly and seriously ill.

Seasonal work

Agricultural producers in the republic regularly employ workers who collect citrus fruits. Such offers are especially interesting for girls and boys at universities, as they provide an opportunity to earn money for their studies within a short period of time.

Work for repatriates

The influx of people from other countries, including Russia, who want to move to their historical homeland, does not end in the Promised Land. Returning to Israel will not automatically get you a job, you have to do it yourself. At the same time, social services in this area support all those involved in aliyah (the possibility of Jews moving to Germany). Permanent residence c) and work for those returning is carried out quite quickly.

Taxes from salary

The vast majority of the working population pays taxes on their salaries in Israel. These primarily include the income tax “mas akhnasa”, calculated monthly by the tax agent-employer.

The basic personal income tax rate is 10% of the salary of 6.22 thousand shekels and increases as the salary increases.

So, for an amount exceeding 6.22 thousand shekels. and up to 8.92 thousand shekels. - 14 %; for an amount exceeding 8.92 thousand and up to 14.32 thousand shekels. - 20 %. The next steps are 31, 35, 48 and 50% depending on the salary.

In addition to income tax, employees pay Bituach Leumi insurance premiums and health insurance contributions from their salaries. They can be charged in full or a reduced amount (determined by the size of the salary).

Thus, the cumulative reduced amount of these contributions from the employee is 3.5% (+3.45% from the employer), and the full amount is 12% (+7.5% from the employer) of the salary. In addition to them, contributions to the pension fund are levied in the amount of 6% of the salary (+12.5% from the employer).

Specifics of the employing company

One way to explain why Israeli programmers receive high salaries is that demand here exceeds supply. In other words, the country lacks qualified and experienced specialists.

Conventionally, all Israeli employers are divided into four groups:

- Specializing in the development and support of programs within the country.

- Working on international servers.

- Start-Up Companies.

- Beit Tukhna (contract employment).

Internal activities

These mainly include banking institutions, departments, and ministries. Programmers earn on average between 5,000 and 15,000 shekels. Education may not be required, the working week is five days, from 9:00 to 18:00.

Database Administrator Salary in Israel (USD) (1) Experienced (2) Mid-Career (3) Entry Level

For labor migrants from the CIS countries, this option will be optimal as a first job. You can read about salaries in the CIS countries by following this link.

Working for a corporation

Income level - from 9,000 to 30,000 shekels. Many specialists receive a company car (about 3,000 is deducted from their salary for it). There is no work schedule; you often have to work overtime and take work home. Business trips often occur.

Interesting Average salary in Canada: who gets paid how much?

JavaScript Developer Salary in Israel (USD) (1) Experienced (2) Mid-Career (3) Entry Level

Due to such harsh working conditions, mostly young people under 30 work in companies.

Start-Up

This is the name given to new companies that have not yet found their feet. Small organizations that employ no more than 100 programmers. In order to join a promising business, you have to work a lot of time here. Therefore, preference is given to young applicants who are ready to work around the clock.

iOS Developer Salary in Israel (USD) (1) Experienced (2) Mid-Career (3) Entry Level

Beit Tukhna

A kind of agency specializing in providing programmers to another company. For example, a large corporation is starting a new short-term project, for which it does not have enough of its own workers, and it makes no sense to create additional staff.

System Administrator Salary in Israel (USD) (1) Experienced (2) Mid-career (3) Entry level

She contacts the beit tukhna and rents the required number of workers from it, paying them wages. The latter, in turn, takes from 1 to 30% of the money earned by the programmer as compensation for the services provided. The income level here usually does not exceed 10,000 shekels net.

Property taxes in Israel

Taxation in Israel involves the payment of taxes by property owners both upon purchase and subsequent ownership. The duty on the purchase of housing is 3.5-10% depending on the cost. In the case of purchasing a land plot, the tax percentage ranges from 0.5 to 6%. New repatriates have an advantage in purchasing housing, since the maximum duty is 5%.

There is no single property tax in Israel; instead, owners pay a municipal tax - arnona. The size of the fee depends on the location and area of the house or apartment. The average arnona is about 46 euros per month. The income received by the owner from rental is taxed at a rate of 31 to 50% depending on the amount.

Sales of real estate are also subject to tax. The duty is paid by the seller after the transaction is completed. The tax is 25% of the difference between the purchase and sale prices of housing. The Israeli tax system provides a number of tax benefits that allow you to reduce the amount of payment up to complete exemption.

The Israeli government provides repatriates with a significant tax reduction to facilitate relocation and settlement in the country. The government fee benefits are just a small part of Israel's program to encourage Jews to return to their ethnic homeland. Find out detailed information about the possibility of receiving additional preferential units from our company specialists. We will help you successfully adapt to a new society.

Average earnings by region of the country

It is impossible to unequivocally answer the question of how much foreign workers earn in Israel. Often, the amount of income will depend on which city a job vacancy is open in. For example, one of the most prosperous in terms of earnings is Tel Aviv. This city is home to the offices of international corporations, banks, trading floors and cultural institutions. Therefore, the average salary in Tel Aviv is significantly higher than in other cities.

If you provide income data depending on the city in which a job vacancy is open, the result can be presented in the following table:

| City | Shekels | U.S. dollars |

| Tel Aviv | 10660 | 3000 |

| Haifa | 9580 | 2700 |

| Ashdod | 7850 | 2200 |

| Netanya | 7600 | 2150 |

| Jerusalem | 7550 | 2100 |

| Be'ersheva | 7000 | 1950 |

| Nazareth | 6500 | 1800 |

However, do not forget that the average salary indicated above includes taxes that must be transferred to the state treasury. After deducting contributions at an income-appropriate progressive rate, your salary may be significantly reduced.

Salary to living expenses ratio

Real estate prices in Israel in 2021 vary depending on the city in the country. The most expensive place to buy real estate is in Jerusalem. In this city, an apartment consisting of three rooms will cost around 650 thousand dollars. For the same price you can purchase similar real estate in Tel Aviv in one of the most prestigious areas of the city.

Buying real estate in a provincial town can cost up to $100,000.

Prices in Israel for rental property directly depend on the prestige of the area and city. You can rent a one-room apartment for $800 a month in the very center of Jerusalem.

In Haifa, renting a property will cost $500. Food prices in Israel vary depending on the region. In large and more developed cities they are an order of magnitude higher than in desert areas.

Income of Israeli politicians

The incomes of Israeli officials are quite high. Their monthly earnings are comparable to the income of successful businessmen and top managers.

- The Prime Minister receives 54,700 shekels (about 1 million rubles),

- Ordinary minister - 49,000 shekels (about 910,000 rubles),

- Deputy ministers and deputies - 44,000 shekels (about 817,000 rubles),

- Judges of the Supreme Court - 92,000 shekels (about 1.7 million rubles).

It is believed that the high level of income of senior civil servants will protect them from corruption. However, it is worth noting that the country’s law enforcement agencies periodically open criminal cases against former ministers and bring them to court sentences.

Tax and social contributions

Israelis are very sensitive to insurance, so almost every citizen has insurance :

- Health insurance - 5% of wages is paid by all people, even pensioners and the unemployed.

- National insurance - about 14.5% of wages is paid by all people over 18 years of age, except for employees on a fixed-term basis, students, and schoolchildren who have reached the age of majority.

Contributions to the pension fund range from 2.5% of earnings.

There is also an income tax . Its size is established and grows along with the income of an individual:

| Income in shekels per month | Amount of income tax in % |

| from 5 300 | 10% |

| up to 8 900 | 14% |

| up to 12 800 | 21% |

| up to 19 800 | 31% |

| up to 41 100 | 34% |

| up to 66 900 | 48% |

| more than 66,900 | 50% |

Consequently, all social contributions and taxation take from 32 to 72% of an Israeli citizen's salary.

How to open a business in Israel

Before moving on to a practical guide to registering a business in Israel, I would like to note several features of the business life of this country.

In general, Israeli entrepreneurs have a fairly democratic business culture. During official meetings and signing contracts, a friendly and calm atmosphere prevails. A person's openness and honesty is valued.

Before negotiations, it is advisable to collect information about the partner’s company and unobtrusively share your knowledge during the conversation. Israeli businessmen are very ambitious and motivated people, so mentioning their activities will help show a serious approach to business and build trust.

There is no strict dress code in Israel. However, foreign entrepreneurs who are just beginning to settle in the country must comply with the minimum business style requirements. Many Israelis are very religious people, particularly when it comes to eating kosher food. Therefore, when choosing a restaurant or dining at home, you need to take this point into account.

According to many reputable rating agencies, Israel occupies a leading position in the world in terms of investment returns and innovative potential. It is not surprising that the largest transnational companies, such as Microsoft, Apple, Philips, are opening their representative offices in this country and increasing their financial investments. And there is an explanation for this.

Advantages of doing business in Israel

- Competitiveness and innovative potential.

- Highly educated and skilled workforce as Israeli universities provide quality knowledge.

- Use of modern technologies and scientific achievements.

- Economic flexibility and government support.

- Multinationality and richness of culture.

In Israel, a foreigner can register a foreign company, in the form of a branch, subsidiary or representative office, or open a new business. To do this, you will need to use the services of local professional legal firms and consult with Israeli lawyers and accountants.

Procedure and cost of registering a company in Israel

- Registration of the main documents of the company, certified by an Israeli lawyer at the Israeli Ministry of Justice.

- Form 1 (application for company registration);

memorandum of association (states the goals and responsibilities of shareholders);

- charter, with the signatures of the owners of the company, verified for authenticity by a lawyer.

- Registration with the Income Tax and VAT Departments of the Ministry of Finance of Israel. These are two separate procedures. It is necessary to provide copies of all company registration documents and owner passports. The procedure is free, but may take more than a month.

- Registration with the National Insurance Institute. Registration of a social package for employees, including unemployment benefits, health insurance and pensions. Takes about 7 days.

The charter must be drawn up in Hebrew, other documentation can be in English or Arabic. The cost of registering a company in Israel in 2021 is 2,645 shekels (630 euros). The services of a lawyer will cost on average 450-500 euros. After registration, the company will be assigned an identification code and issued a certificate.

As a result, the procedure for registering a business in Israel can take from one to three months.

Average salary in Israel

According to official data from the Israeli Central Bureau of Statistics (CBS), the average salary in Israel in 2021 is 12,016.5 shekels per month ($3,635) before taxes. During the year, the figure fluctuates between 500–600 shekels. Men in Israel earn somewhere between 30-40% more than women. At the same time, the latter are occupied for fewer hours.

Important. In accordance with Article 1.2 of the Law on State Insurance of January 1, 1999, the average salary in Israel from January 1, 2021 should be 10,273 shekels per month ($3,105).

Over the past 5 years, the average salary in Israel has increased by 1,700 shekels. The annual increase in the labor force in the country is about 100 thousand people . Among the sectors of the economy in terms of wages, the leading sector is information technology, where over 172 thousand specialists are employed with an average income of about 23.3 thousand shekels per month or 7.1 thousand dollars, as well as mining with a salary of about 27.7 thousand shekels ( 8.4 thousand dollars).

A large number of foreigners from the CIS countries permanently live and work in Israel. Despite the complex procedure for obtaining an Israeli work visa, holders of professions that are in short supply in the local economy can count on decent wages. For example, in the case of official employment, the salary in Israel for Ukrainians starts from 1.5 thousand dollars per month and above.

Salary in Israel by economic sector (shekels (NIS)/dollars ($) per month)

- Mining – 27,729 NIS ($8,385)

- Information technology and communications – 23,342 NIS ($7,060)

- Financial and insurance services – 21,542 NIS ($6,515)

- Electricity and water supply – 19,217 NIS ($5,810)

- Public Administration – 15,779 NIS ($4,770)

- Industry (manufacturing) – 15,642 NIS ($4,730)

- Professional, scientific and technical activities – 15,206 NIS ($4,600)

- Real estate transactions – 11,701 NIS ($3,540)

- Logistics, postal and courier activities – 11,701 NIS ($3,540)

- Construction – 10,015 NIS ($3,030)

- Trade and repair of vehicles – 9,516 NIS ($2,880)

- Healthcare – 8,798 NIS ($2,660)

- Education – 7,596 NIS ($2,300)

- Fisheries, agriculture and forestry – 7,237 NIS ($2,190)

- Administrative and related services – 6,014 NIS ($1,820)

- Arts, entertainment and other services – 5,750 NIS ($1,740)

- Accommodation and food services – 5,123 NIS ($1,550)

Note : Average salaries in Israel by economic sector are shown before taxes (gross).

Salaries in Israel by specialty

Pay in Israel depends on experience, qualifications, specific region and profession. Everything is very individual. For example, an Israeli crane operator earns from 6 to 9.5 thousand dollars a month. In addition, it matters in which sector of the economy the specialist is employed - private or public. The average monthly salary in Israel by profession before taxes is as follows:

- Programmers – 16,800 NIS ($5,080)

- Doctors – 15,800 NIS ($4,780), nurses – 6,800 NIS ($2,055)

- Engineers – 14,800 NIS ($4,475)

- Electricians, welders – 10,800 NIS ($3,265)

- Builders – 8,800 NIS ($2,660)

- Teachers – 8,300 NIS ($2,510)

- Drivers – 7,800 NIS ($2,360)

- Cooks – 6,800 NIS ($2,055)

- Nurses – 6,000 NIS ($1,815)